Dividends continued to feel the impact of the pandemic during the first quarter, but signs of a recovery can be found among the numbers, says Andrew Holt.

A big theme of the past 12 months has been the Covid-19 inspired dividend cuts and the first quarter of 2021 followed this trend. Yet there are clear shoots of a recovery and improvement amongst all this.

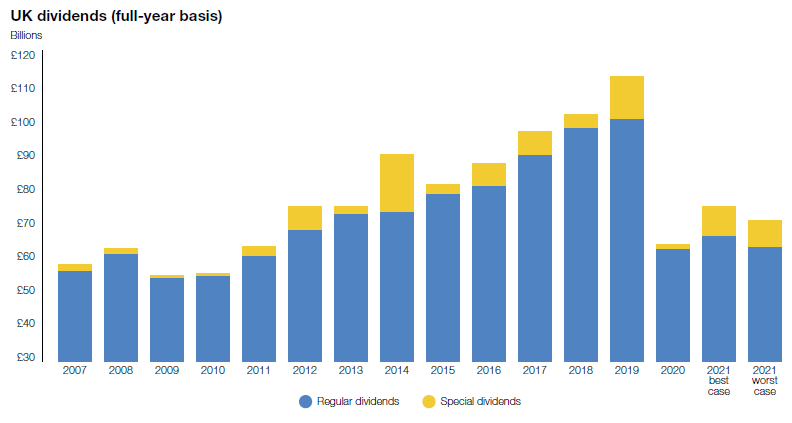

On an underlying basis – which excludes one-off specials – UK dividends reached £12.7bn in the first quarter: a 26.7% fall, according to Link Group. Although putting this in perspective, it is an improvement on the 39% decline recorded in the final quarter of 2020.

One boost was Aviva’s insertion of an extra £274m interim dividend, which helped to make up for some of the 2020 shortfall ahead of its May final payment. “Future dividends per share are expected to grow by low to mid-single digits over time,” Aviva said in a statement.

Equally, there were a handful of companies that restarted dividends but do not normally pay in the first quarter – wealth management firm St James’s Place and automotive fluid manufacturer TI Fluid are good examples.

This picture is likely to continue, notes Link Group, as irregular distributions are likely to continue cropping up over the next few months as companies get back on track causing some volatility in the overall numbers.

But the broad picture is a positive one: with half of UK companies either increasing, restarting or holding their dividends steady in the opening three months of this year, compared to just a third in the fourth quarter of 2020.

Interestingly, the biggest positive contribution so far in 2021 came from housebuilder Persimmon’s interim payout, worth £398m. Along with Berkeley, Persimmon was one of the first two companies to cancel its dividend this time last year, though both resumed payouts in the third quarter as the housing market held rm.

Banking dividends are also returning, with Investec becoming the first bank to restart its dividend, followed by its larger rivals.

There are also positive signs from mining, insurance, and media companies.

By value, food retailers were the stand-out winners, increasing their dividends by more than a fifth (22%) on an underlying basis, thanks, in particular, to Tesco.