The outlook for dividends this year has been radically ramped up, with most sectors expected to show growth this year, but two industries in particular are projected to be strong contributors to the fillip.

Miners may have paid minimal dividends during the first quarter, but they are expected to recommend larger payments for the second three months of the year, Link believes. The other sector that will boost overall dividends this year is oil.

In the first quarter these companies handed back 29% more cash to shareholders, year-on-year, as prices made an astonishing rebound. This looks like this is only the beginning. With crude prices crashing during the pandemic, there is a lot of headroom for growth now that the oil majors are once again enjoying big increases in their cashflow.

This is within the context of soaring commodities which have also bolstered the prospects for the mining industry to be one of the UK’s biggest dividend-paying sectors. The ongoing mining boom has contributed around 80% of the £4.5bn upgrade in Link’s 2022 forecast.

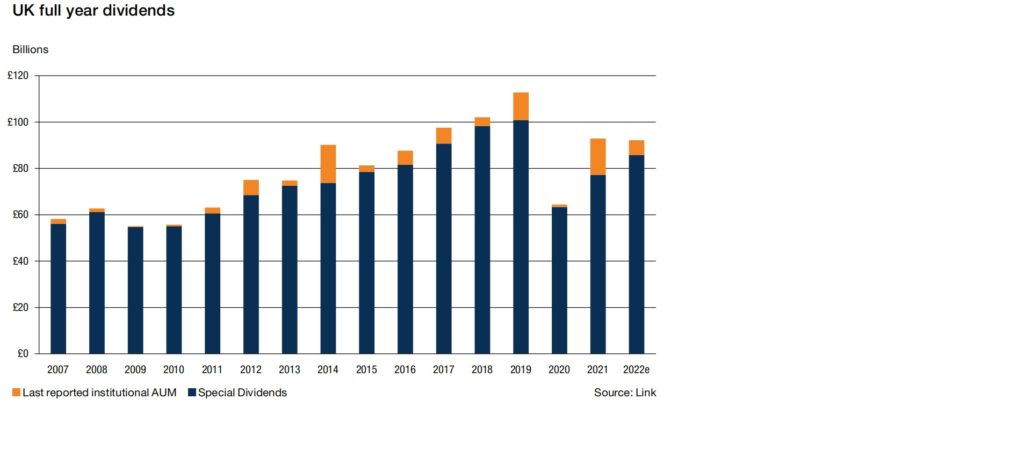

The firm now expects headline dividends to reach £92.2bn this year, a fall of 0.8% year-on-year reflecting lower one-off specials and BHP’s migration from London. Underlying pay-outs, however, are expected to reach £85.8bn which would be 15.2% higher than in 2021, adjusted for BHP’s departure.

Other signs of a stronger than expected year for dividends include AstraZeneca’s first increase for almost a decade in the first quarter, BT handing cash back to shareholders after a two year hiatus and a post-Covid-19 rebound from the property sector.

Retailers are also showing signs of a revival, with large special dividends from Next and B&M European Value, while Royal Mail’s additional payment reflects strong demand for internet purchases through the pandemic. In addition, banks continue their recovery from Covid-19 at a slightly faster pace than Link expected.

Comments