Two of the largest challenges society faces today – climate change and social inequality – can benefit from a joint approach, particularly as investors may have to navigate enhanced regulation in both areas, says Alex Bernhardt, global head of sustainability research.

Climate change and inequality related to gender, race/ethnicity, age and ability are inextricably linked. Globalisation has acted to change the dynamics of both climate change and social inequality.

Over the past roughly 40 years, the latest phase of globalisation has acted generally to increase inequality – as measured by wealth and income metrics – globally and within many nations. Alongside this social impact, increasingly globalised trade has driven up carbon emissions, deforestation and the exploitation of resources, all of which are steady contributors to the severity of climate change.

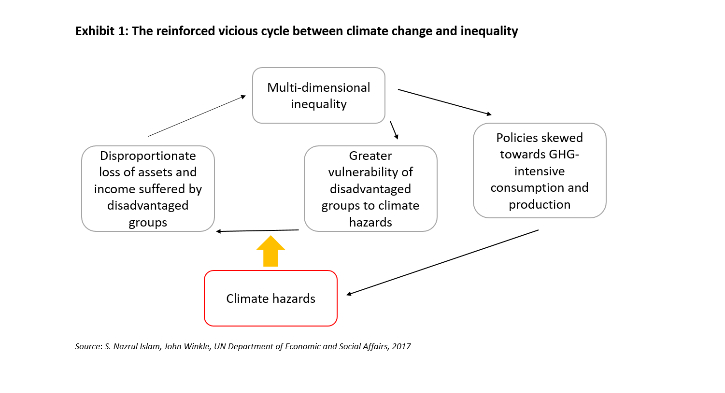

In turn, the tangible effects of climate change have exacerbated inequalities due to their disproportionate impact on disadvantaged, vulnerable groups. This has created a negative feedback loop in which the poorest portions of the population are being excluded from economic growth and left without the financial resources to navigate the growing climate crisis (see Exhibit 1).

Joined-up responses

In response to climate change, governments around the world have examined a host of mechanisms to reduce emissions, with varying effects on vulnerable social groups.

One prominent example, putting a price on carbon, is viewed by many economists as one of the most effective means of cutting emissions. However, when not properly implemented, carbon-pricing schemes can have negative repercussions on low-income families/individuals and may face strong opposition as was the case with the ‘gilets jaunes’ in France. More broadly, some see dwindling political support for carbon taxes in key jurisdictions.

An alternative could be a carbon ‘fee and dividend’ policy such as proposed under the US Energy Innovation and Carbon Dividend Act. This mandates a gradually rising carbon fee on fossil fuel emissions with carbon dividends or rebates circulated to households. Such an approach would go some way to addressing the regressive nature of more blunt carbon tax instruments.

Policies to address social inequalities can also be one of the most effective ways to reduce emissions.

For example, Project Drawdown, a non-profit organisation, ranks climate solutions by their effectiveness. It suggests initiatives targeting women’s health and the education of girls can be some of the most effective emissions reduction strategies available to reach 2050 climate targets as they have the effect of slowing population growth (a key emissions driver), while improving family resilience to climate change.

These interventions also produce many ‘co-benefits’ which are not directly climate-related including improved health and lower incidences of disease and maternal and child mortality.

For all the above reasons, we believe climate justice – including a just transition to a low carbon economy – is not only desirable, but also necessary.

A social Inevitable Policy Response?

BNP Paribas Asset Management supports the Inevitable Policy Response (IPR) initiative, which postulates that markets have not yet priced in (an inevitable) forceful policy response to climate change.[1]

The IPR initiative is premised on the idea that governments will be forced to act more decisively to address climate change than they have done so far, exposing investor portfolios to significant risk. The longer this policy response is delayed, the more abrupt, disorderly, and disruptive it will be.

While IPR’s scenarios seek to forecast climate policies with a just transition lens, it’s plausible that a concurrent social Inevitable Policy Response could emerge given the historically high level of inequality in markets such as the US where the income and wealth gap between the country’s richest and poorest has risen sharply since the 1980s.

Inequality can only increase so much before policy change occurs – due to pressure at the ballot box or by means that are more dramatic. Analysis from academics at Otto-Friedrich-Universität Bamberg, Germany and Australian National University’s Centre for Applied Macroeconomic Analysis counts income inequality as a direct factor in political polarisation. This effect is seen most clearly in the deterioration in the economic position of the poorest fractions of the population.

A balanced approach

Many climate policies have been designed with an environment-first approach. However, it seems increasingly likely that policy change may be spurred by rising social pressure.

In part, this is due to the tangible nature of social inequality, which can be felt more pervasively than the disparate and acute impacts of extreme weather and climate disasters. The Covid-19 pandemic, which has exacerbated and laid bare the unequal effects experienced by disadvantaged groups, will also play a significant role.

For these reasons, it may be wise for those looking to spur climate action to hitch their wagon to social movements looking to address inequality. Nonetheless, not all policies designed to relieve social inequality will have a positive effect on climate mitigation.

For example, increasing minimum wages may alleviate income equality for workers, but it may also increase consumption, waste and emissions as a result of individuals having more disposable income.

We believe this is not a reason to abandon efforts to raise minimum wages; to the contrary, such policies may be essential to address wage stagnation and inequality. Instead, minimum wage increases could be coupled with environmental policies to reduce the potential negative environmental impacts of increased consumption such as carbon pricing.

Work to do for policymakers and investors

Overall, policymakers should seek to coordinate policies to address both environmental and social issues simultaneously as they are simply too interconnected and urgent to address separately.

In their engagement[2] and investment strategies, investors may wish to consider both climate and social regulation that is not yet reflected in today’s markets.

In addition to managing regulatory risk, investors may want to target investments in companies contributing to or responsibly addressing the transition to a low carbon economy via their stakeholders.