Patrick Houweling, head of quantitative credit at Robeco

Although much empirical research around factors focuses on equities, the concept and benefits of factor investing apply equally well to corporate bonds.

Award-winning research by Robeco shows how factor investing can also be applied to the corporate bond markets and how systematically allocating to factors — size, quality, low risk, value and momentum – has been demonstrated to deliver higher risk-adjusted returns.

In the academic literature on corporate bonds, low risk and momentum are the best documented factors, while there has been far less research on quality, value and size. In our study, we defined factors consistently with the existing literature. We used readily available bond characteristics (spread, rating, maturity) that are intuitive for corporate bond investors.

Multi-factor portfolios offer more stable returns

We examined the risk-return profiles of individual and multi-factor portfolios. Single-factor portfolios have their own distinctive risk-return profile, while delivering higher risk-adjusted returns than the market index. Multi-factor portfolios offer diversification benefits that make the relative performance versus the index more stable over time.

Our findings show that the multi-factor portfolio retains the high sharpe ratio generated by the individual factors, but with smaller drawdowns and a lower tracking error versus the market. We thus conclude that allocating to multiple factors is effective, in investment grade and high yield segments.

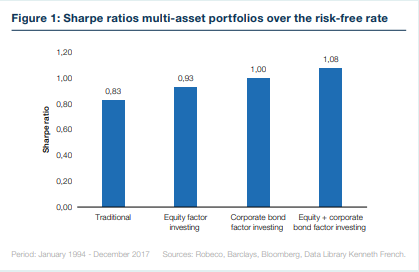

Having established the added value of factor investing in the corporate bond market, we looked at other asset classes too – equities and government bonds. Investors who already allocate their equity portfolio to factors may also be interested in extending this to approach to their corporate bond holdings. Our results demonstrate that adopting a multi-factor approach in the corporate bond portion of a traditional multi-asset portfolio boosts its sharpe ratio. While multi-asset investors who already allocate to equity factors and opt to allocate the corporate bond portion of their portfolio to factors too can improve their sharpe ratio still further, as the figure below shows.

Enhanced factor investing

Robeco research has also shown that it is possible to improve on these academic results by enhancing the factor definitions and by enhancing the portfolio construction. In doing this, it is important to understand the latent risks in each factor and to mitigate those that are not properly rewarded with higher returns and to diversify across variables. This can be done by expanding the scope of these variables beyond bond market characteristics, for example, by also looking also at accounting and equity data.

In terms of portfolio construction, performance can also be enhanced in several ways. These methods include focusing on reducing turnover and keeping down transaction costs, avoiding unintentional negative exposure to other factors in a single-factor portfolio and finally preventing large sector and region bets to prevent concentrated positions and improve diversification.

Robeco offers single-factor and multi-factor strategies in investment grade and high yield that can be implemented as standalone solutions or incorporated in a multi-asset approach. To learn more about our offering visit robeco.com