Sponsored article

Compression over the past two years in high yield and emerging market debt (‘alternative credit’) credit spreads, along with ‘late-cycle’ behaviour in the US economy, have led some investors to be nervous about allocating to alternative credit. But what could be the key strategic benefits of the asset class for many schemes?

DIVERSIFICATION

For many institutional investors, the majority of their growth assets continue to be allocated to global equities. But alternative credit offers investors the opportunity to diversify their risk exposure and improve their risk-adjusted return profile.

For many institutional investors, the majority of their growth assets continue to be allocated to global equities. But alternative credit offers investors the opportunity to diversify their risk exposure and improve their risk-adjusted return profile.

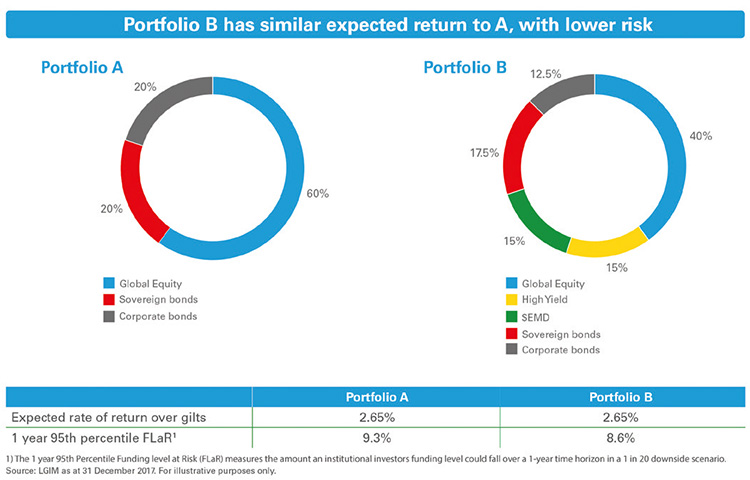

In the charts below we have modelled two portfolios with similar expected returns. Portfolio A’s risk profile is highly concentrated in equities. In portfolio B we have improved the diversification by allocating to US dollar- denominated emerging market debt ($EMD) and high yield. This has led to a lower concentration in equity risk and a reduction in the investor’s total risk.

Memories from 2008, where almost all growth assets experienced significant falls in value simultaneously, have led people to question the benefits of diversification. However in these episodes there often still are relative winners and losers and having a diversified portfolio can moderate the impact of a downturn. For example, during the dot.com crisis in the early 2000s, global equities fell 44% peak to trough. Over the same time period, high yield only fell 3.9%, with $EMD returning +6.7%. Over this period Portfolio B would have outperformed Portfolio A by over 7%.

A STABLE SOURCE OF CASH

Maturing pension schemes and an uptick in transfers out have put meeting benefit payments high on the agenda for many pension schemes. While we believe the endgame portfolio for most pension schemes should have cashflow matched buy and maintain investment grade (IG) credit as a cornerstone, the expected return from IG credit may be insufficient to meet some schemes’ return requirements. For these schemes, we believe a ‘cashflow aware’ approach can be appropriate.

In a cashflow aware approach, a pension scheme can obtain cashflows from a range of sources by ‘turning on the taps’. This may include equity dividends, property rents and alternative credit. The stability of cashflows offered by alternative credit, even over times of severe economic stress, make it very attractive for pension schemes as it reduces the risk that a scheme has to sell assets at depressed prices to meet benefit payments.

ATTRACTIVE RISK-ADJUSTED RETURN POTENTIAL

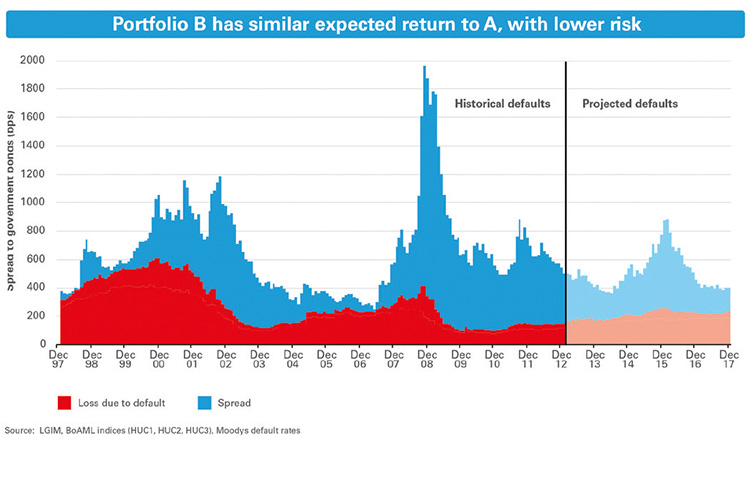

The key driver in asset allocation for the majority of investors is what return one can expect relative to the amount of risk. In chart below, the blue bars show the history of US high yield credit spreads. The red bar shows the default loss an investor would have experienced (left side of the dotted line) or projected to experience (right side of the dotted line) if they purchased those high yield assets. Spreads have compressed in high yield and are at the lower end of their historical range. However the blue bar remains significantly higher than the red and indicates high yield still offers value relative to expected default experience. This result is also true for other alternative asset classes such as $EMD.

We believe that alternative credit assets offer a number of attractive qualities, including diversification, a stable source of cashflow and potential returns in excess of expected defaults. While the current low level of credit spreads and the evidence of late cycle dynamics support being cautious, we do not feel this merits having a very low allocation. The ‘optimal allocation’ to alternative credit varies by investor but we believe it is an important constituent and should form a meaningful part of most pension scheme’s strategic asset allocation.