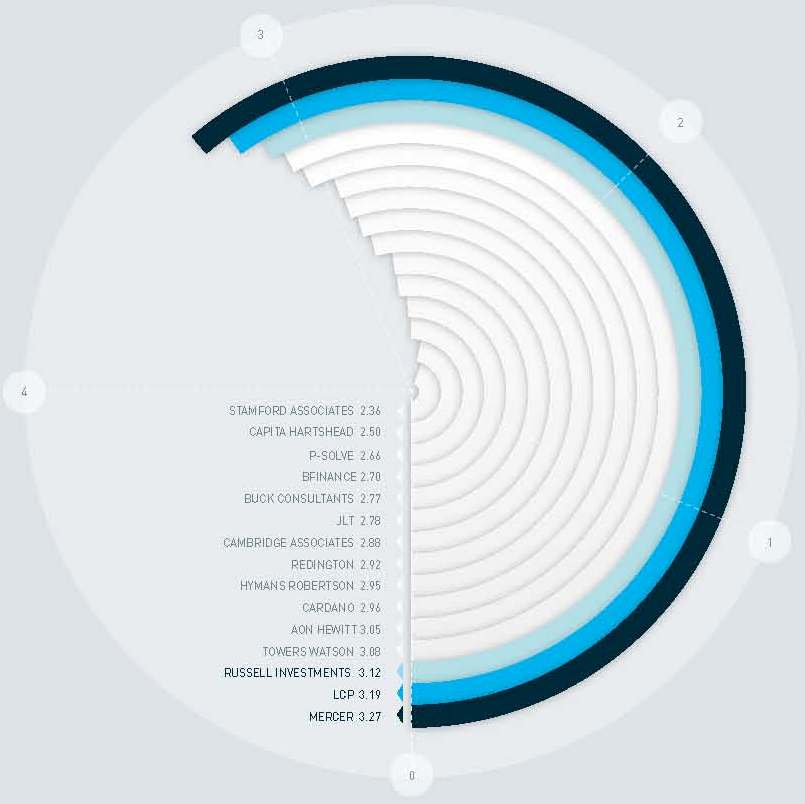

Mercer was again the top choice for asset managers in this category, which asked respondents to address their relationships with consultants by considering and ranking the frequency and quality of communication.

This included the regularity and thoroughness of feedback on funds, the speed in responding to queries and finally their willingness to put forward asset managers for beauty parades in front of clients.

Mercer notched up 3.27 points, with LCP breaking into the top three in second places on 3.19, and Russell Investments close behind with 3.12. At the opposite end of the spectrum, Stamford Associates came in 15th place with a score of 2.36, just below Capita Hartshead in 14th with 2.50.

Servicing ranking

1. MERCER (3.27)

2. LCP (3.19)

3. RUSSELL INVESTMENTS (3.12)

4. TOWERS WATSON (3.08)

5. AON HEWITT (3.05)

6. CARDANO (2.96)

7. HYMANS ROBERTSON (2.95)

8. REDINGTON (2.92)

9. CAMBRIDGE ASSOCIATES (2.88)

10. JLT (2.78)

11. BUCK CONSULTANTS (2.77)

12. BFINANCE (2.70)

13. P-SOLVE (2.66)

14. CAPITA HARTSHEAD (2.50)

15. STAMFORD ASSOCIATES (2.36)

Find out which consultant:

– Is most willing to take on board new ideas or products

– Has the highest quality research

– Is best for innovation and development in DC

– Was voted the UK’s best investment consultant

Read portfolio institutional‘s view

Comments