UK Pension schemes seeking to address the dual challenges of achieving cost savings while improving the risk-return profiles of their equity holdings are increasingly turning to smart beta approaches.

UK pension schemes seeking to address the dual challenges of achieving

cost savings while improving the risk-return profiles of their equity holdings are increasingly turning to smart beta approaches.

Smart beta strategies are structured to capture various risk premia such as value, momentum, quality or low volatility.

Since each risk premium has a different long-term risk and return outcome, pension schemes can use well-designed smart beta strategies to access them and align their equity investments with their target outcome.

The rationale for smart beta investing

The traditional way of investing in equities has been through market cap weighted indices. This has also been the default approach for measuring the risk and returns that equities offer. However, the key failing of a market cap weighted approach is that prices determine a stocks’ weight in the index and stock prices are often not rational due to a difference in information, circumstances and objectives. The most influential factor is that investors are subject to behavioural flaws, such as fear and greed, loss aversion and herding.

It is these inefficiencies that many believe explain the existence of the various risk premia such as value, momentum and more recently low volatility and quality.

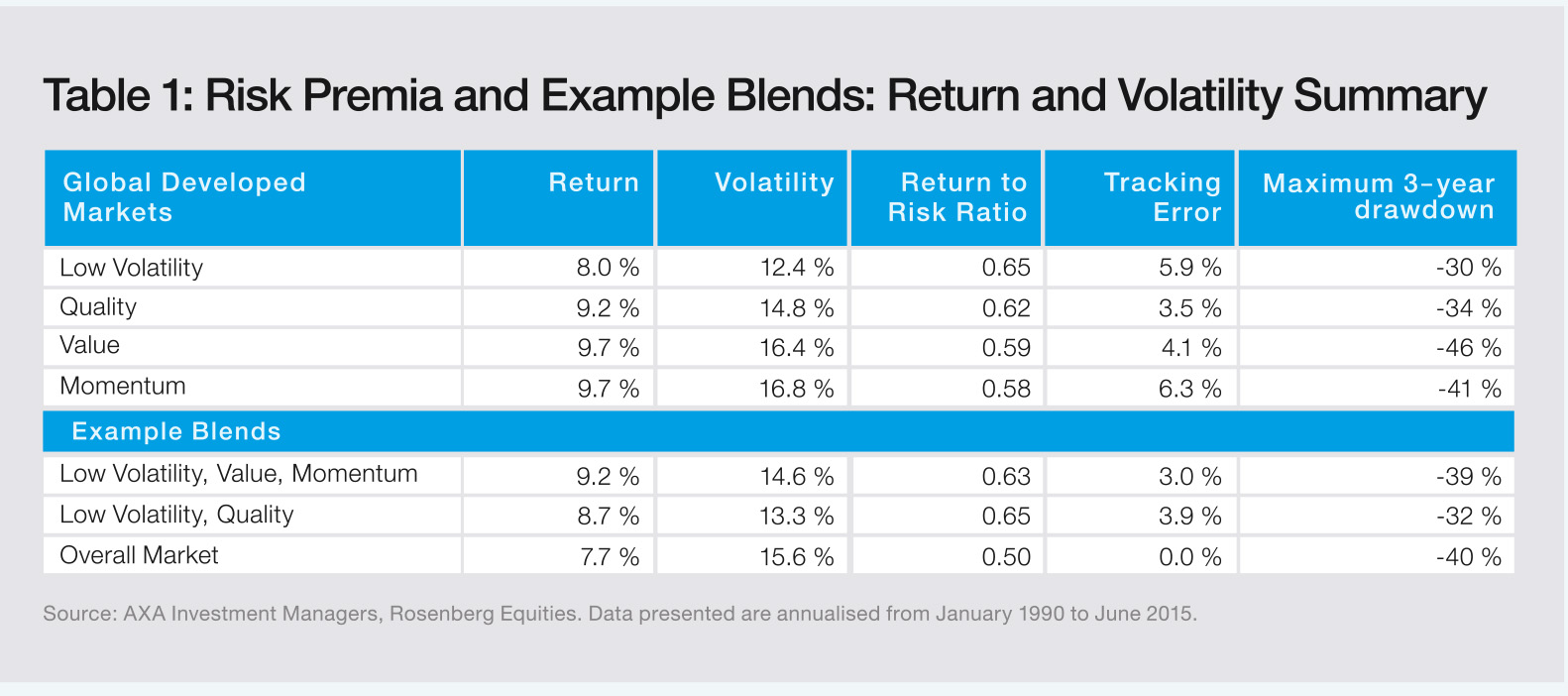

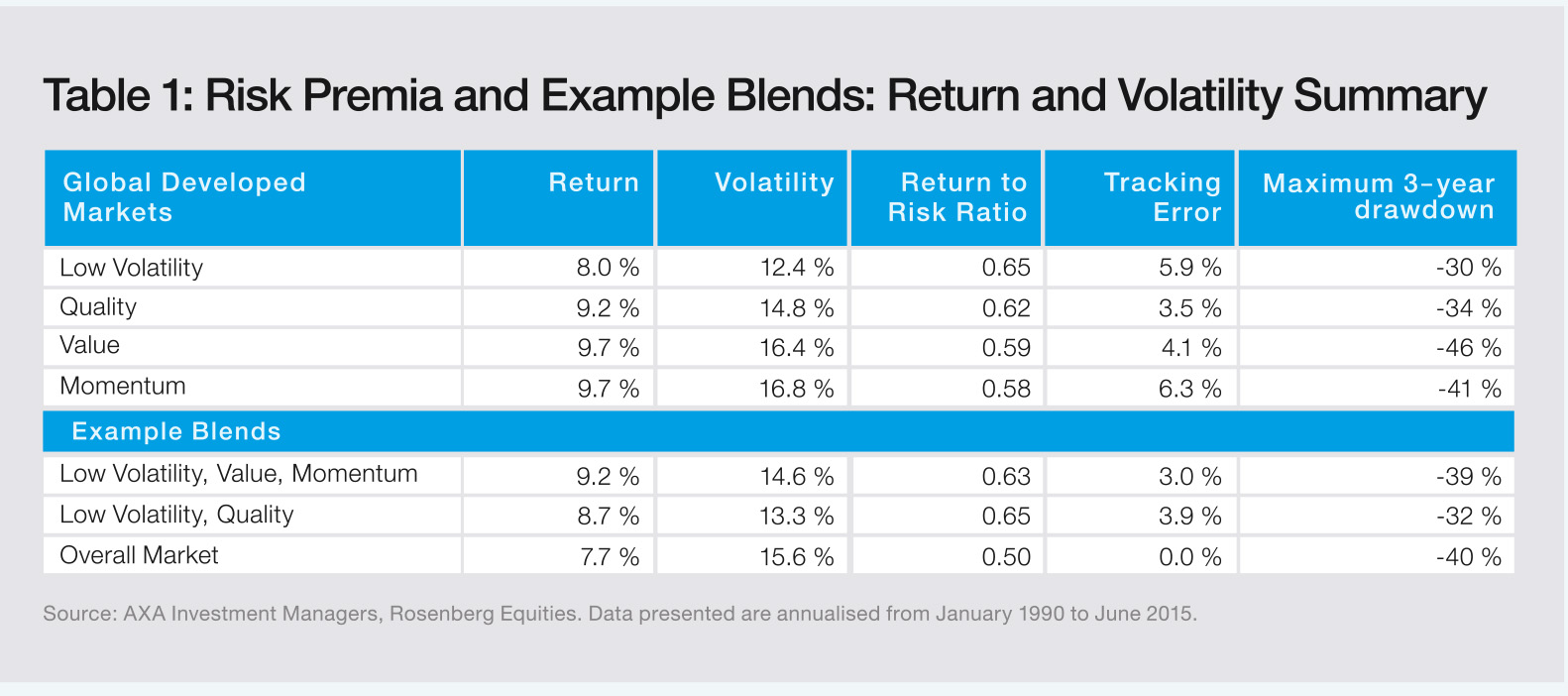

All four risk premia have delivered superior historical long-term returns compared to the market cap index. Momentum and value have demonstrated the highest rates of return, but with the highest levels of volatility or total risk. Low volatility and quality exhibit lower levels volatility with somewhat lower levels of excess return.

