Emily McGuire, partner at Aon

More than half of UK defined benefit (DB) pension schemes have reduced the level of equities in their portfolios during the past two years. At the same time, as schemes sharpen their focus on their chosen endgame, diversification into alternative growth assets has increased. This change was one of the key findings from Aon’s 2019 Global Pension Risk Survey, which charts the actions, plans and concerns of UK DB pension schemes.

The survey’s results overall trends – of maturing pension schemes and reducing time to reach long-term targets – have had a clear impact on schemes’ investment strategies. This is in line with many of the trends we saw in the survey two years ago – notably de-risking and diversification. But this year the difference lies in the pace of change and the level of activity – schemes have firmed up their views and have acted decisively.

While this has been driven by schemes’ own circumstances, actions have typically fallen into two categories: schemes that have reduced equity exposure but increased liability hedging to reduce overall volatility, and those that have diversified from equities into alternative growth assets.

Wind the clock back 10 years and equities were typically 50% of a scheme’s investment portfolio. That has changed, with allocations now far lower and with 40% of respondents expecting to reduce that figure further over the next year. Nevertheless, they still need to maintain investment returns – which is where the rise of alternative growth assets comes in.

GROWING INTEREST IN ILLIQUID INVESTMENTS

As schemes look to alternative investment ideas, we have seen a continuing interest in illiquid asset classes. Almost a quarter (23%) of respondents expect to increase or make allocations to less liquid assets.

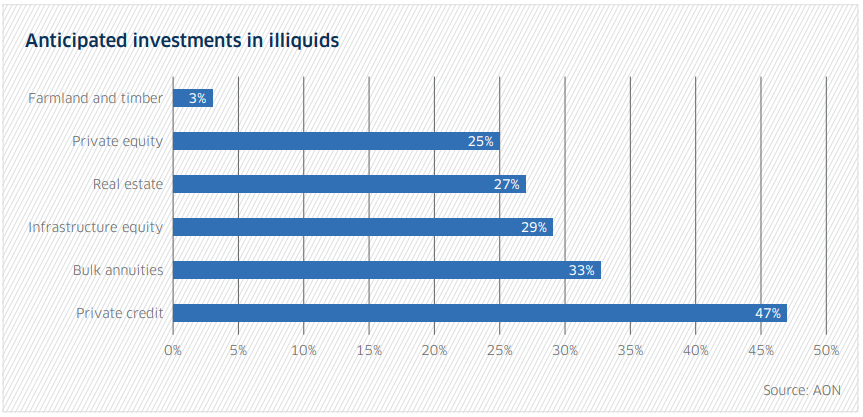

Pension scheme investors are looking for multiple types of illiquid assets and we are seeing the greatest interest in private credit (47%), which includes direct lending to corporates, real estate debt and infrastructure debt. Schemes are also indicating that they expect to increase their exposure to bulk annuities (33%), real estate (27%) and infrastructure (29%).

The anticipation of bulk annuity purchases reflects the increasing maturity and level funding of pension schemes in general. The overall average timescale to achieve long-term targets has fallen from 11.1 years in 2017 to 9.4 years in 2019, a reduction of 1.7 years. Aligned to this, there has been a significant increase in the adoption of a buy-out target since the 2017 survey – from 27% to 35%. We also see interest across a range of different illiquid asset classes, such as infrastructure with 20 to 25-year time horizons, through to real estate, where we are seeing a shift to global property portfolios, and to more cashflow-generative private credit type investments.

THE CASE FOR ILLIQUIDS

Increasing levels of interest in illiquid asset classes as pension schemes explore alternative investment ideas can be explained by their potential to provide a more diversified source of return from more traditional markets as well as predictable levels of income. Illiquid asset returns are predominantly driven by income with security offered by asset-backed or contractual cash-flows; and, or, seniority in the capital structure. The range of strategies available provides flexibility, in that they can form part of a scheme’s growth portfolio or part of its de-risking strategy. The income-orientated nature means they are likely to be used more defensively, while the lack of reliance on capital appreciation is also attractive in a range of market environments and scenarios.

BARRIERS TO ILLIQUIDS INVESTING

We also asked respondents to explain, where applicable, what is preventing them from considering illiquid asset classes. The most cited reason (40%) is that schemes are exploring buy-in or buy-out in the near term. A third of respondents (33%) do not believe illiquid assets offer attractive risk-adjusted returns compared to liquid markets. Just under a quarter (22%) gave as their reason for not investing in illiquids a lack of resources or expertise to have a meaningful allocation.

For schemes closest to buy-out, allocations to illiquids may not represent the best option for their portfolio – locking down risks and liquidity are significant factors for ensuring assets that are easily transactable. But, for schemes aiming to achieve self-sufficiency, and depending where on their journey they are, illiquid assets can offer attractive risk-adjusted returns relative to liquid markets and generate cash to pay benefits when they fall due.

Historically, meaningful allocations to illiquid assets have been the preserve of larger schemes. However, they are increasingly becoming more accessible to a broader range of schemes, for example, through partial delegation strategies, such as those offered by Aon.