Macro uncertainty: keep calm and wait for opportunity

By Mike Clements, head of European equities at SYZ Asset Management

It is difficult to make predictions it was once said, particularly about the future. Last year, I failed to foresee Brexit and the unstoppable ascent of Donald J. Trump to the White House.. This year I didn’t expect a snap election in the UK and when it was called I wouldn’t have imagined that the Conservative party would emerge from it in a worse position. It is lucky that making calls on political outcomes is not part of my investment process.

We are currently undergoing a macro-economic and geo-political maelstrom on both sides of the Atlantic, and it is difficult to know how the market will react to impending elections and economic flashpoints. This is naturally unnerving for investors, but, fortunately, it is possible to separate politics from portfolio decision making. Indeed, despite failing to predict or factor in any of the big political events of last year, our European equity strategies outperformed both the benchmark and peer group averages.

Active opportunities set to ripen

With this in mind, as usual, we put our crystal ball to the side and favour an opportunistic ‘wait and see’ strategy. Following seismic political events of 2016, there will be plenty of aftershocks which can be exploited to generate alpha. Impending macro upsets or short-term economic shocks do not concern us. However, that is not to say changing political winds or other unexpected shifts cannot provide windows of opportunities. For example, we are watching the Brexit negotiations closely.

Importance of scenario planning

Indeed, investing is often about timing. Our bottom-up investment philosophy focuses on high-quality companies with a strong competitive edge and solid balance sheets suffering from short-term pressures. Sometimes we unearth companies that pass our rigorous process but fail to get the green light on valuation grounds – the timing is just not right. Hence, we keep close attention to bouts of indiscriminate selling precipitated by political or economic flashpoints.

We also undertake rigorous scenario planning exercises to assess what various outcomes may look like. Of course, some of this analysis will ultimately be fruitless as there will always be multiple potential outcomes, but, crucially, it allows us to strike when an opportunity arises.

Italian opportunity is playing out nicely

Last year we were actively searching for ideas in a highly out of favour market, namly Italian financials. The well documented issues with the major banks balance sheets and the political turmoil of the Renzi referendum gave an interesting entry point into a number of high quality companies. For example we invested in a company called Eurocastle, which is an independent third-party servicer for non-performing loans, Anima, a leading asset manger and Banca Sistema, a speciality finance company.

Volatility is an opportunity!

Where else should investors be looking right now? With markets moving higher on the back of solid global risk appetites there are currently no obvious contrarian plays either at a country or sector level. However, there is one market which is looking out of favour and that is volatility. If you look at the Vix, a well know volatility gauge, you have to go back to 2006 to find the current low levels. We are not sure why it is so low right now. It could be because of the benign macroeconomic conditions, the dampening effects of central bank policy or it could simply be investor complacency. However, in a market where many people believe equity index valuations are high, exposure to volatility is an interesting contrarian theme.

