The level of asset outflows in the final quarter of 2021 have not been seen since the financial crisis, giving a clear indication of where investors think we are heading.

As a further indicator, on an absolute basis, global large cap core equity strategies witnessed their largest outflows since 2005, a few years before the financial crisis exploded.

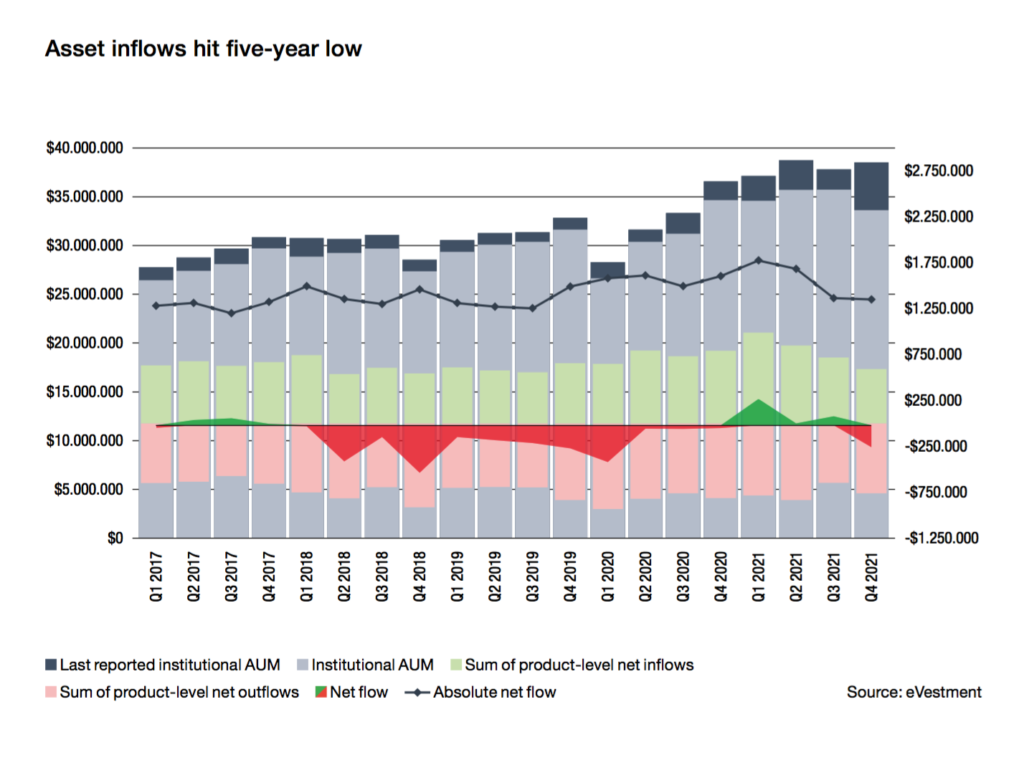

Furthermore, the volume of asset movement as a proportion of reported assets in Q4 is in-line with the lowest levels seen during the past five years (see graph).

The primary reason was the low volume of inflows to traditional non-cash strategies. On an absolute basis, it was the lowest since mid-2018 through mid-2019, but as a proportion of reported assets it was the lowest level of the past five years.

This point, combined with the relatively large proportional allocations to cash in Q4, gives an indication that investors were extremely cautious – or even worried – about committing capital to traditional strategies entering 2022.

Caution also prevailed in the two largest inflow drivers in Q4 – US passive core and global emerging market passive fixed income – a highly defensive coupling of investments.

Putting these inflows into a historical context, the amounts allocated would not have been placed within the five largest inflows in the prior quarter – yet another indication of the low volume of allocations during the quarter.

While it was not enough to drive overall inflows, preferences remained for fixed income strategies: with seven of the 10 largest inflow universes being fixed income-focused.

All this adds up to a grim asset allocation picture. And, it could be noted, given the uncertainty and drive south in global markets, a warning sign of things to come.

Comments