It is our view that these premia offer long-term superior performance because they avoid investor behavioural flaws. Instead, they provide a better connection with the fundamental characteristics of companies that ultimately drive a stock’s risk and return – corporate earnings.

The investment ideas underpinning risk premia are not new, but pension schemes can now access these premia in a more direct, transparent and efficient way using well-designed smart beta strategies.

Blending risk premia to reduce dependency on a single source of return

The returns shown in Table 1 are annualised averages over the last 25 years. Over shorter time horizons an individual risk premium may suffer from periods during which it is not in favour. Long periods of weakness may not suit the objectives of a pension scheme. While pension schemes are long-term investors, downside volatility can lead to declining funding levels, which in turn can lead to increased contributions. This could apply equally for defined contribution members, especially just before the decumulation phase.

Instead of relying on the long-term risk and return characteristics of a single risk premium, pensionschemes might look for a blended solution. By blending risk premia, investors can reduce dependency on one source of return and further manage and target the risk and return outcomes offered through smart beta investing.

Finding the right blend

A useful framework for analysing performance patterns is to look at each risk premium’s behaviour in the context of the corporate earnings cycle, which we split into four stages:

i. Earnings expansion > early cycle – bull market: Earnings are growing rapidly and equity

market prices are rising.

ii. Earnings expansion > mid/late cycle – bull market: Earnings are growing but the rate of change is steady or slowing. Equity market prices are rising.

iii. Earnings recession – bear market: Earnings are in recession (falling by 20% or more) and equity market prices are falling.

iv. Recovery market: Earnings are in recession (falling by 20% or more) but equity market prices are rising in anticipation of recovery.Since 1990 we have experienced three full earnings cycles and we can draw two conclusions from these periods:

1. There is some observable consistency in the historical behaviour of individual risk premia at different stages of the earnings cycle, and

2. No single risk premium performs well at all stages of the cycle. A smart beta investor may therefore benefit from blending more than one risk premium to take advantage of the different performance patterns and to reduce the possibly of a protracted period of underperformance.When considering a blended smart beta approach, a pension scheme should ensure the selected blend is consistent with its long-term objectives. For example, a pension scheme that wants to minimise drawdown when markets are distressed might not see any benefit from investing in a blended premia strategy that has too much exposure to value and momentum. While such a blend can be expected to reduce the overall tracking error when markets are rising, it will also increase overall volatility and is not expected to reduce the drawdown when markets fall.

However some risk premia are more natural complements to each other in terms of overall risk profile while potentially improving the pattern of returns.

For example, both the quality and low volatility premia exhibit defensive behaviour in bear markets (see Table 1). When blended, these two complementary strategies offer attractive down market performance. Blending them may also boost overall returns and help reduce the risk of a long period of underperformance as the quality premium is expected to outperform during periods of earnings expansion, notably the mid to latter stage.

The reason quality has the twin attributes of defensiveness during recession and solid performance as the earnings cycle matures is because it benefits from a fundamental link to corporate earnings growth stability and balance sheet strength.

During a recession, quality is less exposed to balance sheet distress and earnings drawdown than the market. Its importance grows in the latter stages of earnings expansion because it offers exposure to earnings growth which becomes harder for companies to achieve and therefore for investors to capture.

A smart beta approach that blends low volatility and quality may suit pension schemes with an objective to improve long-term equity returns, reduce volatility and drawdown risks and wish to avoid long periods of cyclical underperformance, which a focus on low volatility alone may provide.Individual risk premia demonstrate different performance patterns over the earnings cycle with long-term risk and return characteristics that may result in long periods of underperformance. Pension schemes should not rely on a single risk premium to align their long-term equity investments with their overall investment goals, but consider adopting a smart beta solution that blends risk premia.By carefully selecting and blending risk premia, pension schemes can better manage risk and target their desired long-term outcomes in a cost effective and efficient manner.