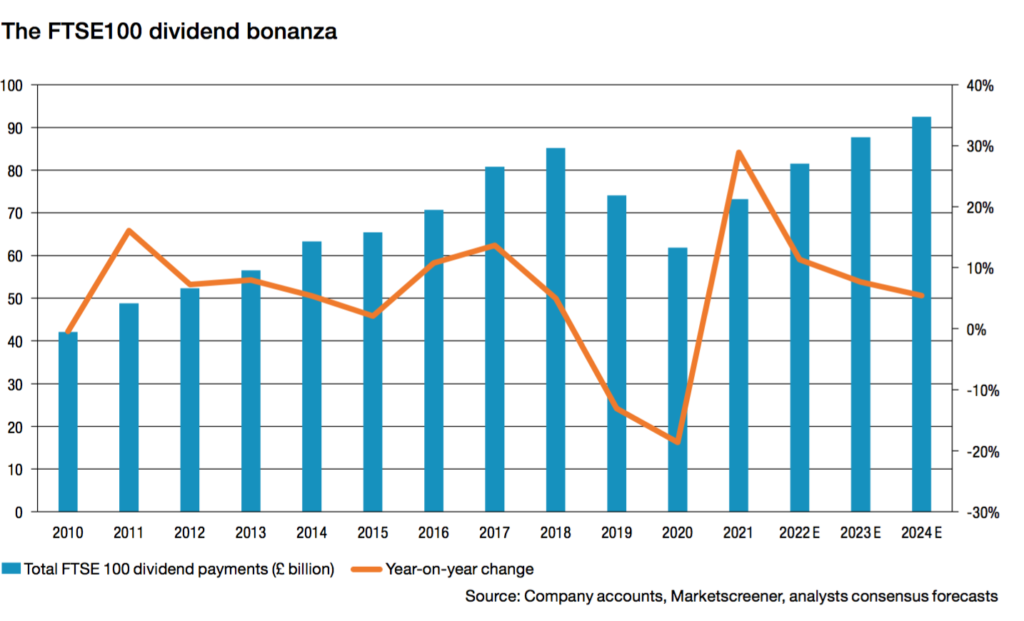

This year could be the best yet for cash returns from the FTSE100, with £81.5bn forecast to be handed back to shareholders, £1.6bn to be paid in special dividends and a record £50.3bn spent on buybacks.

Three FTSE100 firms are expected to offer a double-digit yield this year, while 12 are forecast to offer more than 7% – five financial companies, three housebuilders, two miners, one tobacco firm and a telecom company, according to stockbroker AJ Bell.

Such numbers fly in the face of the uncertainty which has hung over much of the economy but will be lapped up by investors.

There have been meaty increases in dividends paid by big beasts Glencore, Shell, HSBC, AstraZeneca and BP.

These are expected to offset anticipated falls at pharmaceutical giant GSK, thanks to a change in corporate structure, Rio Tinto and Antofagasta, as well as BHP and Ferguson switching their primary listings to Sydney and New York, respectively.

One interesting trend is FTSE100 firms embarking on £36.7bn of buybacks in the first six months of 2022, which is often a ‘contrarian indicator’ ahead of a crisis. As happened when buybacks reached a peak in 2006, just before the financial crisis hit.

However, ongoing strength in oil and gas prices, given the energy crisis, is set to boost dividend estimates for 2023 – with analysts nudging up their dividend payment forecasts further.

But it is financials which are expected to be the biggest contributor to FTSE100 dividends in the coming year.

Overall, the future dividend picture looks bright, with analysts expecting 2023 to set yet another record for blue chip ordinary dividend payments, even if profit growth is expected to slow – before grinding to a complete halt in 2024.

Although the combination of lower economic activity, which seems likely, plus higher interest rates and rising input costs, could pose a big risk to these positive dividend forecasts, or scupper them completely.

Comments