How could the currency effect of a potential no deal Brexit affect institutional portfolios?

Most institutional investors have by now positioned their portfolio to protect them against the UK failing to agree a trade deal with the EU. Over the past year, almost 60% of UK schemes have reduced their exposure to London-listed equities in-line with the general trend towards de-risking, according to Aon.

This is a strategy that could protect them if the UK trades with Europe on WTO terms. But even a globally diversified equity portfolio could potentially be hit by the lack of a trade agreement if it is exposed to exchange rate risks.

This is particularly the case for euro-denominated investment portfolios, where converting revenue into sterling could become a lot more costly from January in the event of a no-deal Brexit. Some investors have already identified this risk.

Indeed, the proportion of institutional investors who have hedged more than 60% of their overseas equity exposure has nearly doubled to 42% from 26% in the past year, according to Mercer’s Asset Allocation Survey. However, this still leaves a significant proportion of risk unhedged, which could prove costly, particularly for defined contribution schemes with a higher level of equity exposure.

So far this year, the negative exchange rate effects of a potential no-deal Brexit have been relatively benign, largely due to a persistently falling dollar and interventions by the European Central Bank to prevent extreme euro appreciation, exchange rate risks are a two-way street after all.

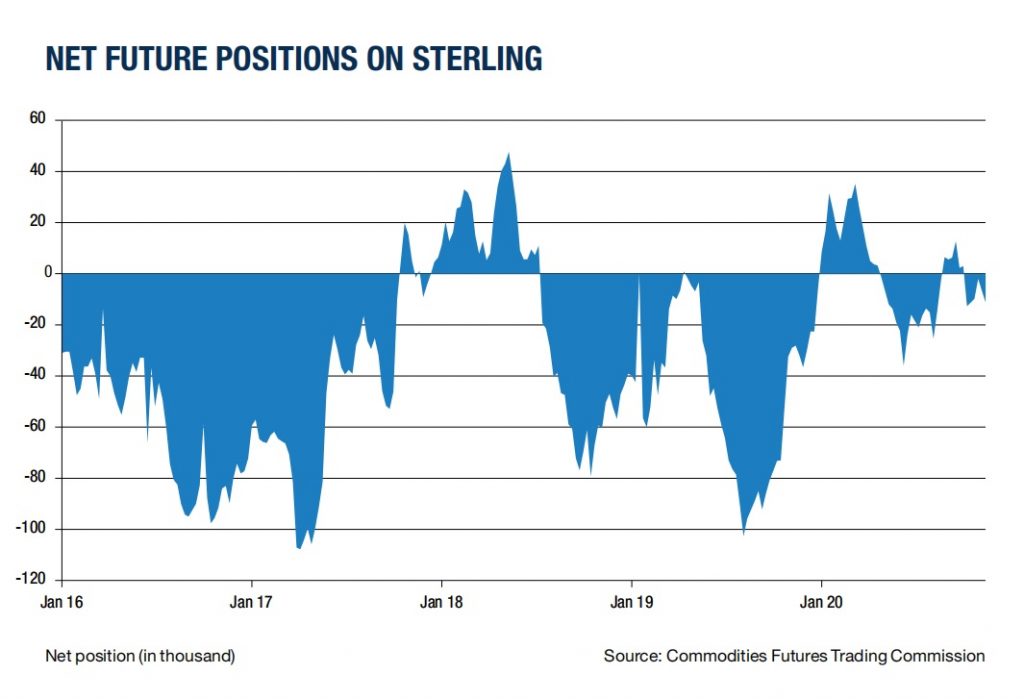

But with the clock for a trade deal between the UK and the EU ticking, short bets against the sterling are on the rise. At the beginning of November, asset managers and institutional investors globally held close to 60,000 short positions against sterling, an increase of more than 2,000 net short positions compared to the end of October (see chart below).

Over the longer term, short bets against the pound are far from the peaks seen in 2016, this could soon change, as the episodes of currency volatility seen during the summer last year demonstrate.