Rob Stewart, head of responsible and charity investment at Newton Investment Management

At Newton, our overarching approach to responsible investment is grounded in our belief that responsible investment is better investment.

We think that looking at environmental, social and governance (ESG) factors and actively engaging with companies to help improve their ESG profiles over time can not only help pinpoint risks beyond those identified in a company’s financial statements, but also help improve a company’s performance over the long term.

While being an active responsible investor is our starting point, we think that more broadly there are perhaps too many definitions of what responsible investment is, which may lead to confusion for some would-be investors. With that in mind, over time we have distilled our approach to responsible investment strategies into three broad areas. While not a definitive list, we believe our approach helps demystify and break down the jargon often deployed in this sector.

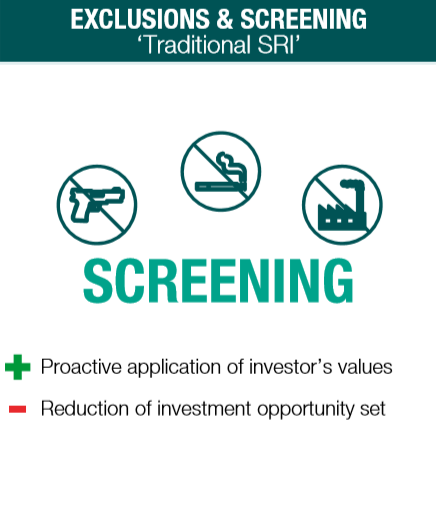

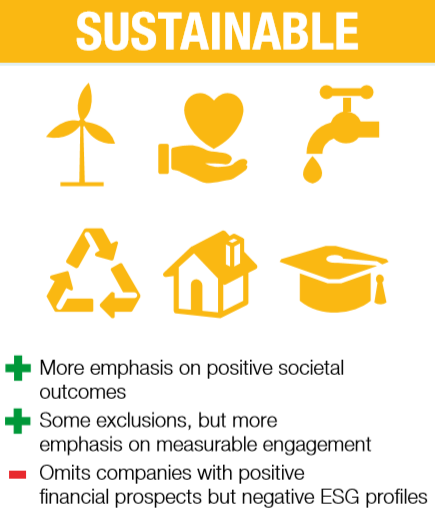

The diagram below sets out the key attributes of the three areas: exclusions and screening, integrated ESG, and sustainable investing.

Newton’s three broad categories of responsible investment

Exclusions and screening is an investment approach we have run since 1988 for some of our faith-based and charity investors. At the request of these clients, we can tailor portfolios to exclude entire sectors, for example armaments, tobacco or alcohol, or screen out individual companies.

The second broad category is our integrated ESG approach, which is how we manage the vast majority of our clients’ assets (and has developed as part of the evolution of our investment approach since 1978).

We were early adopters among our peers by expanding the investment universe in which we make active voting decisions and engage with companies. Following our inception in 1978, we focused initially on domestic UK companies, but widened this in 2000 to ensure we were active stewards across all global companies.

This practice has evolved to also entail our responsible investment analysts integrating ESG alongside conventional financial analysis before we commit our clients’ capital to an investment opportunity. We view ESG considerations as an integral part of our research, alongside conventional financial analysis, as they can also affect a company’s financial prospects.

In addition, we actively engage with the companies we invest in to help improve their ESG profiles over time. In this approach, ESG analysis, carried out by our dedicated team of responsible investment analysts, is a key input into the investment decision-making process. However, the ultimate decision about whether to include a security in a portfolio lies with the portfolio manager. This means that companies with material ESG risks may be included in the portfolio as long as the portfolio manager believes that the valuation adequately compensates for the risks identified. In our view, this time-honoured method of ESG analysis enriches our fundamental analysis of risks and opportunities.

Finally, the newest element of our responsible investment approach is what we term sustainable investing. In short, our sustainable strategies adopt the fundamental principles captured by our integrated ESG approach, but amplify the responsible investment requirements by adopting sustainable ‘red lines’ and a responsible investment veto approach.

We use ESG analysis to identify companies with robust business models which effectively incorporate sustainability into their core business and strategy. While engagement with companies on ESG considerations is common to our integrated ESG and sustainable approaches, our sustainable strategy ‘red lines’ are an extra step to ensure that the companies that we choose to invest in do not violate the UN Global Compact’s 10 principles that promote responsible corporate citizenship (relating to areas such as corruption, labour standards, human rights and the environment). The ‘red lines’ also ensure that we avoid companies with characteristics which make them incompatible with the aim of limiting global warming to 2°C.

Finally, we exclude tobacco as we do not view those businesses as compatible with our commitment to sustainable investment.In this context, our responsible investment team determines whether an investment opportunity is suitable for sustainable strategies over and above the traditional financial analyst’s recommendation. We do not expect the veto to be needed, but it is a strong signal of what matters most to our sustainable strategies both internally and externally.