In the first of a new series, portfolio institutional looks at a new project hoping to shed light on asset flows in the data-poor institutional investment industry. Chris Panteli reports.

In a world awash with data, it might come as a surprise just how little there is covering the institutional investment space. It is an issue that has frustrated fund managers who feel unable to accurately gauge what their clients want.

As managers feel the burden of downward fee pressure across the industry as regulations simultaneously push up costs, the once-enviable margins asset managers traditionally enjoyed are now much smaller and it is therefore far riskier to enter new markets or launch new strategies without knowing whether the demand is there first.

It was after hearing these concerns from clients that research provider Spence Johnson decided a new approach was needed.

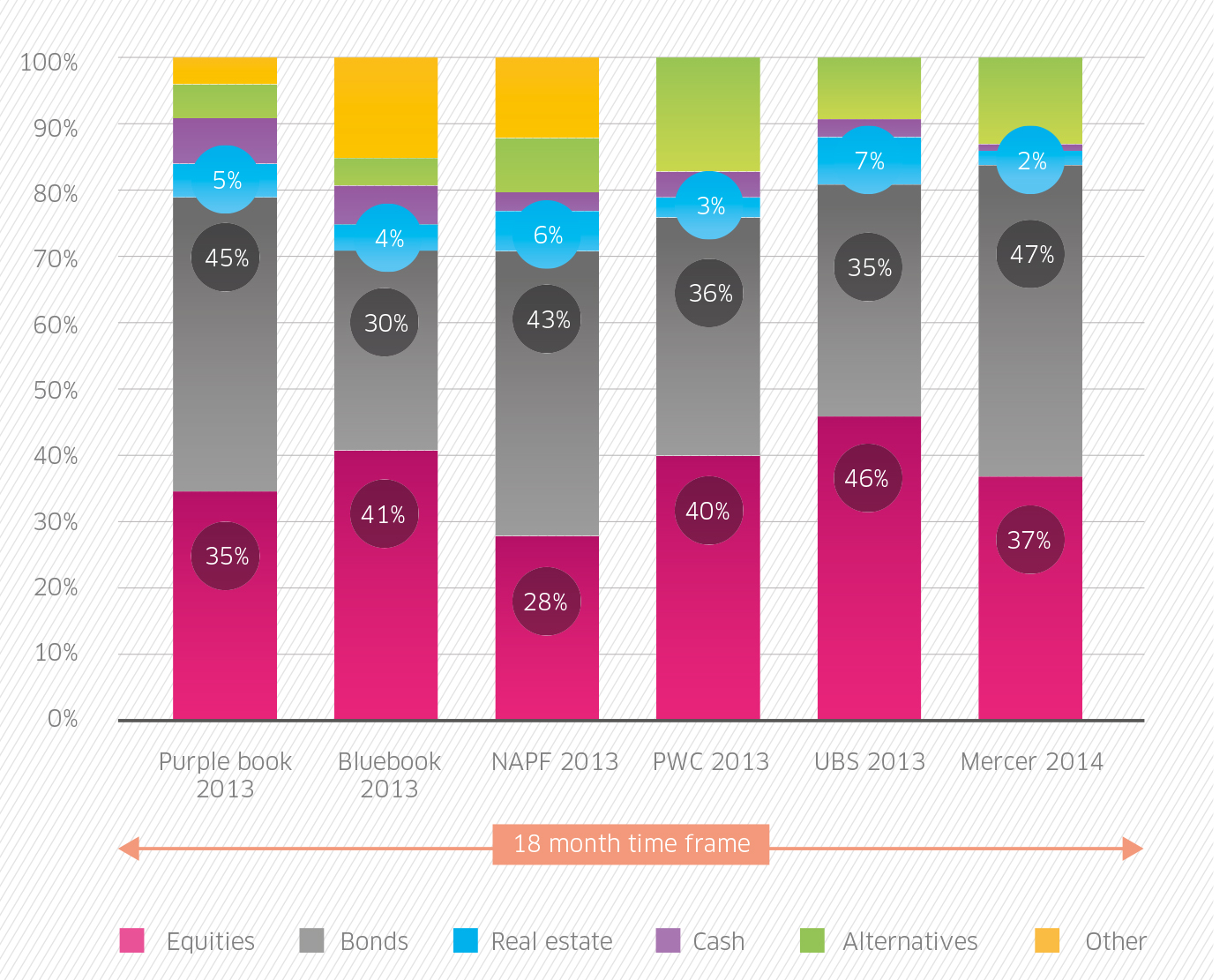

“A number of our clients had become increasingly frustrated by the differences in the basic level of information available in the market, says director Nigel Birch. “For instance, if you take four of the most credible market sources and look at their data for the equity allocation publicly stated by UK DB pension schemes in 2013, the figure varies by 19%, and that’s just among the credible sources (see chart 3, inset).

“Looking at other industries such as insurance, retail, IT and pharma, we are miles behind in understanding our clients,” says Birch.

“While investment on the institutional side has pioneered the use of advanced data analytics and increasingly big data to understand investment trends and make decisions, when it comes to strategic business and client and product decisions they are actually a long way behind and the fact that asset managers don’t know the broad asset allocation of institutional investors is indicative of that.”

In a bid to combat the confusion, Spence Johnson formed its research based purely on the data available from the asset managers themselves, beginning with its own clients and spreading out to asset managers across Europe. The project has 27 founder members, from multi-national one-stop shops to small boutiques, all anonymously providing data on segregated mandates and pooled funds in the institutional space only.

Participation allows the managers to measure the flow of new money net of performance alongside their individual market share within those areas. They can also assess how much of their business comes through consultants.

- 1

- 2

- »

Comments