The term ‘smart’ has become synonymous with products or strategies that supposedly have a progressive edge or an added element of skill, particularly in the consumer electronics world. In the world of investment, ‘smart beta’ has exploded onto the scene to describe index strategies which provide investors with a different type of equity exposure than traditional market capitalisation- weighted indices.

Today, investors have been confused by a plethora of terms to describe these strategies and while the industry has latched onto ‘smart beta’ – Axa Investment Managers has even trademarked ‘SmartBeta’ – names such as alternative indexation, factor indices, engineered, customised and advanced beta are also commonly used.

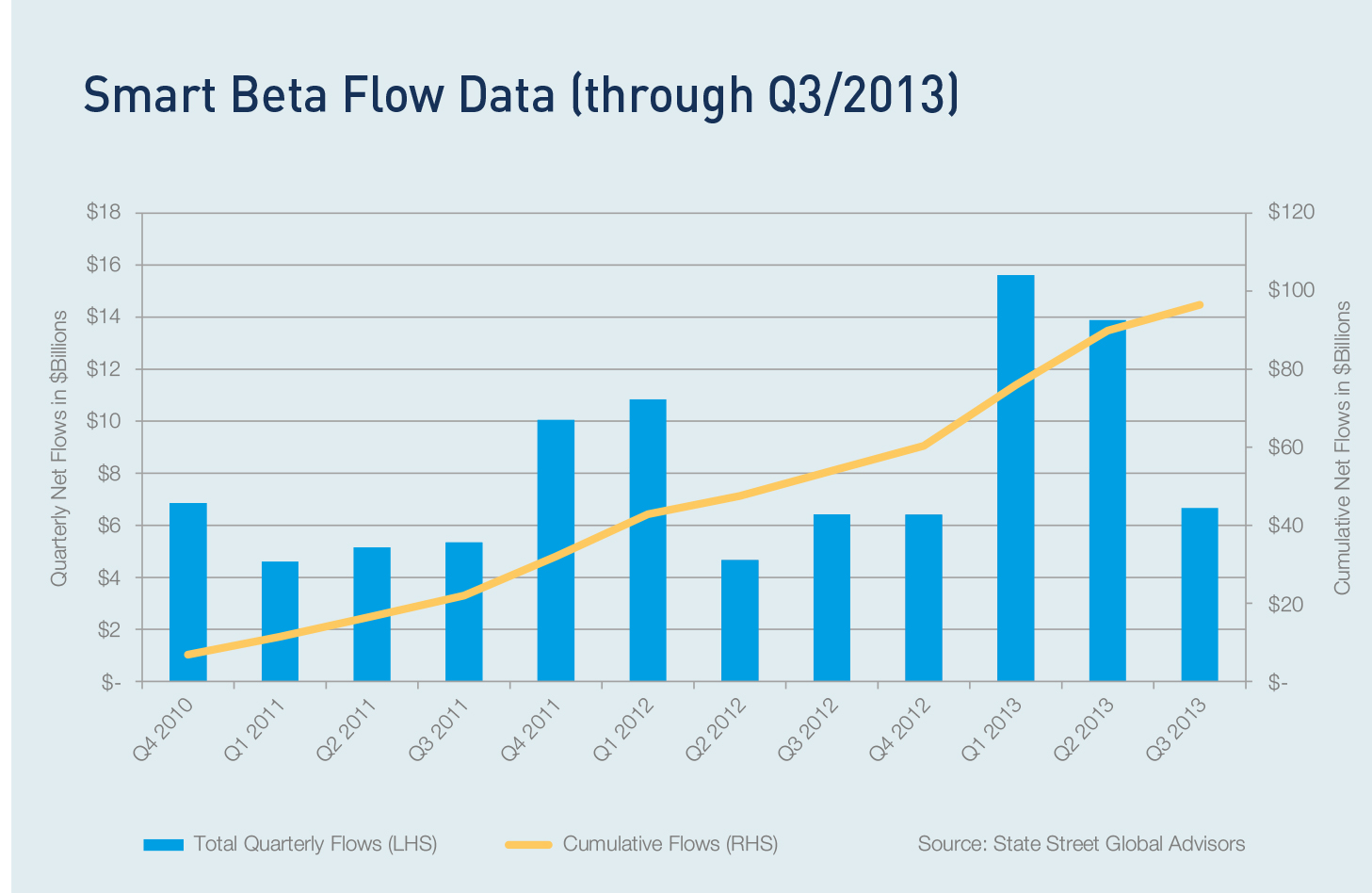

According to State Street Global Advisors, smart beta strategies have grown to $97bn worldwide over the past three years, but inflows in Q3 of 2013 fell to $6.6bn compared to more than $13bn in each of the two previous quarters (see chart). So smart beta has enjoyed mixed fortunes of late, but is it really ‘smart’ and does that mean regular beta is dumb? Furthermore, given the dynamic nature of portfolio rebalancing, is ‘smart alpha’ perhaps a more accurate term to describe these strategies?

