Jennifer O’Neill, Senior responsible investment specialist at Aon

When developing or implementing a responsible investment policy, equity holdings are usually the main focus of attention.

There is often a perception that integration of ESG factors is less relevant to bonds and fixed income assets, for several reasons: the shorter and predefined investment horizon, and the fact that investors do not have voting rights and the ability to exert influence on issuers in the same way that equity holders do.

In our view, ESG integration in fixed income should be receiving the same amount of attention as equity. It will become ever more relevant as defined benefit pension schemes continue their journey of de-risking away from equities into fixed income. For investors holding fixed income assets to receive contractual income and principal repayment, downside protection is naturally a material consideration: how could ESG factors affect the ability of the issuer to meet its obligations over the duration of the issuance, or negatively affect the value of its issued debt in the interim?

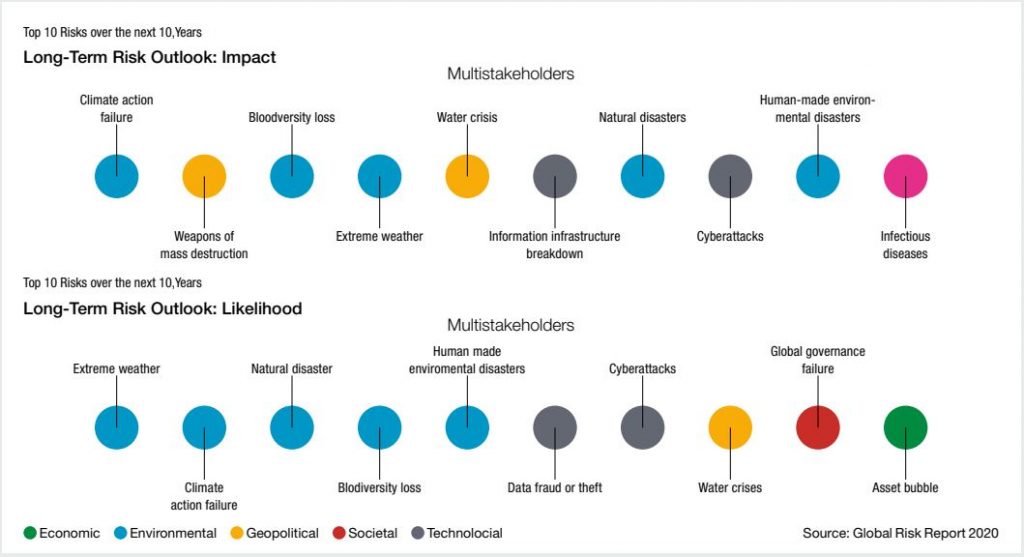

Thinking about this in the context of the World Economic Forum’s 2020 Global Risks Report, which identifies climate change risk as the primary risk over the next 10 years in terms of impact (having nudged the use of weapons of mass destruction into second place) and likelihood, let us consider the implications for bondholders:

Aon’s annual Weather, Climate and Catastrophe Insight Report highlights that economic losses from natural disasters exceeded $232bn (£176.6bn) in 2019, which – following the two costliest years on records – has brought the costliest decade in history to a close. The costliest category of economic loss in 2019 was flooding ($82bn/£62.4bn).

Fixed income investors are undoubtedly affected by capital loss events such as these. Understanding corporate – and sovereign/ sub-sovereign – exposure and action to mitigate these risks is key to determining the appropriate return for the risks incurred.

A prime example of this are US municipal bonds. A great deal of media attention has latterly focused on the financial risks of climate change as a threat to the ability of municipal bond issuers to repay principal (and meet continuing coupon obligations), owing to the cost implications (direct – as a result of extreme weather events – and indirect, in the form of lost tax revenue arising from these events and the suppression of economic activity in the aftermath) of climate change. Credit rating agencies are beginning to factor these risks into their assessment of bond issues – and bond fund managers often undertake proprietary analysis of their own, as part of initial and ongoing due diligence. But, the extent to which ESG risk assessment is integrated into the portfolio construction process does vary by fund manager and strategy.

So how can investors, such as pension scheme trustees, understand and think about how this is monitored and mitigated within their bond portfolios? Crucial to this is understanding how appointed fund managers are doing so. To what extent are those managers assessing material ESG risks, and how does this play a part in portfolio construction? Does it align with what the trustees would expect – are they comfortable with the processes that are in place? Engaging with an independent third party to assist in objective analysis of the managers’ commitments can provide a useful form of oversight. Refreshing this on an annual basis can ensure that trustees stay abreast of developments, in terms of portfolio constituents, and the managers’ own processes.

Investors should not neglect ESG integration in fixed income. Understanding the role this plays in investment strategy is a crucial part of exercising the fiduciary duty of trustees.