UK dividends have slumped to a nine-year low and are expected to remain subdued in the coming years, weakening the prospect of equities making a quick recovery.

Covid’s impact on the economy made 2020 a painful year for dividend investors and while those banking on shareholder incentives can expect some level of recovery this year, they might want to brace themselves for a slow ascent.

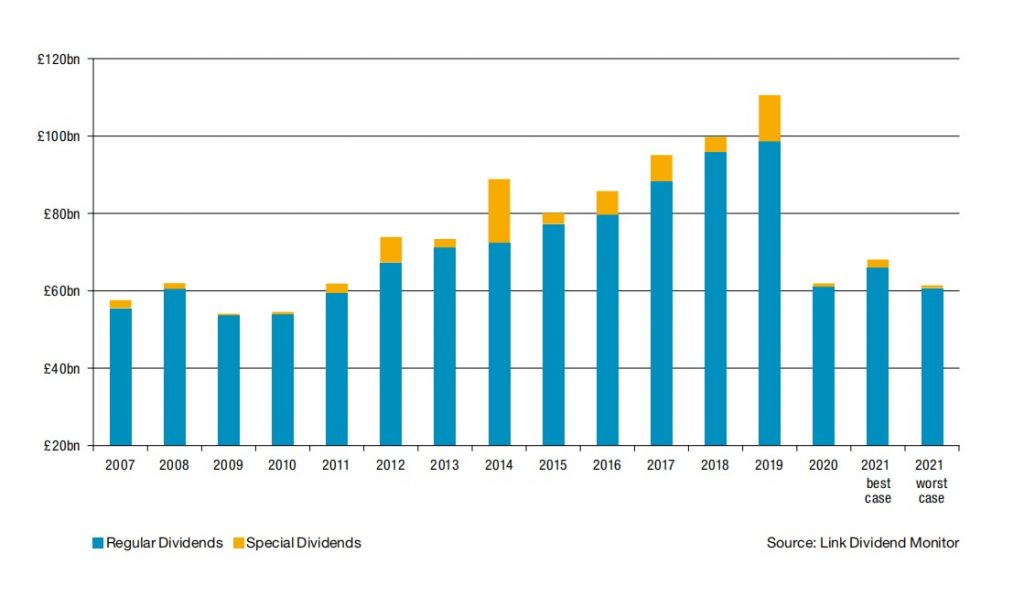

Over the past 12 months, headline dividends fell by 44% to £61.9bn, the lowest level since 2011 and a decline not seen “since at least World War II”, according to Link. Financial stocks were a major contributor to the overall reduction in shareholder returns, accounting for two-fifths of all dividend cuts due to the PRA ban on dividend payments for banks introduced in early 2020.

Despite the ban being lifted in December, investors are unlikely to see dividend growth levels restored to pre-pandemic levels until at least 2025, Link warns. Investors can expect to pocket between £68.1bn and £61.5bn in dividends this year, Link believes, meaning that pay-outs will remain far below the £110.6bn peak seen in 2019. Large caps are expected to recommend relatively higher levels of shareholder returns, while it will take longer for smaller stocks to restore their dividend pay-outs to pre-pandemic levels (see chart).

UK dividend outlook

While dividend income fell across the globe, investors in UK equities are likely to be more exposed to dividend cuts due to the relatively high concentration of banking, mining and oil companies in the FTSE100, sectors which have traditionally been higher dividend payers.

The disappointing dividend outlook poses a challenge for UK equities to make the comeback that appeared on the horizon in the final quarter of 2020. November and December saw strong inflows into equity funds, with the last-minute Brexit deal providing an unexpected boost for the asset class, according to Calastone. Following years of outflows from UK plc, the last five trading days of the year saw £148m of net inflows into the asset class. The growth prospects for UK stocks hinge on the potential for the value factor to return, a factor which is relatively over-represented in the FTSE100.

By the end of 2020, the Russell 1000 Value index outperformed the Russell 1000 Growth index for the first time in years, an early indication of change. However, the painful economic effects of the lockdowns have added to the expectation that dividends are likely to remain subdued for the coming year, Link warned.