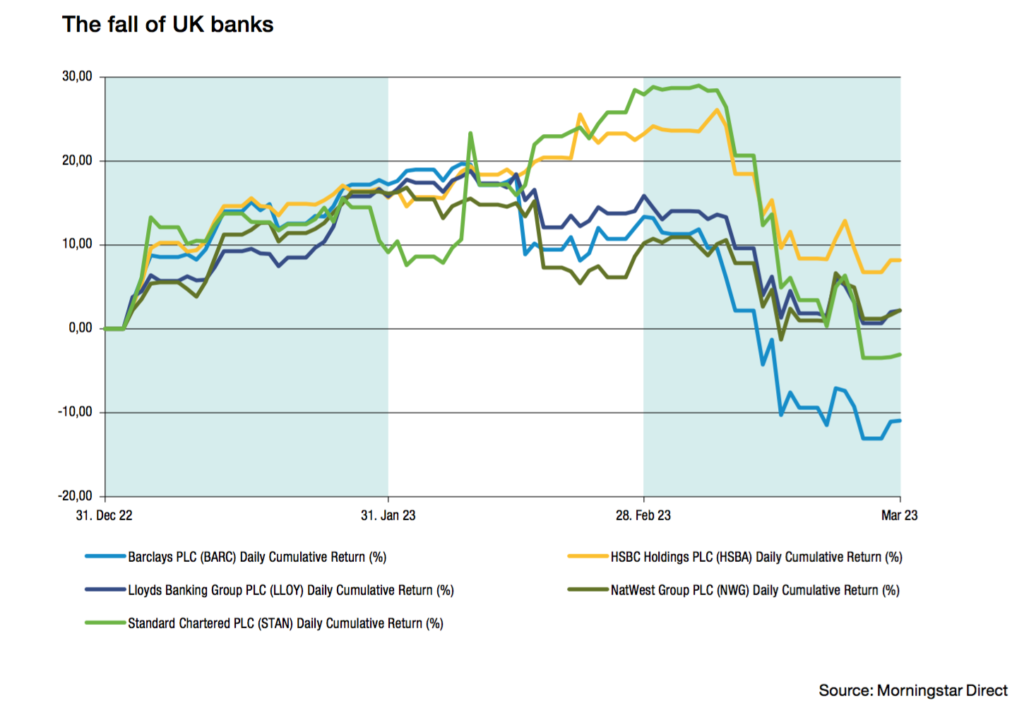

The fall of Silicon Valley Bank (SVB) followed by regulators closing Signature Bank and then struggling Credit Suisse bought by rival UBS for a discount led to a sharp selloff in financial stocks.

About $460bn (£373bn) was wiped off the sector’s value when the negative headlines spread from California to New York and then Europe. The biggest losses occurred in the US where the KBW Bank index fell 18%, just ahead of Europe’s Stoxx 600 Banks index dropping by 15%. The crisis even rippled through to Japan’s Topix Banks index, which tumbled 9%.

Something, no doubt, not lost on investors.

Whether banks started to crack under the strain of historic interest rate rises, or if the oversight of lenders introduced after the 2008 financial crisis failed, stocks nevertheless plummeted in March.

The rate rise narrative is a strong one. Rate rises – currently the central bank norm – can bring problems for lenders who find themselves exposed to duration risks in their credit portfolios. SVB’s collapse sparked concerns over unrealised interest rate losses on assets held by the banks.

Simultaneously, rapid cash withdrawals and declines of liquidity reserves can have a ripple effect in the more vulnerable parts of the economy, as banks restricted in their ability to provide credit.

Commentators keep repeating that this crisis is not comparable to 2008’s financial catastrophe based on the view that the banking system is now built on stronger foundations. But the events in March question that premise.

How, and when, will the crisis abate? It is an interesting point given that Deutsche Bank was another big name caught up in the crisis. Yet those backing British banking institutions should be relatively safe.

Economic research firm Pantheon Macroeconomics has observed that stress levels are low among British banks, with none having been “mismanaged” like Credit Suisse or have a large destabilising pool of fixed income securities like SVB.

It is nevertheless a problematic picture for investors. Finance stocks are usually reliable up-tickers in a portfolio. This new crisis potentially shifts this narrative to one where financial institutions with sensitivities to rates will remain vulnerable.

Something investors will have to consider, even if they have not been forced to do so already.

Comments