Timing interest rate hikes can be a challenge for any central banker. Raising rates too early or too steeply could plunge the nation into recession. Yet most central bankers believe that excessively loose monetary policy could help drive prices higher.

As such, they are convinced that raising rates could play a vital role in tackling inflation. And as price levels are creeping up globally, central bankers across the world have stepped in to make borrowing more expensive.

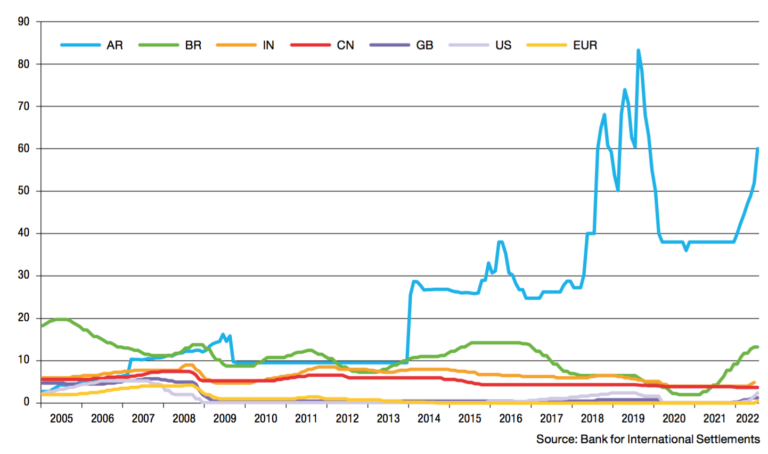

But while the actions of the Fed, European Central Bank and the Bank of England have hit the headlines, many emerging market central banks beat them to raising rates and are doing so at a faster pace. Latin American countries, such as Argentina, Brazil and Peru, started raising rates last year or in January in response to skyrocketing inflation.

This reverses the decades-long trend of emerging markets following in the footsteps of the Fed. It also showcases that developing economies have had limited success in their attempts to control inflation.

For example, despite multiple rate hikes, inflation in Brazil is still double digits while in Chile it remains at 13%. The problem extends beyond Latin America. The Czech Republic, for example, has raised rates from 0.25% to 7% in a year, but inflation remains at around 17%.

But there are outliers. China in particular has not only retained a loose monetary policy, but even cut rates twice this year because inflation slowed throughout the summer.

Those investing in the developing world usually approach rate hikes with anxiety.

This is why emerging market bonds saw dramatic outflows of more than $50bn (£44bn) in the first half of 2022. But it might be worth noting that this time around, emerging markets appear to have become relatively less exposed to the impact of rate rises in Washington.

This is partly due to relatively higher issuance of local currency debt, making them less exposed to a stronger dollar.

But the flipside is that investors in soft currency debt remain exposed to inflation, which may be higher than those in developed markets.

The sell-off at the beginning of the year may have created an opportunity in emerging market debt but investors may want to pick the countries they invest in carefully as the course of inflation remains hard to predict.

Emerging market versus developed market central bank rate hikes

Comments