The London Stock Exchange’s junior market has come of age as its constituents are forecast to be on the verge of returning a record amount of cash to investors once again.

Dividends by Aim companies this year are on track to beat the £1.1bn paid last year at £1.3bn, according to shareholder services group Link. This would be a 16.8% rise in headline terms.

In the first half of 2019, shareholder payments improved by almost a quarter (23.9%) year-onyear to £633m. Special dividends and new listings were behind the rise.

A further rise is forecast for 2020, albeit only by a modest 2.3% to £1.33bn (see chart). Slower economic growth and lower specials are behind such a muted outlook.

Dividends paid by Aim companies have trebled since 2012 at an annual growth rate of 18.2%. Over the same period, shareholder cash returns have only grown by 45%, or 5.9% a year, on the main market. A sign, perhaps, that the growth this year is not just a fad.

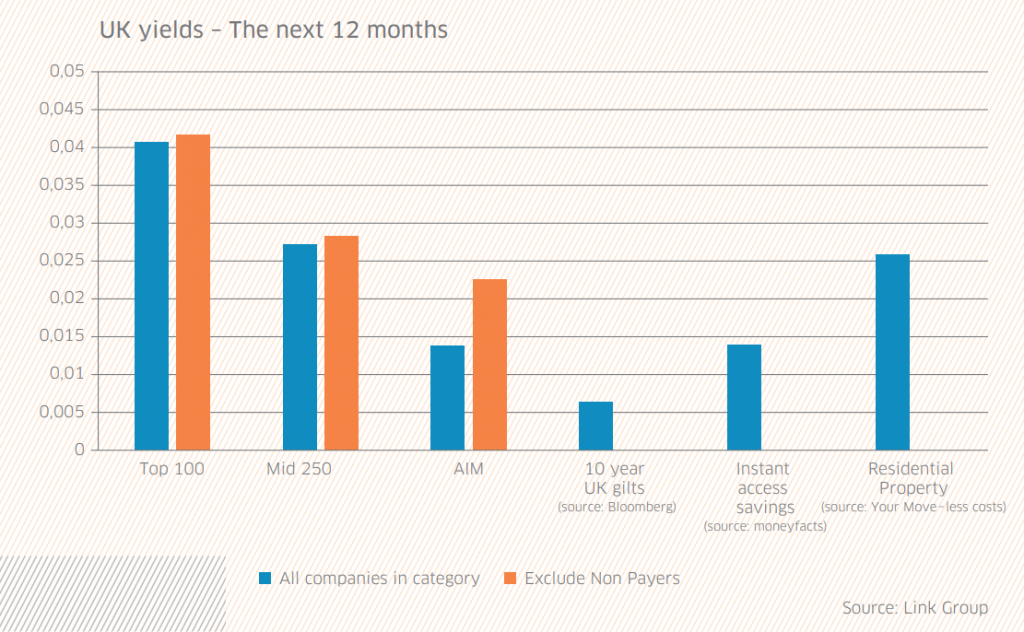

It is important to note, however, that the combined pay-out by Aim companies is nothing compared to that of the members of the more established main market, where some of the world’s largest brands can be bought and sold. Indeed, small caps with a full listing returned a combined £4.8bn to shareholders in the past 12 months.

Aim is a different market today than it was 20 years ago. Back then the regulation-light exchange lived up to its reputation as a risky market. There seemed to be too many companies asking investors for cash to study a hole in Kazakhstan to see if there is anything worth selling in it. Today, investors can assess more established businesses such as ASOS and Fevertree.

Link Market Services chief operating officer Michael Kempe said dividend growth matters because it lies at the heart of share valuations. “The faster the growth rate, the higher the value,” he added. “And the more visible the dividend stream, the more certain an investor can be about its value.”