Between March and June 2020, Censuswide surveyed 400 professional portfolio builders across the UK, Italy, Germany and Switzerland to uncover attitudes towards sustainable investing and the role of sustainable indexing.

Sustainable is the new standard

Climate change, wildfires, and the Covid-19 pandemic have shown an increasing impact on European investors. Climate risk is now widely embraced as an investment risk and transitioning from traditional investments to sustainable ones. This is quickly becoming imperative, especially for those investing for the long-term

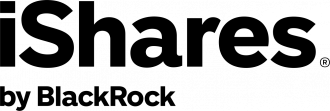

As a result, an unstoppable transition to sustainable investing is now in progress with 78% of European and 81% of UK investors already integrating sustainability into their portfolios.

Source: Censuswide, iShares Sustainable Investing Research, June 2020.

For illustrative purposes only.

It’s time to act

Many of our clients are under pressure to transition their portfolios to be more sustainable and this was confirmed in our survey with 80% of European investors placing the incorporation of sustainability into their portfolio construction strategies as either urgent or very urgent.

- Investors in the UK: 84%

- Investors in Italy: 85%

- Investors in Germany: 78%

- Investors in Switzerland: 72%

Future first

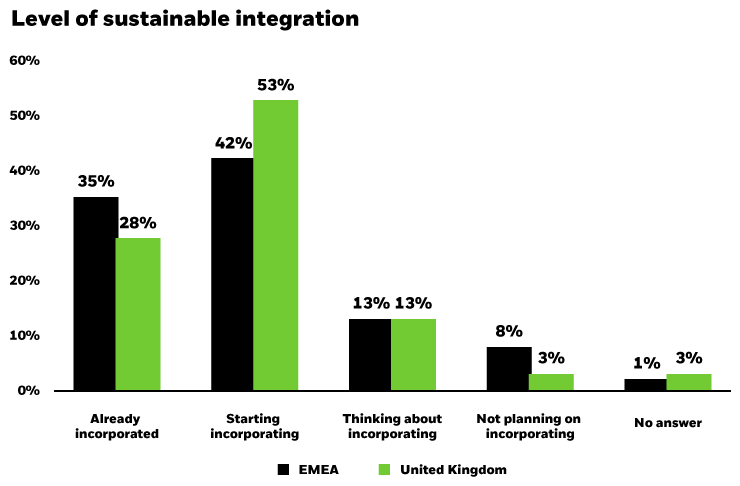

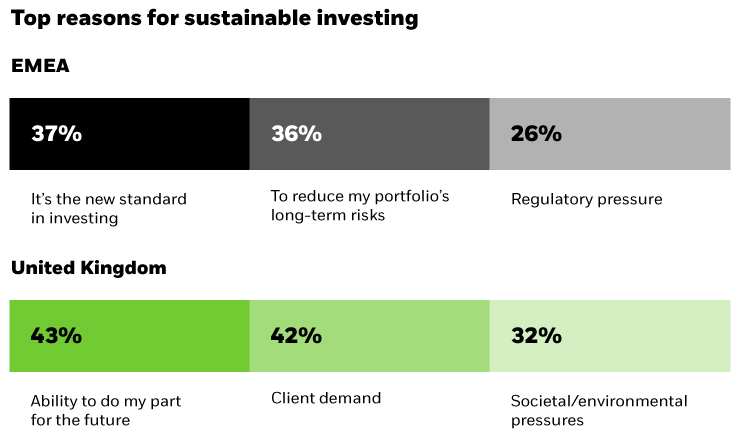

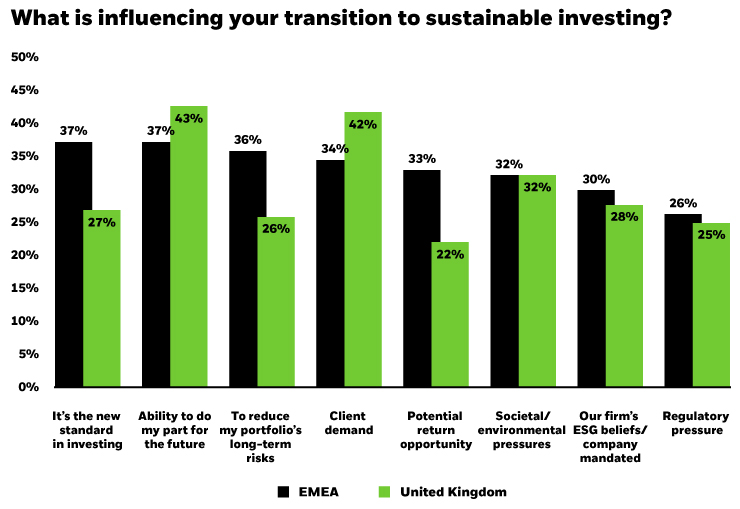

We asked investors what the driving forces are behind this urgency to transition portfolios.

Source: Censuswide, iShares Sustainable Investing Research, June 2020.

For illustrative purposes only. Note: Total may not add up to 100%, as those investing for the long-term.

Whether it’s due to ethical considerations, corporate beliefs, client demand or potential return opportunities, sustainable investing is reshaping portfolio models.

Source: Censuswide, iShares Sustainable Investing Research, June 2020.

For illustrative purposes only. Note: Total may not add up to 100%, as respondents could pick more than one factor.

Challenges to change

Transitioning to sustainable investing is not without its roadblocks. We identified 3 main challenges professional investors are facing today:

- Lack of confidence in ESG data and ESG scores

- Choosing the right sustainable investment vehicle

- Choosing which fund provider to work with

A crucial role

As investors seek more sustainable investment avenues, indexing has naturally come to the forefront and 80% of the investors surveyed believe indexing is crucial to achieving a more sustainable portfolio.

ESG integration is increasingly central to the investment process for many in our industry. We view this as a major structural shift and are proud to deliver transparent, high quality and reliable ESG data, indexes and tools to power better investment decisions.

Baer Pettit, President and Chief Operating Officer, MSCI

To uncover why investors believe indexing will play such a crucial role in helping them achieve more sustainable portfolios we asked them why they currently choose indexing.

Source: Censuswide, iShares Sustainable Investing Research, June 2020. For illustrative purposes only. Note: Total may not add up to 100%, as respondents could pick more than one factor.

Indexing: Clarity in complexity

Our research tells us that as investors transition into sustainable investments, navigating the choice, terminology and data interpretations can be challenging. We believe an important reason why so many investors are turning to indexing, is because indexing can help provide the clarity and simplicity investors need to pursue their specific financial and sustainability goals.

iShares believes index products such as ETFs and index mutual funds will play a pivotal role in the transition to sustainable aware portfolios, by providing choice, value and access to all investors.

Manuela Sperandeo, EMEA Head of Sustainable Indexing

The sustainable indexing investment revolution has started.

Visit iShares.com to download the full research report and learn why we believe indexing provides investors with the clarity they need to build more sustainable portfolios.

Capital at risk.

Until 31 December 2020, issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. From 1 January 2021, in the event the United Kingdom and the European Union do not enter into an arrangement which permits United Kingdom firms to offer and provide financial services into the European Economic Area, the issuer of this material is: (i) BlackRock Investment Management (UK) Limited for all outside of the European Economic Area; and (ii) BlackRock (Netherlands) B.V. for in the European Economic Area, BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded. For qualified investors in Switzerland: This document is marketing material. This document shall be exclusively made available to, and directed at, qualified investors as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, asamended.©2021BlackRock,Inc.AllRightsReserved. 1511251