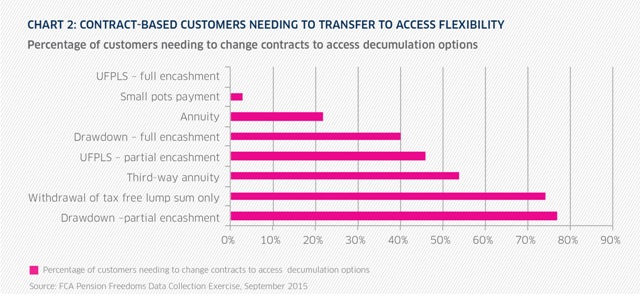

FCA research released in September shows 77% of contract-based scheme members would need to transfer to a new provider if they wanted to take drawdown and partial encashment, while 74% would be obliged to move if they only wanted to withdraw their tax free lump sum.

This compares to just 22% who would have to move if they wanted to buy an annuity (see chart below).

Paul Darlow, actuary at consultancy Xafinity, says: “Not all providers are equal in terms of the speed they have embraced roll out of the flexibilities. A number appear to be slow to react but it might be that the nature of systems and processes are harder to change, or they need to build certain capabilities from scratch.”

The challenge for members who are forced to transfer to a new provider is both the disinvestment risk which could erode their pots if they are out of the market for any length of time, and the potential reduction in funds from paying exit fees.

In a bid to tackle the potential disincentive to members engaging with freedom and choice, the government launched a consultation in July looking at how to manage fees and charges. The consultation ends in October.

The inertia in the contract-based arena to get on board with freedom and choice, appears to be outstripped by a lack of appetite in the trust-based world.

As the NAPF survey shows, more than twice as many contract-based employers offer managed drawdown compared to their trustee counterparts.

This seems somewhat surprising since trustees are obliged to act in members’ best interests and failing to respond to their post-freedom and choice demands runs contrarily to that.

However, the additional governance and cost burdens of offering all the new flexibilities makes it cumbersome for trustees to commit.

Nazarova-Doyle says: “On the trust side there is practically zero appetite for offering [flexibilities] within the scheme sadly. It’s a lot of responsibility and additional cost. We are hoping that trustees will want to take that responsibility, but it seems to not be happening.”

JLT’s experience is repeated elsewhere with Fidelity Worldwide Investment reporting just 23% of trust-based schemes are offering full flexibility.

Comments