Abbie Llewellyn-Waters is head of sustainable investing at Jupiter Asset Management

Sustainability is at the core of the debate among policy makers and asset managers now, thanks to mounting environmental risks and a sharp focus on social issues, amid the crippling coronavirus pandemic. Abbie Llewellyn- Waters explains that doing good for the planet and for people need not be at the cost of profit and expands on her team’s forward-looking investment approach in allocating capital for transitioning to a better future.

For a second year running, environment concerns top the list of global economic risks cited by the World Economic Forum.

In 2020, extreme weather, policy inertia, biodiversity loss, natural disaster and human-made damage were identified as the top five risks. This year infectious diseases moved to the fourth spot and social issues are also flagged as key concerns. Devastating Australian bushfires, Arctic Circle wildfires and the Texas big freeze showed the threat of global warming is not a distant concern. Drought in sub-tropical Taiwan had a big impact on global semiconductor supply, which under- pins many economic sectors.

These unexpected climate events under- line the fact that sustainability as a concern has moved well beyond philosophical, populist, political or ideological debates. They are pure economic risks. Understanding how capital is allocated in this transformed landscape is more important now than ever.

Holistic view

We take a holistic view when addressing sustainability. The spread of coronavirus since early 2020 showed how the most marginalised are the most vulnerable in terms of economic impact and fatalities. Lack of access to computers for home learning is also a future systemic risk in exacerbating the attainment gap.

We launched our first sustainable investment strategy in 1988 and our Global Sustainable Equities strategy just marked its third anniversary. We have long standing commitment, innate expertise and years of authenticity that makes us well qualified to comment on the evolving scenario.

In this context, it is important to mention that we hold ourselves to the same ac- count as our investee companies. Jupiter was a founder signatory to the Carbon Disclosure Project (CDP) in 2000. Eight years later, in 2008, we signed the Principles for Responsible Investment, or PRI.

Back to the future

There is increased recognition that the world cannot kick the can down the road as far as the climate emergency is concerned. And the deal sealed in April between Biden’s climate emissary John Kerry and China is particularly important because if the two largest emitters align, we should anticipate accelerated policy. Cutting net CO2 emissions has fast become a business-critical strategy since the world’s largest nations signed a legally binding agreement in 2015 to cut global warming. Cement could be an apt illustration of how carbon may become an internalised cost to business. If the cement sector were a country, it would be the third largest emitter of carbon. Cement has been a cornerstone of civilization since the Roman empire, and we need it for building hospitals, roads and housing. Even renewable energy projects are dependent to a degree on the sector. Currently, there is no scalable alternative to cement.

But we anticipate all industries will be subjected to carbon pricing mechanisms in the future, which can have an impact on cashflows and profitability. Pricing in these risks at the early stage of fundamental analysis is absolutely core to delivering returns on a consistent basis over the long run.

The shift towards decarbonization is not just about mitigation through divestment. It is also about how we price assets.

Investment framework

Therefore, holding a low carbon portfolio that is transitioning to delivering net-zero is key for our performance. The portfolio companies are already aligned to a net-zero economy by or before 2050. Some will achieve net-zero much sooner. Our investment framework is designed to capture these leading companies.

We look for credible and deliverable strategies and capital allocation programmes backed up by targets over the short-, medium- and long-term to make this assessment and seek clear medium-term actionable targets of decarbonisation that bridge executive and board tenures.

That bring us to the core questions. Do you need to sacrifice performance to look at sustainable investing? Do you need to take on too much risk for a leading sustainable strategy?

Risk and return

Our own experience shows you can deliver attractive returns if you use broader stakeholder analysis to enhance your conviction about your investments. We prioritise materiality and relevance. And our Global Sustainable Equities strategy illustrates that this can be achieved on a diversified low volatility basis as well.

Our bias for quality companies has al- lowed us to keep volatility low in our in- vestment framework. Economic sustainability, strong balance sheets, resilient cashflow and whether these companies are built for the long term are some of the factors we consider while making our in- vestment choice. And our strategy has proven to be resilient even during the coronavirus upheaval.

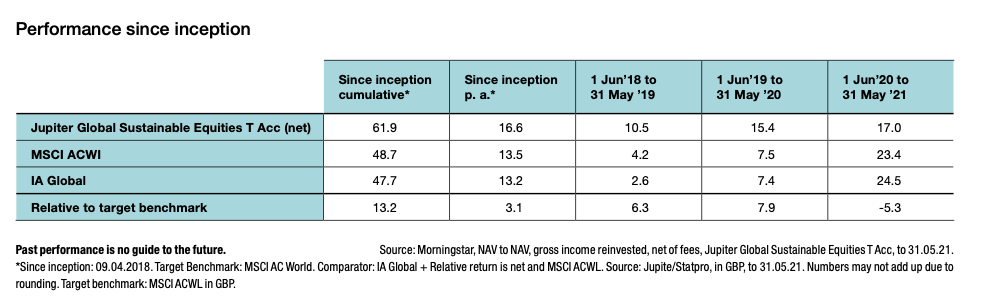

The performance of our Global Sustainable Equities strategy upholds the success of the investment framework. Since the fund’s launch on April 9, 2018, to May 31, 2021, the cumulative returns of the fund (T ACC) have been 61.9% compared to its benchmark’s returns of 48.7%, deliver- ing top quartile performance relative to global peers.

We aim to create a forward-looking portfolio that addresses issues such as the environment and inclusivity. At the heart of it all is delivering a positive impact across planet, people and profit for a more sustainable world.