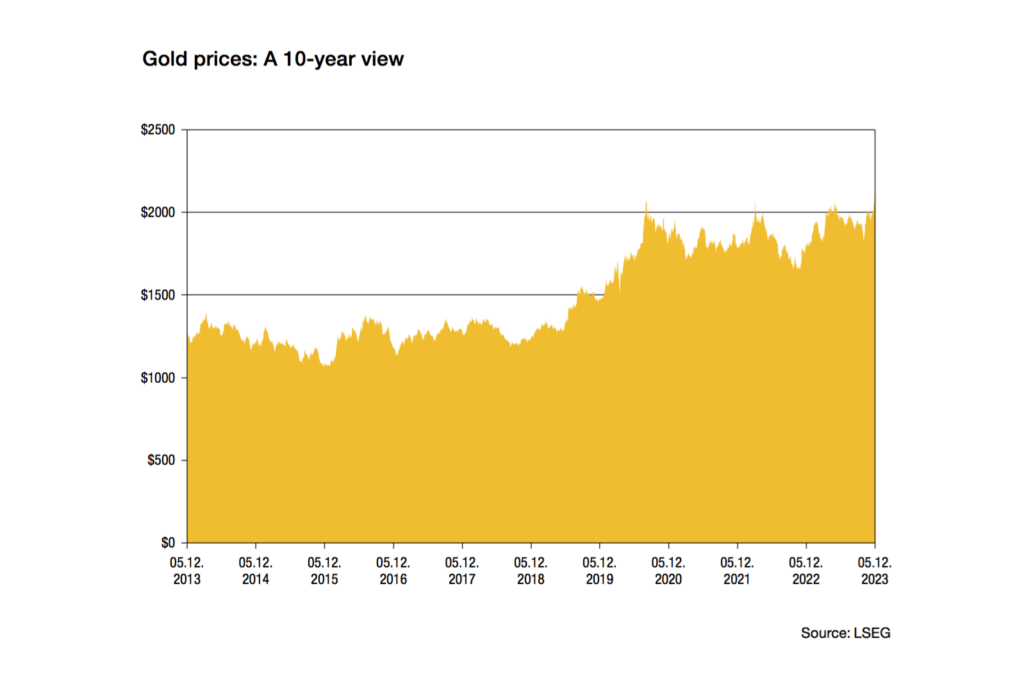

As we welcome a new year, it appears that investors are not full of cheer. In early December, the price of gold reached a new peak, which is not typically a sign of confidence in the markets.

Indeed, on 4 December, the value of the precious metal jumped 2% to $2,111 (£1,673) per troy ounce – an historic high and the third time it has breached $2,000 in the past three years. With so many issues shaping the markets, the price was unlikely to have been influenced by a single factor.

A weaker dollar, for example, on expectations that the Fed could cut rates next year, has made prices cheaper for those investing in other currencies.

Another factor could be that inflation, although falling, has been sticky for more than a year and currently stands at 4.6%

in the UK and 3.2% in the US. There could be concerns among some investors that it may not fall to 2% anytime soon.

Then there is the ongoing war between Israel and Hamas and what it could mean for energy prices if other nations are drawn into the conflict.

Back in May, almost a quarter (24%) of central banks told The World Gold Council that they intend to increase their reserves in the coming year due to pessimism over the US dollar.

Then there are the stock markets. When it performs badly, investors will turn to gold to diversify their portfolios as the asset behaves differently to shares.

Indeed, Goldman Sachs expect modest growth in US equities predicting that the S&P500 will only expand by 5% in 2024, while JP Morgan expects earnings growth in the US blue chip index of around 2% to 3%.

All of these factors point to a potentially difficult period for investors in 2024 and holding gold might help until the uncertainty lifts.

Comments