A sponsored article byAniket Das, Legal & General Investment Management

Not only does index investment still have a crucial role to play in portfolios, but the rise of factor-based investing, or ‘smart beta’, means that investors now have a single route to accessing the potential benefits of both active and passive investing.

Not only does index investment still have a crucial role to play in portfolios, but the rise of factor-based investing, or ‘smart beta’, means that investors now have a single route to accessing the potential benefits of both active and passive investing. Factor-based investing, which seeks to identify the underlying characteristics that drive performance, has grown rapidly since the global financial crisis. This is because investors are looking to go beyond asset class labels and understand the true drivers of risk and return in their portfolios. Investors are using factor-based investing across equity, fixed income and multi-asset strategies, seeking a cost-effective route to enhanced returns, lower risk, or higher levels of income.

What are factors?

Market factors can be defined as any broad driver of the performance of an asset class. Examples include growth, inflation and interest rate sensitivity. All three of these factors are typical drivers of corporate bond prices, for instance. Shocks to growth can hurt company profits and a bond’s safety, while changes in interest rates and inflation levels can affect the discount rate investors use to price the bond.

While broad asset class returns can be explained by market factors, we have to look at individual securities to explain the performance of a portfolio holding active, or off-benchmark positions. We can then see that certain characteristics, or factors, drive the performance of one security relative to another, and that these characteristics are distinct from market factors.

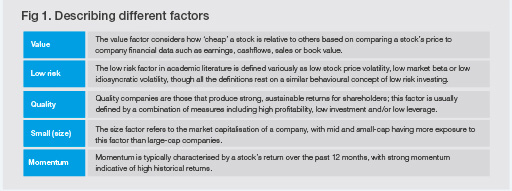

In the case of equities, factors are labelled under groups such as value, size, momentum, low risk and quality. These groups of characteristics, alongside market factors, better help to explain the different drivers of overall portfolio performance.

Choose your factors carefully

While factors may drive risk and return, they do not necessarily produce a positive long-term return. Investors must therefore be careful to understand which factors are likely to be rewarded when choosing where to invest. We would suggest investors consider the following three questions:• Is there an economic reason, a behavioural trait or a structural anomaly as to why the factor should be rewarded?

• Is there a body of academic research supporting the existence of a positive return premium in the factor?

• Is there evidence of the factor working in multiple regions, time periods and possibly asset classes?Answering these questions is fundamental before plotting a course towards factor-based investing if investors are to gain the type of outcome they desire.