Asia has been working diligently to address the sustainability challenges that it faces. The growing popularity of ESG investing in the region underscores the fact that work that’s been taking place behind the scenes on the sustainability front over the past few years is finally gaining momentum.

ESG investing in Asia gathers steam

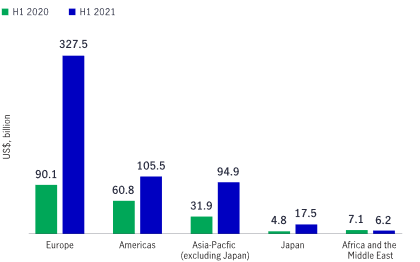

If the amount of capital raised to fund sustainable endeavours in the first six months of 2021 could be viewed as a gauge of the progress that we’re making toward addressing sustainability issues, there could be cause for celebration. After all, global debt issuance related to environmental, social, and governance (ESG) objectives during the period surged 76% from a year ago to a record high of US$551.6 billion, accounting for nearly 10% of all debt issuance—a far cry from where we were just five years ago.¹

Unsurprisingly, Europe accounted for the lion’s share of total issuance (59.3%), with North America and Latin America together coming in at second place (19.1%). Encouragingly, issuance in the Asia-Pacific region (excluding Japan) in the first half of the year also grew, both in terms of share of new issuance and in value, to just under US$95 billion, or 17.2%1 (up from 16.4% in H1 2020²).

Sustainable debt issuance surges in the first half of 2021

These numbers are impressive in absolute terms, but they acquire additional significance when expressed as a percentage share of total fixed-income issuance in Asia over the first six months of the year; during this period, roughly one of every five debt issues in Asia can be classified as a sustainable bond issue. Using this metric, Asia charges to the top of the league table from a geographical basis, ahead of the Americas and Europe.

It’s fair to say that the rise in ESG bond issuance reflects a growing awareness of sustainability challenges among policymakers, corporates, and investors alike, particularly in the wake of the COVID-19 crisis, which provided a much-needed perspective and framework regarding how to best approach issues that have come to light. Policymakers responded to the call to building back better, while investor demand for sustainable investing surged, recognising the role that they can play to help progress broader ESG goals.

This has been particularly true in Asia: A recent survey of 200 global institutional investors (representing roughly US$18 trillion in assets under management) showed that of the 70 or so respondents who are based in the Asia-Pacific region, 79% planned to increase their ESG allocation significantly or moderately in response to the pandemic.³ It’s difficult not to be heartened by the finding: For a region that’s been widely perceived to be behind the curve on the ESG front, it represents an important shift in investor mindset.

Despite these positive developments, however, challenges remain. Read more

1 “Sustainable finance review first half 2021,” Refinitiv, July 19, 2021. 2 “Sustainable finance review first half 2020,” Refinitiv, July 2020. 3 “Investment Insights 2021: Global Institutional Investor Survey,” MSCI, January 2021.