Dividends bounced back in 2021, but growth is expected to slow this year as corporates are facing a series of headwinds, Link believes.

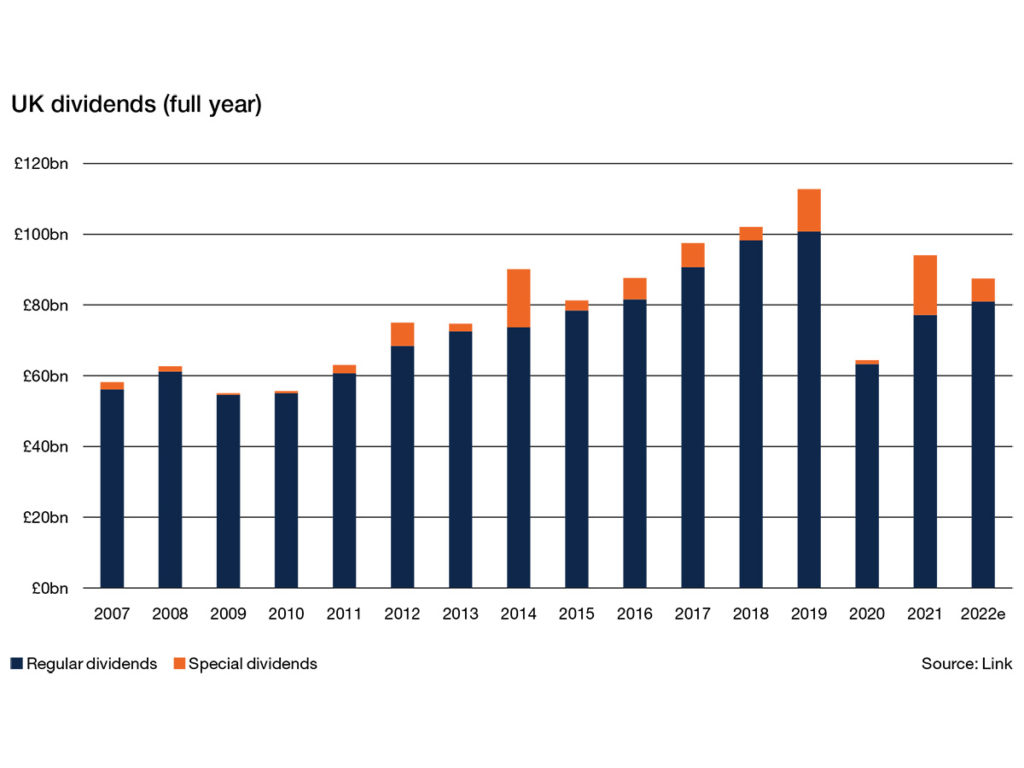

After a torrid time during Covid, UK dividends last year reached a level last seen in mid-2017 as investors shared £94.1bn, a 46.1% rise in 12 months.

However, Link warns that shareholders should not expect the same level of growth in the year ahead. Some of 2021’s growth was slightly superficial, as one-off special dividends boosted the headline total by a record £16.9bn – three times their normal level.

Beneath the surface, underlying pay-outs rose more modestly, up 21.9% to £77.2bn, close to the levels paid in 2015. Overall, 2021 was an unbalanced year with excessive dependence on mining companies, whose booming profits meant pay-outs were three times larger than the long-term average.

Yet the recovery in UK dividends is uncomplete. This year presents risks, albeit different to those during Covid.

The extent to which companies are victims or beneficiaries of inflation will be vitally important. And then there are headwinds in the form of possible Omicron disruption and tax hikes.

In addition, going forward mining companies can neither sustain the pace of increases nor likely repeat the size of the special dividends they dished out last year.

Nevertheless, many commodity prices have firmed up, meaning that their regular pay-outs are well supported.

Banks and oil companies should be the main engines of progress in 2022, while telecoms will get a boost from the restoration of BT’s dividend. These three sectors could generate up to three-fifths of UK dividend growth in 2022, says Link.

There is, however, a degree of uncertainty around Link’s forecast. It expects underlying growth of 5%, bringing total pay-outs of £81bn this year. This is equivalent to 8.9%, if adjusted for the de-listings of BHP and Morrisons, which Link notes, with some justification, will leave a big dent in the dividend pie.

Special dividends are likely to be much lower in 2022, meaning headline payments will fall 7% to £87.5bn.

Comments