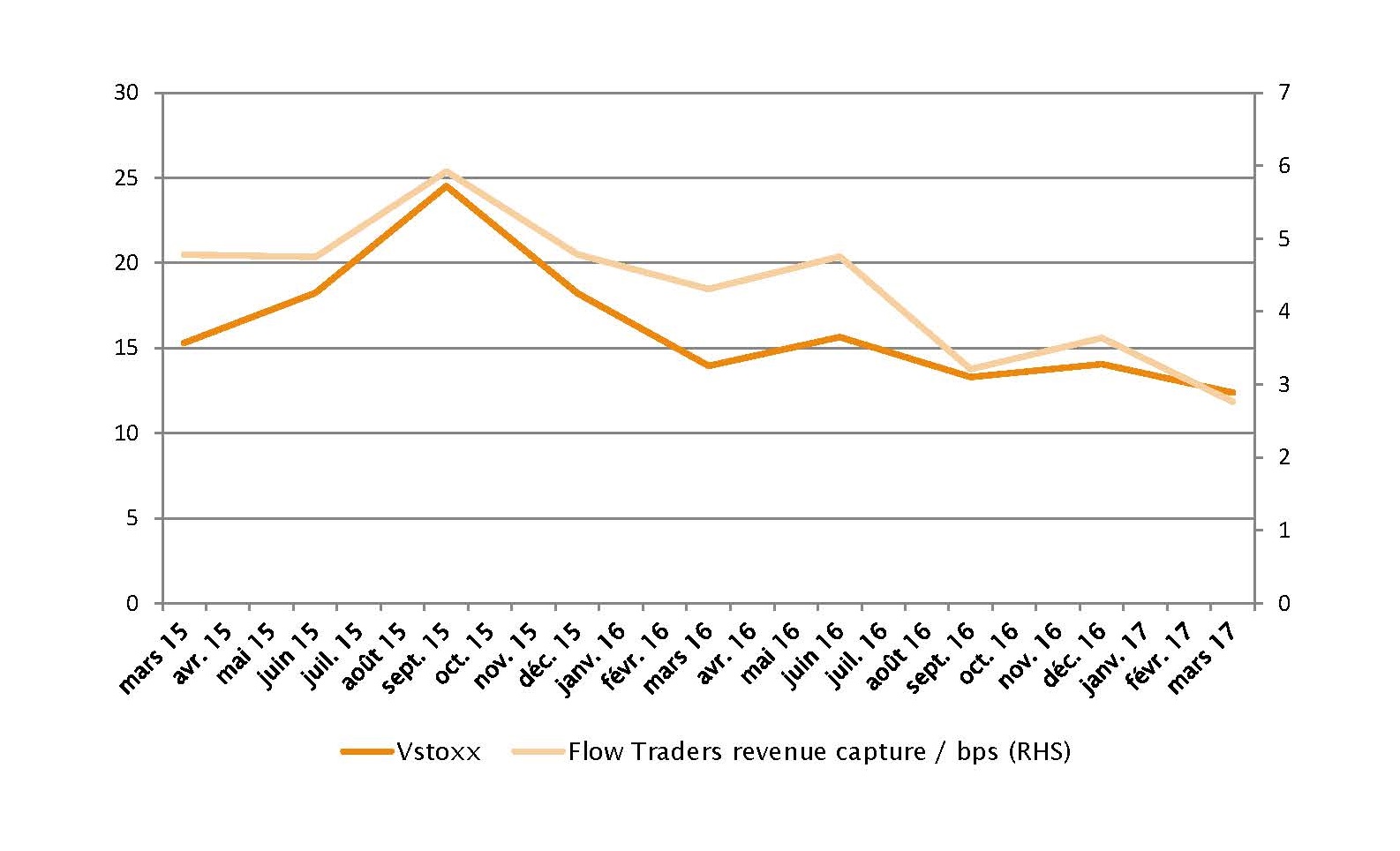

Within the European market there are a number of interesting ways to play this theme. The trading business such as exchanges and market makers are attractive as they combine high returns and solid cashflow generation with exposure to volatility driven revenue. Across our European equity portfolios we have positions in IG Group, a leading provider of spread betting and CFD products, and Flow Traders, a leading ETF market maker.

Flow Traders is a great example of what we like to invest in. the company dominates the ETF space with around 20% share in market making volumes. It will benefit over the long term from the structural growth in ETF but in the short term its revenues are largely influenced by volatility. When volatility is subdued, then it revenues suffer from a double whammy of tight spreads and low volumes. However, when market dislocations or stress occur, volatility provides a nice kicker to the structural revenue growth. Despite being very well positioned, the company’s shares have been depressed so far this year and we believe there is substantial upside if volatility returns to more normal levels.

For more information please click

Disclaimer

“This advertisement has been approved for issue in the UK by SYZ Asset Management ( Europe ) Limited (authorised and regulated by the Financial Conduct Authority with reference number 666766 to provide investment services to Professional Investors). This advertisement is intended to the Professional Investors only. An investment involves risks. The information or data contained in this advertisement does not in any way constitute an offer or a recommendation to invest nor does it in any manner constitute the provision of investment advice in relation to same”.