There are investment products out there that have more leverage than we think. In the fixed income space we are seeing loans on loans; strategies that lend money and are then being levered up.

Himanshu Chaturvedi, Cambridge Associates

Investors have increasingly been entering new asset classes in their search for yield. But is this journey taking them into p re-crisis territory once more?

The reach for yield is nothing new. Investors across the globe have been forced into new asset classes to deal with a backdrop of low interest rates, loose central bank monetary policy, and now inflation and heightened political risk.

Traditional assets, particularly in the fixed income space, have become overvalued and lost their lustre and so in order to close expanding funding gaps, investors have had to either work their existing assets harder or look to new forms of income.

This has meant moving up the risk curve into higher yielding, illiquid securities sometimes carrying higher leverage. Popular choices among institutions include high yield bonds, infrastructure and private market assets such as direct lending and leveraged loans.

But Peter Martin, a former investment consultant and now investment officer at the Medical Defence Union, aired concern over this market dynamic at a recent portfolio institutional event.

“These days it’s all about trying to generate some return from somewhere in a sensible risk fashion, but not be pandering to fashion and trying to avoid [a situation where] ‘God forbid it’s 2006 again’,” he said. “The more I see of it, the more concerned I am about people pushing the envelope and taking the risk too far in the lower-for-longer tight credit spread environment.”

Martin added that he fears investors have begun to develop unrealistic expectations of the long-term returns that can be extracted from bonds without taking excessive risk.

Speaking at the same event, Willis Towers Watson senior investment consultant Kate Hollis agreed, warning investors to be careful about reaching too far for yield, particularly in private markets. “You have so much less transparency on what’s going on and you could have a strategy which does beautifully for a couple of years and then suddenly blows up, because the fund manager is taking on too much money and reaching too far to allocate the capital,” she said.

Is this just hearsay or are investors and asset managers actually pushing this search for yield too far? And in doing so, are they creeping back into old habits last seen in the build-up to the financial crisis?

BE AWARE OF LOW QUALITY

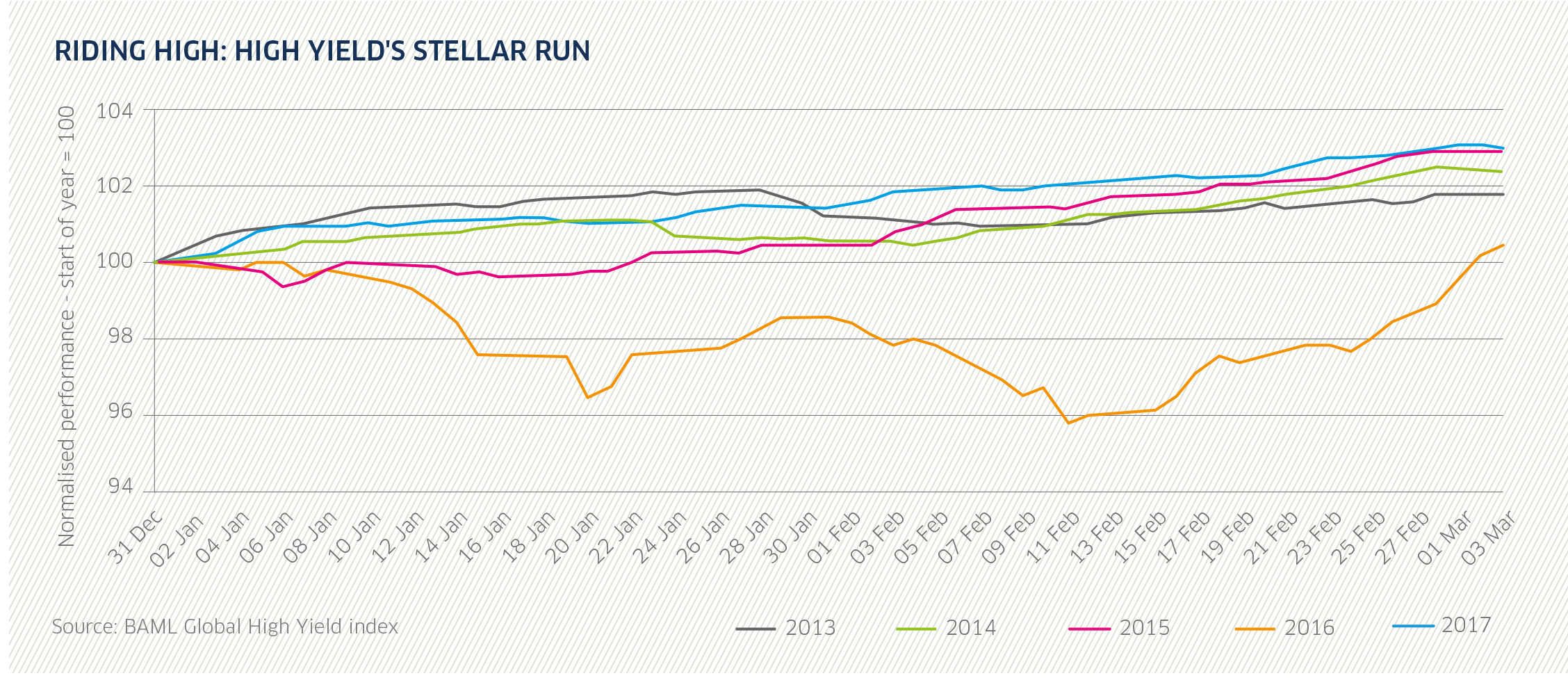

There is no doubt investors are chasing higher yielding assets. The Bloomberg Global High Yield Corporate Bond index has returned 13.56% over one year and the strength of the bond market since the start of the year (see chart below) has led to a flurry of new issues from companies looking to raise capital.

But Kames Capital has observed that these i ssues have moved down the credit quality curve as strong returns have led to lower-rated companies issuing securities. In the US market more than 20% of total new bond issuance in 2017 has been triple-C – double the rate of last year.

The asset manager warns investors to avoid the lure of these issues. This is not just because of the low credit quality, but also due to concern over the way some of these issuers are funding payments to borrowers. One example is French glass packaging company Verallia which in February issued a €350m (£303m) tripleC bond that allowed coupons to be paid for in either cash or more of the bond.

Kames Capital investment manager in the high yield team Jack Holmes says: “We have had CCC-rated bonds with non-contractual coupons – so the company can choose to pay borrowers with more debt, rather than cash; never a good sign – and bonds funding lending to the riskiest sub-prime personal borrowers in the UK.”

Similarly, M&G Investments head of portfolio management David Lloyd observes as markets have become more expensive investors have been forced to take on more risk to achieve a particular target return. This behaviour, he adds, has led to an increase in investors entering the market seeking to pick up a yield, known as high yield tourists.

“It is not necessarily taking risk per se,” he says, “but it is taking risk you are not familiar with or not properly equipped to analyse and make a judgement on.” This, he warns, is something that “never ends well”.