A weak pound saw UK dividends reach almost record heights in the second quarter, forcing an upgrade in expectations for the year. Investors shared £37bn of corporate cash in the three months to the end of June, 38.6% more than they did in the same period a year earlier. This was the second-largest quarterly total on record, according to Link.

Large one-off special payments were a big driver. But the underlying dividends, which exclude those specials, jumped 27% to £32bn in 12 months, boosted by a weak pound.

The dollar-sterling exchange rate is playing an influential role in the dividend picture.

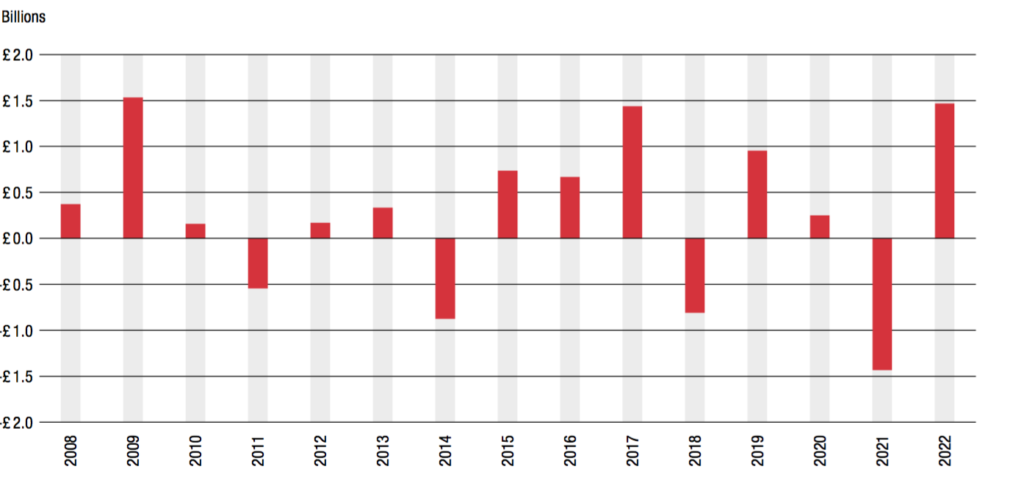

In the second quarter, two-fifths of shareholder payments were in US dollars, generating an exchange rate boost of £1.4bn to their sterling value (see graph). This means the pound’s weakness is set to add between £3.5bn and £4.5bn to the full year’s total.

This has helped to reshape the UK dividend outlook. Link has upgraded its UK plc dividend forecast for 2022, with expectations that headline pay-outs will rise 2.4% to £96.3bn, while underlying pay-outs – which exclude special dividends – could jump 12.5% to £86.8bn.

If sterling maintains its current level for the rest of 2022, it is set to have its worst year against the dollar. The translated value of dollar dividends is, therefore, getting a big boost.

But the outlook is not all positive. Core growth expectations are slightly weaker, reflecting the likelihood that mining dividends have peaked. Such payments contributed almost a quarter of the total in the three months to the end of June.

There are two other concerns that could impact the positive dividend picture.

The first is the post-pandemic dividend catch-up effects. Companies suspended dividends during Covid, but this will soon wash out of the figures. And the UK entering a recession could also hinder the ability of many companies to grow their dividends.

Q2 exchange rate boost/penalty

Comments