There is good and bad news for investors on the dividend outlook. The bad news is that UK cash returns fell 9% on a headline basis to £32.8bn in the second quarter.

The good news – albeit relative – is that regular dividends tell us more about the true trend: and they beat forecasts in the second quarter at £32.2bn.

The underlying growth rate, which adjusts regular dividends for exchange rate movements, was 3.5% in the second quarter, down from 5.2% in the previous three months.

By far the biggest contribution came from banks, which have reported strong profits. They paid £7.8bn, an impressive three-fifths rise year-on-year. Banks are also comfortably 2023’s biggest engine of UK payout growth, according to the UK Dividend Monitor.

Meanwhile, the broadly based industrial goods and support services sector delivered a double-digit dividend growth surprise in the second quarter: with 95% of companies in the sector recommending annual increases.

The biggest negative impact came from sharply lower mining payouts. These fell by a third, as lower commodity prices saw an impact on cashflows in the sector.

And while economists ponder the potential deterioration of the British economy, with assessments edging towards a recession, the paradox is that the dividend picture has brightened.

The banking sector in particular is benefiting from the interest-rate medicine the Bank of England is administering to cool the inflationary fever.

Outside of the banking sector, companies with pricing power are building margins, contributing to inflation, of course, but in turn, boosting their dividend fire power.

For the rest of 2023, the third quarter is already playing out in line with Dividend Monitor expectations earlier in the year, but the fourth quarter now in fact looks likely to be markedly stronger.

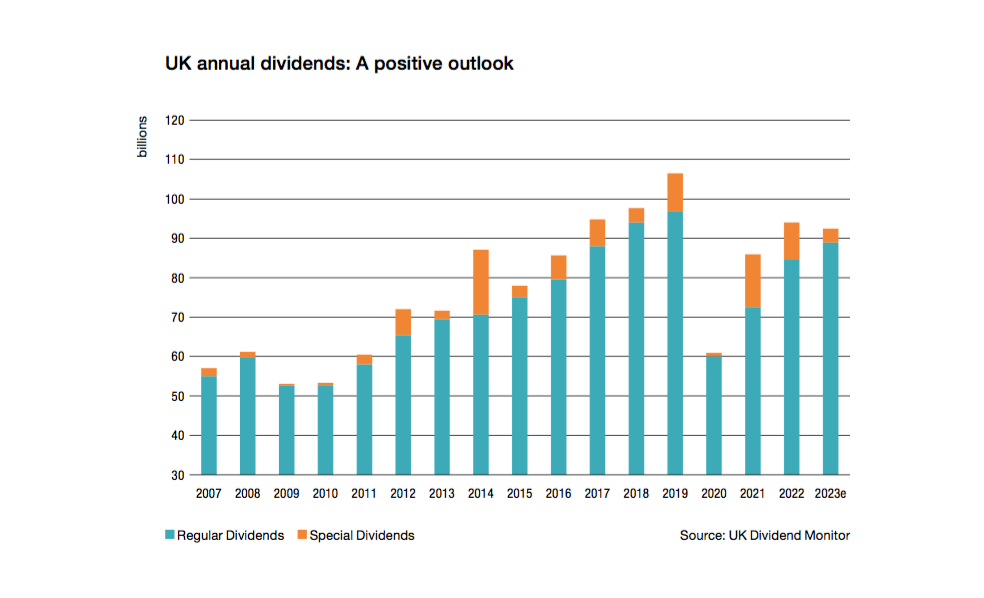

Headline payouts are still likely to fall this year, down 1.7% to £92.4bn, as lower one-off special dividends and negative exchange-rate effects in the third and fourth quarters take their toll. But this is nevertheless £1bn more than was forecast three months ago.

Regular payouts that exclude specials are now on track to reach £88.9bn, almost £2.7bn more than forecast three months ago, and equivalent to an encouraging underlying increase of 6.1% for the year.

Comments