Armit Bhambra Head of iShares UK Retirement, BlackRock

Fixed income will continue to play a pivotal and multi-faceted role in European pension scheme portfolios. Whether it be for growth, income or liability and cash-flow matching, many schemes in the region will need to hold bonds as they de-risk in a low yield environment.

The regulatory changes and increased capital requirements that resulted from the global financial crisis have reduced investment banks’ willingness to hold bond inventory, therefore impacting market liquidity.

In areas such as high yield and emerging market debt, bond ETFs allow access to the asset class at a fraction of the cost of investing in the underlying bonds. This article explores why schemes should add bond ETFs to their toolkit.

SOURCES OF ETF LIQUIDITY

There is one feature of ETFs that is unique and not shared by mutual funds: they have a secondary market, whose benefit is accentuated when the underlying market is costly to trade. For example, the round-trip cost of trading cash bonds in the US high yield market can be around 75bps. However, the iShares iBoxx USD High Yield Corp Bond ETF (HYG) has an average daily volume of $2.1bn (£1.6bn) and trades at 1bps wide.¹

In the past, it was a common belief that Europe-domiciled ETFs lacked the liquidity required to facilitate trades of institutional scale. But the volume of large trades in these markets continues to grow. This is because liquidity between US-domiciled ETFs and Europe-domiciled (UCITS) equivalents is fungible. In other words, clients can consider the combined liquidity of US and UCITS bond ETFs that track the same index.

For example, a client looking to trade a UCITS ETF can benefit from the secondary market liquidity of the US-domiciled ETF if the authorised participants facilitating the trade use the same underlying bonds in each fund’s creation units. This is common practice across several iShares ETFs that track markets such as US investment-grade credit, hard currency emerging market debt and US dollar floating-rate bonds.

What has all of this meant for bond ETF usage by pension schemes? Meaningfully lower transaction costs have resulted in a plethora of applications that have helped solve the challenges pension schemes face. Initially, we saw schemes use ETFs for interim beta when, for example, switching between managers and tactical asset allocation. However, some schemes have become more sophisticated, using bond ETFs as a replacement for credit derivatives, building custom liquidity sleeves and, for some exposures, strategic asset allocation.

FOUR KEY TRENDS TO DRIVE BOND ETF MARKET GROWTH

Over the past 10 years, the global bond ETF market has reached a record high five times and assets now stand at more than $1trn (£774.3bn). However, bond ETFs still comprise only 1% of total cash bonds outstanding.²

At BlackRock, we believe that global bond ETF assets are well positioned to double to $2trn (£1.5trn) by the end of 2024, for four reasons:³

An evolution in portfolio construction:

Bond ETF investors are hardly passive. Millions of people are actively using them in innovative ways to achieve a variety of outcomes.

Modernisation of the bond market:

Bond trading as a percentage of debt outstanding has declined in the post-crisis, dealer-centric world and market participants look to ETFs and electronic trading to help improve liquidity.

ETF innovation:

The development of new bond ETF exposures will add convenience for investors, provide new tools to customise portfolios and drive future bond ETF adoption. More bond ETFs will incorporate environmental, social and governance (ESG) inputs into their methodologies or target green bonds to fund sustainable projects.

ETF adoption by institutional investors:

Institutions other than pension funds are increasingly using bond ETFs. Insurers are deploying short-term government bond ETFs to manage their cash reserves; fund managers hold bond ETFs instead of cash in anticipation of new issues; and endowments use bond ETFs while transitioning between non-liquid strategies and active managers.

So what does this mean for the bond ETF market? We will likely see a deepening of the same dynamics we have seen play out in this market already. As institutional usage of bond ETFs continues to drive overall bond ETF market growth, schemes looking to use them will benefit from increased volumes and depths, and thus larger sizes can be traded at low cost, relative to transacting in the underlying market.

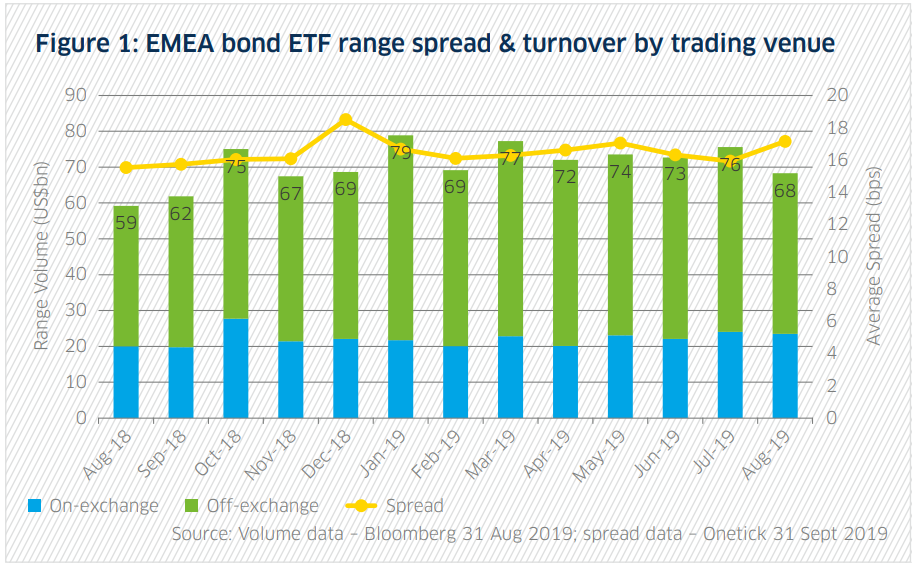

We have seen larger trade volumes as a result of MiFID II, which has resulted in a significant enhancement in the reporting and transparency of overall secondary market activity. To put this into context, more than 75% of the average daily volume recorded since January 2018 has been recorded on over-the-counter venues (see figure 1). Already, the enhanced reporting of ETF trades has enabled larger ETF transactions. The largest trade in a European bond ETF to date, worth $550m (£425.8m), took place in January 2019.⁴ In normal market conditions, market makers can enable cost-effective and sizeable trades into and out of credit ETFs. In times of stress, being able to transfer risk, whether to get out of positions or to increase allocations when prices are depressed, is crucial. ETFs can serve as an efficient, open-access vehicle for investors. Furthermore, they provide price transparency in the underlying bond market when it seizes due to closure or a lack of liquidity in the primary market.

Pension schemes are faced with a plethora of challenges in meeting their primary objective of being sufficiently funded to make member benefit payments. The time is now to seek new efficiencies, especially for those schemes underfunded in a lower for longer environment. Bond ETFs, when used and traded in the right way, can be an effective tool when applied to pension scheme portfolios.

We believe this is the time for schemes to consider adding bond ETFs to the tool kit.

1) Source: BlackRock, the Exchange Traded Product Landscape.

2) Source: Bloomberg and BlackRock 2019.

3) Source: BlackRock, Primed for Growth: Bond ETFs and the path to $2trn.

4) Source: Bloomberg, Tradeweb, IHS Markit. Prints reflect the largest known trades on iShares UCITS Credit and ETFs as of August 2019 across exchange and over-the-counter trading venues.