As Local Government Pension Scheme (LGPS) pooling reaches the latest stage in its development, Sebastian Cheek looks at some of the groups formed and considers how consolidation might affect the asset management industry.

“Obviously [managers] are either going to win big or lose big.”

Andrien Meyers, JLT Employee Benefits

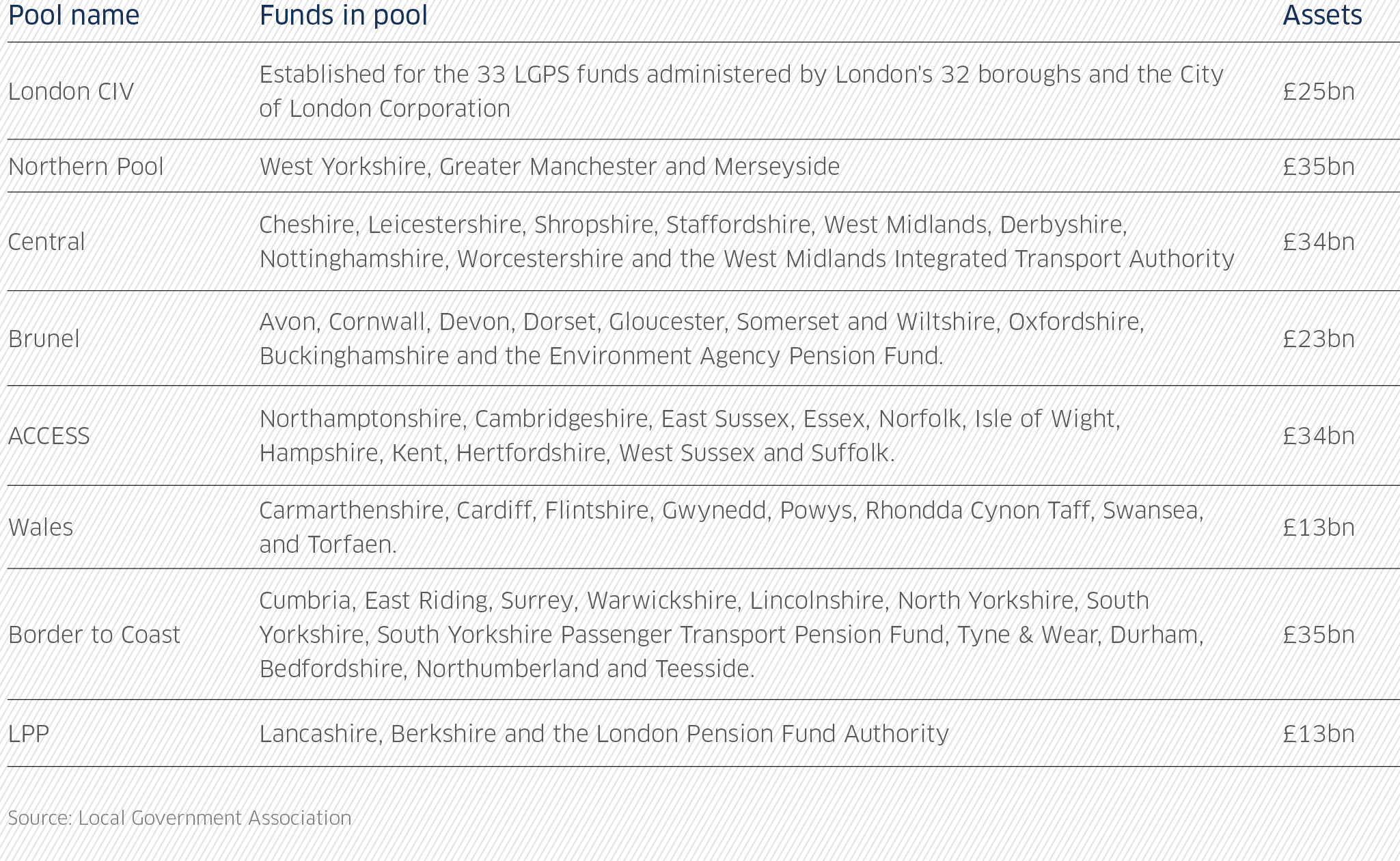

The pace of Local Government Pension Scheme (LGPS) pooling has been rapid. The UK’s 89 LGPS funds (apart from those in Scotland and Northern Ireland) have formed eight asset pools since former Chancellor George Osborne’s request in October last year to create a small number of ‘British Wealth Funds’. In July the process took a step further as the groups submitted final plans for full pooling by April 2018.

The government’s request had, on paper, been relatively simple: create a smaller number (around six) of investment pools, each around £25bn in size, that show significant cost savings and economies of scale, keep governance with the administering authorities and have the capability to invest in UK infrastructure. It dismissed an all-out merger of funds following swathes of negative feedback from members and other parts of the industry.

In practice however, it has been no easy task as the pools each have to effectively set-up a full-blown asset management business. This is a huge undertaking involving managing and moving assets, setting up IT platforms, legal structures, recruitment and obtaining Financial Conduct Authority (FCA) authorisation – all against an uncertain backdrop following Brexit and the

departure of Osborne, the man behind the changes.

The pressure to meet the challenges before the impeding deadline will of course be most keenly felt by the pools themselves, but the asset management industry including consultants and asset managers will also have to be alert to the changes because for them, it could potentially mean either winning or losing big.

EACH THEIR OWN

All eight pools (see table inset) submitted their final proposals to government on 15 July. So far two of the eight pools – Local Pensions Partnership (LPP) and the London Collective Investment Vehicle (CIV) – have received the all-clear from the FCA to operate, essentially, as asset managers.

But there is not a one-size-fits-all approach in terms of the vehicle to be used as each pool will have its own degree of in-house management. Common among the structures however, is for the individual funds to retain control over asset allocation while asset manager selection becomes the responsibility of the company running the pool.