With the yield curve on US treasuries inverting and more than a quarter of all global bonds now trading at negative rates, investors are running out of places to hide and turning towards precious metals as the traditional haven of choice.

Gold spot prices hit a six-year peak in August while futures rallied to $1,555 (£1,275) amid growing investor concern about the global economy.

A key driver behind the spike in demand for precious metals was the Federal Reserve rate cut earlier that month, moving interest rates to their lowest level in a decade.

The move triggered an inversion of the US yield curve with yields for 10-year treasuries tipping below that offered by two-year paper, making it less attractive for investors to hold longer-dated debt.

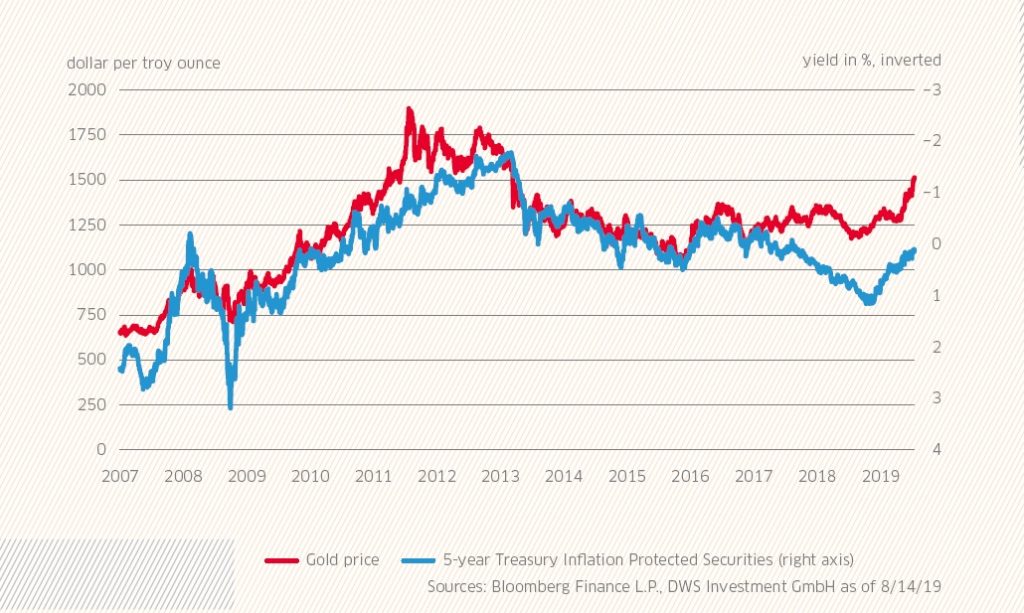

The rate cut has been a key factor in driving up the gold price, which during the past 10 years has shown a close correlation with US real yields. While investments in physical gold have been popular, investors are also increasingly seeking access through exchange-traded commodity funds.

Yet ETC data also points to an interesting turnaround as investors increasingly appear to favour silver as an alternative to gold. By the end of July, the most popular exchange traded product (ETP) in Europe was the ETFS Physical Silver fund, which attracted $318.3m (£261.0m) throughout the month, followed by the iShares Physical Gold ETC which booked $233.29 (£191.3m) in net new assets throughout the month and has gained more than 12% YTD. Similarly, among the most popular ETFs traded on the London Stock Exchange in August was L&G’s Gold Mining Ucits ETFs.

At the same time, Synthetic Gold ETFs and gold mining stocks have historically been prone to high levels of volatility. For example, the L&G Gold Mining ETF jumped from an annual price return of -12.28% in 2015 to +82.78 the following year and -0.06% the year after that.

Even physical ETPs, which have become a preference for investors, have seen significant bouts of volatility during the past five years. For example, total return on the iShares Physical Gold ETC dropped below -11% in 2015.