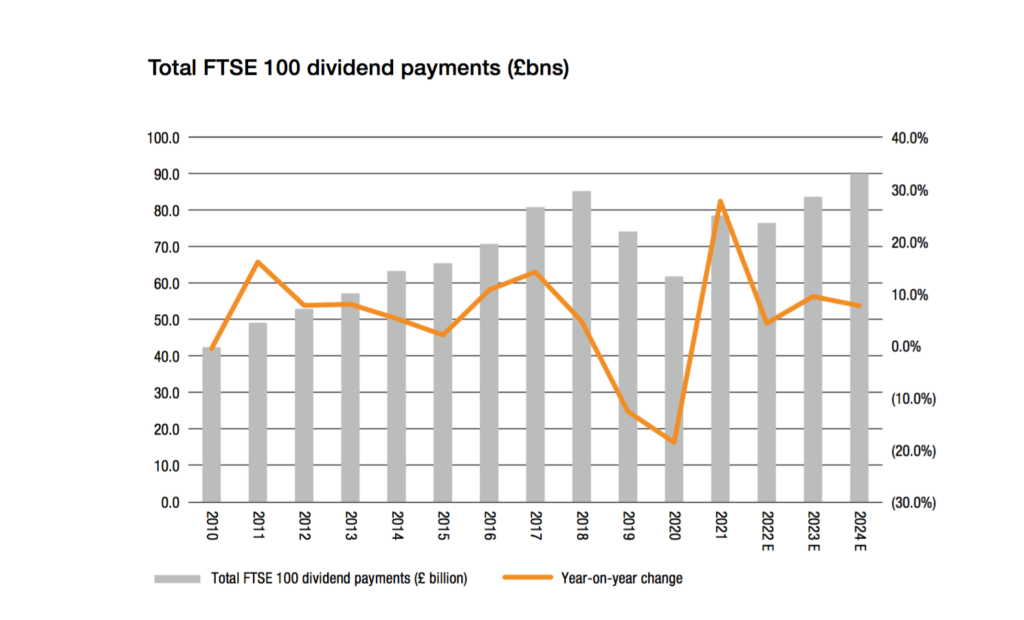

FTSE100 dividends are set for a substantial surge. The top 100 London-listed company dividends are expected to jump by 11% this year, says stockbroker AJ Bell.

That’s not all. The dividends will continue to climb next year by another 7%.

Although this year’s payments will not beat the ordinary dividend record set in 2018, next year’s shareholder returns are expected to reach new heights.

AJ Bell expects 2022’s ordinary dividends to come in at between £76.4bn and £81.2bn, rising to £85.8bn for this year.

Driving this outlook is an expected record year for pre-tax profits from the blue chip index. The forecast is looking at a 23% profit jump in 2023, setting a new record by handing back £279bn to shareholders.

The expected impressive dividend rise comes despite nagging recession fears, which seem to recede by the day. There is also a banking wobble, although AJ Bell notes that this appears to be more of an issue for badly run lenders in the US and Switzerland.

Indeed, it is in banks, and financials more generally, which are the key drivers for dividend growth among the FTSE100’s constituents in 2023.

Banks are expected to distribute a whopping £14.6bn to investors this year. A figure higher than the £13.3bn peak seen in 2007 – prior to the financial crisis.

Yet the big dividends are condensed among a small group of companies with just 10 stocks forecast to collectively return £46.6bn, or 55% of the forecast total for 2023. And the top 20 are expected to generate 73% of the FTSE100’s total payout at £62.1bn.

HSBC is forecast to be the single biggest paying FTSE100 stock in 2023, with the usual suspects of Shell, British American Tobacco, Glencore and Rio Tinto next on the list.

That said, history suggests that it is not the highest-yielding stocks which prove to be the best long-term investments. The strongest long-term performance often comes from companies that have the best long-term dividend growth record, as they provide the dream combination of higher dividends and a higher share price.

Source: AJ Bell from company accounts, Marketscreener and consensus analysts’ forecasts

Comments