Matthew Murphy is a senior institutional portfolio manager in the global income team at Eaton Vance

March marks one year since financial markets witnessed an unprecedented level of volatility and tumult. UK institutional investors are well aware of this milestone as well as the tremendous resurgence in global capital markets over the ensuing period, fuelled largely by monetary and fiscal stimulus. Value opportunities, where they exist, have become more difficult to find, with few sectors able to claim attractive valuations. Consider, too, that the realisation of potential upside requires one or more catalysts. With these factors in mind, we think that emerging markets local currency (EM FX) is a key area that merits investor attention based on the fundamentals, macro environment and technical support for the sector.

Here are the key reasons why:

Relative value. EM FX lagged most risk assets during the rebound. Last year, the FX component of the JP Morgan Government Bond Index-Emerging Markets (GBI-EM) Global Diversified, a primary benchmark for local currency EM debt, was down over 7% in USD terms. Even as recently as November, many EM currencies were still trading at 2020 lows.

Fundamentals. EM growth is leading the global economic recovery. Crucially, EM lockdowns were not as severe in the initial response phase to Covid-19, and they are not restricting business activity as aggressively now with additional waves, either. Global trade and EM exports have recovered to “pre-Covid” levels. In addition, the rallies in prices for oil and commodities more broadly have improved the economic dynamics for many EM countries.

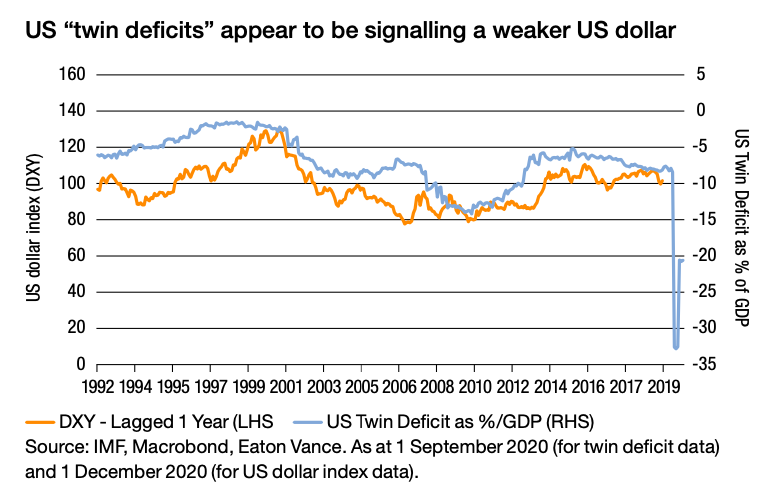

Macro environment. Developed-market monetary policies should continue to anchor core interest rates at extremely low levels, which includes $18trn (£12.8trn) of negative-yielding debt. Combined with massive fiscal stimulus in many countries, the global economy is likely to remain awash in liquidity. Furthermore, when US deficits balloon, as they have recently, historically that has resulted in a weaker US dollar. The chart below shows the relationship between the twin US deficits (budget and trade) with the US dollar. The USD line is lagged by a year to high- light how the path of the deficits has often been a predictor for the path of the US dollar. If previous patterns hold, the sharp increase in the deficits could indicate further sharp erosion of USD strength.

Technicals. Investors have been allocating to EM debt, including crossover buyers seeking to avoid the ultra-low yields available in other sectors. We believe, however, that this trend has plenty of steam left, given that cashflow into the sector did not turn positive until the end of last year. Until that inflection point, following the start of the pandemic in March 2020, outflows from the sector were the largest on record.

Positive flows into the sector are likely to help EM countries struggling with the effects of Covid-19, which continues to wreak havoc on lives and livelihoods. EM countries vary widely in their ability to navigate the associated economic challenges, with a growing roster of defaults and debt restructurings making selection critical. Notwithstanding these difficulties, we remain broadly constructive on the space.

In conclusion, emerging markets local currencies are likely to be a powerful factor driving EM debt returns this year. With proper expertise, due diligence and attention to country-specific risk, we believe that investors who allocate to EM debt will be better positioned to capture one of the few value opportunities that appears to be so elusive in other sectors today.

Sources of data: Eaton Vance, JPMorgan, IMF, Macrobond. Data is as at 31/12/2020, unless otherwise specified. This material is presented for informational and illustrative purposes only. It should not be construed as invest- ment advice, or to adopt any particular investment strategy. Investment views, opinions, and/or analysis ex- pressed constitute judgments as of the date of this material and are subject to change at any time without notice. This material is for the benefit of persons whom Eaton Vance reasonably believes it is permitted to communicate to and should not be shared with any other person without the consent of Eaton Vance.

Outside of the EU and US, this is issued by Eaton Vance Management (International) Limited (“EVMI”), 125 Old Broad Street, London, EC2N 1AR, UK, and is authorised and regulated by the Financial Conduct Authority. In emerging market countries, the risks may be more significant in regards to sensitivity to stock market volatility, adverse market, economic, political, regulatory, geopolitical and other conditions. For Professional Clients/Accredited Investors only.