Global markets may be unpredictable but the dividend outlook remains positive, as record payout levels were the order of the day in the first quarter of the year.

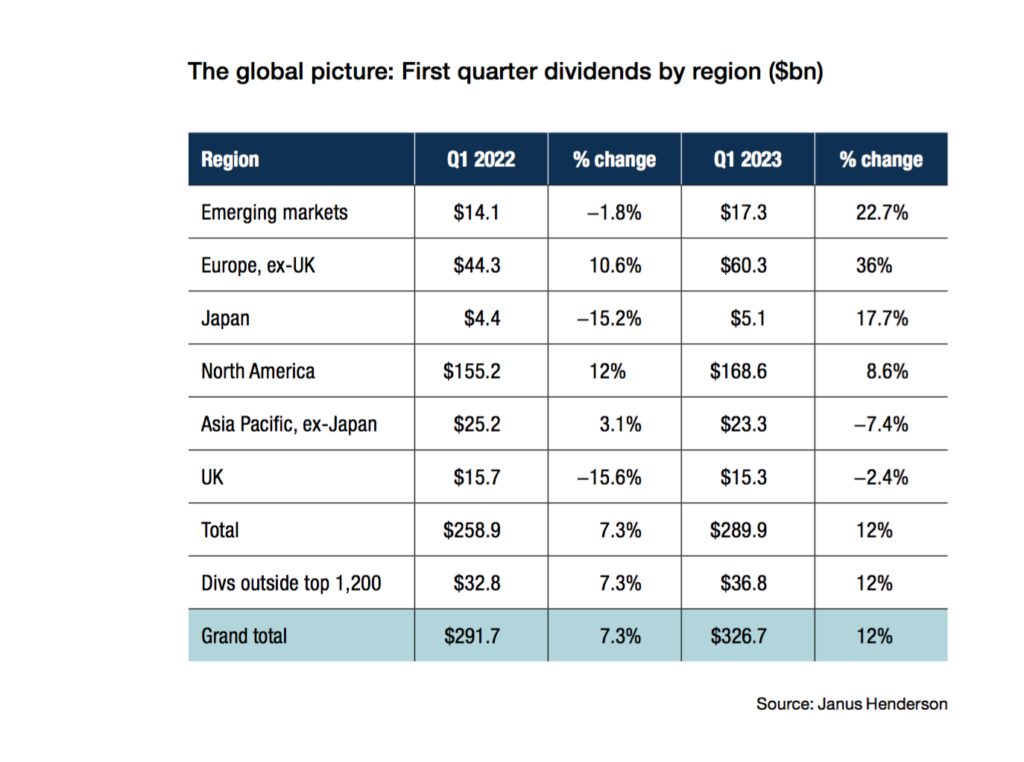

Data from Janus Henderson reveals that 95% of companies worldwide either held or increased their dividends in the opening three months of the year, a period that saw a 12% hike in payouts to $326.7bn (£257.4bn).

This strong showing has triggered an upgrade to the asset manager’s 3.4% full year forecast, with global dividends now expected to hit $1.64trn (£1.33trn) on an underlying basis, 5% higher than last year.

During the first quarter, Europe, ex-UK, led the way with 96% of companies increasing or maintaining their payouts in what is traditionally a modest period for boards returning cash to shareholders.

Denmark, Germany and Switzerland accounted for three quarters of cash returns and saw one-o payments from Denmark’s Moller-Maersk – the biggest payout in the world during the period – and Volkswagen.

The picture in the UK was di erent with total payouts 2.4% lower than a year earlier at $15.3bn (£12bn). This was largely due to a weak sterling as no UK company cut its cash returns during the period.

North America naturally takes up a decent chunk. It had another strong quarter returning $168bn (£132.4bn) to investors, 8.6% higher than a year earlier.

But the aggregate figure for the US can be misleading: special dividends from the likes of Ford boosted the headline figure, and the underlying trend shows slowing growth when you focus on ordinary dividends.

Still, 97% of US companies in the index held or hiked, higher than the global average, with strong contributions from real estate, technology and healthcare companies.

Comments