The rise of smart beta

Given the prominent marketing behind smart beta you could be forgiven for thinking it is a relatively new investment strategy, but many argue the rationale underpinning the idea, that of gaining equity exposure through alternative, systematically-constructed indices, has been around for at least three decades.

In fact, systematic strategies designed to improve upon cap-weighted indices have arguably existed since the 1980s when Intech founder Robert Fernholz published a 1982 paper, Stochastic Portfolio Theory and Stock Market Equilibrium, in which he demonstrated the inefficiencies of cap-weighted and that a higher return can be generated with similar risk by better diversifying the holdings and rebalancing the portfolio. More recently, Robert Arnott and the team at Research Affiliates also arguably coined the term ‘fundamental indexation’ – where stocks are weighted based on fundamental criteria, such as revenue, dividend rates, earnings or book value – with the Research Affiliates Fundamental Indices (RAFI) series in 2004. But alternative indices did not come into their own until after the financial crisis, which exposed the shortcomings of both market cap and some active management strategies.

Throughout much of the 1990s, market cap had offered investors diversification, liquidity, transparency, and low cost access to market beta, but come 2008 a significant chunk of the index was comprised of financials and investors learned the hard way that you track and index down as well as up.

Pension Protection Fund (PPF) principal – portfolio management John St Hill says from an asset owner perspective the interest in smart beta has stemmed from increasing dissatisfaction with the performance of active managers. “In the current environment people are a lot more aware of fees,which they pay both directly to active managers, and in terms of execution,” he says. “That, combined with the revolution in technology, has made it easier to produce very cheap and effective indexation strategies which can be customised to a much greater degree.”

Much has been made of the flaws with capweighted indices, not least the fact they tend to overweight overpriced stocks and underweight undervalued stocks. When Cass Business School programmed a computer to randomly pick and weight each of the 1,000 stocks in a sample of alternative indices – effectively simulating the stock-picking abilities of a monkey – it found many of the monkey fund managers would have generated a better performance than was produced by some of the alternative indexing techniques available. Even more surprisingly the experiment, which repeated the random stockpicking process 10 million times over each of the 43 years of the study, concluded that almost every one of the 10 million ‘monkey’ fund managers beat the performance of the market cap-weighted index.

Emperor’s new clothes

The act of harvesting premia by tilting portfolios towards factors such as small cap, momentum or value stocks has been common practice for some time, but industry experts believe there is now a range of strategies under the smart beta umbrella that were not available to investors five years ago and in that sense they are ‘smart’ when compared to market cap.

Russell Investments director of the Pension Solutions Group Crispin Lace explains: “The concept of using equal weighted or fundamental has been around since the cows came home, but smart beta is more about improving the tools at your disposal as an investor, more about empowering you to get cheaper access to factors, markets and return drivers. I would argue smart beta is really useful for investors.”

According to David Schofield, president at Intech, his firm has spent almost 30 years constructing equity portfolios to exploit the risk premium from the need to rebalance them. “You have to trade it [the portfolio] and that action accounts for the vast majority, if not all, of the return benefit,” he says. “This is not well understood by practitioners; there remains this lingering belief that things like the size, value, or low volatility effect are these irreducible factors that don’t need to be explained, they just outperform. We are saying if you dig down further you can explain the outperformance of those approaches in terms of this rebalancing.”

Some believe active quant strategies have exploited these rebalancing premia for some time and a number of the new products coming in on the smart beta bandwagon are simply a rebranded version of these. “A lot of the smart beta products are a reinvention of the old quantitative approaches,” says Duncan Hodnett, head of institutional business at Eaton Vance. “They are still highly reliant on optimisation techniques exploiting specific quantitative factors and in 2008 quant models were less relevant in understanding market direction. Some factors will have periods of underperformance versus cap weighted if that particular factor is out of flavour.”

Parametric – a wholly-owned subsidiary of Eaton Vance – which invested in its first systematic rules-based strategy in 1994, describes itself as “factor agnostic” and opts for an equal weighted strategy at country and sector level based on liquidity and transaction costs, using rebalancing triggers. This, Hodnett explains, is partly because of concern that a wave of money has rushed into low volatility strategies, particularly following the financial crisis, and bid up prices exposing them to the risk of sharp corrections and the fact that fixed rebalancing periods are too static and predictable. “We are not chasing a specific factor because over time some of those factors will lag the market,” says Hodnett. “In 2008 momentum managers got absolutely hammered. Other strategies tend to rebalance on a calendar basis, so on a quarterly or semi-annual basis, and those strategies and indexes which disclose their rebalancing periods publicly are open to front-running so other people can trade in front of them.”

But S&P Dow Jones Indices meanwhile does exploit specific factors. It runs among its other strategies a low volatility index which is designed to extract the 100 least volatile stocks from the S&P 500, a strategy designed to lag in rising markets but protect in down markets. This is to capture the ‘low volatility anomaly’ that over time portfolios of less volatile stocks tend to offer higher risk-adjusted returns than high volatility stocks.

- 1

- 2

- »

Comments