For professional investors only.

Picture a snowball rolling down a hill, getting bigger and gaining momentum the longer it travels. The shift towards sustainable investing is our snowball. And it is gathering momentum – European investors expect nearly 50% of their assets under management to be sustainable by 2025, compared with 21% in 2020.¹

However, sustainable investing is complex, with no one-size-fits-all approach. After conducting over 100 client interviews², we identified five challenges that European investors face with the shift towards sustainable investing:

1. Transitioning portfolios

Building a sustainable portfolio tailored to specific requirements can be time-consuming. It is also challenging for investors to assess their current portfolio against ESG metrics and then determine which product substitutions will make their portfolio more sustainable.

When you invest with iShares, you get access to the broader added value, experience and expertise of BlackRock.

- Our Portfolio Analysis and Solutions team can help evaluate your portfolio’s holistic sustainability profile to assess your portfolio against ESG metrics.

- We can evolve your portfolio’s sustainability metrics with product substitutions, using alpha-seeking, factor and index sustainable funds.

- We can build a sustainable proposition based on your sustainability objectives.

2. Making sense of the data

Sustainable data, metrics and calculations vary per provider and interpretation differs – all of which makes it difficult for investors to quantify the sustainable output of their investments. Investors need to trust that a provider is taking a robust, rigorous approach when assessing the quality and accuracy of ESG data.

In 2020, we added 1,200 sustainability metrics to Aladdin, our risk and portfolio management system, and established multiple partnerships with data analytics firms.³ This data feeds into our risk management platform and our investment process – from research to portfolio construction, modelling, and risk management and reporting.

At iShares, we are committed to offering transparency, consistency, and expertise with analysing and interpreting ESG data, driving a push for standardisation across the industry.

3. Choosing the right product

In the first half of 2021, 48 sustainable ETFs launched industry wide in Europe alone.⁴ With a growing number of sustainable investment products available, investors need sustainable ETFs that are built with quality at the forefront, with a provider that is aligned to local regulations and the fast-changing sustainable landscape.

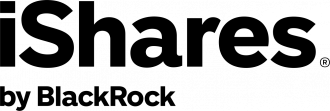

The BlackRock Sustainable Investing framework classifies iShares ETFs and index products according to four sustainable approaches.

With more sustainable ETFs registered on more European stock exchanges than any other provider, iShares gives you choice to select the fund that meets your needs and clarity through our sustainable investing framework.

4. The emerging climate trend

Climate change has emerged as a crucial factor for investors to consider; in fact, it is widely recognised that climate risk is investment risk. In 2020 alone, natural disasters led to an estimated US$120 billion in damages – the highest ever recorded.⁶ But along with other ESG principles, investors often aren’t sure how to incorporate climate considerations into their portfolios.

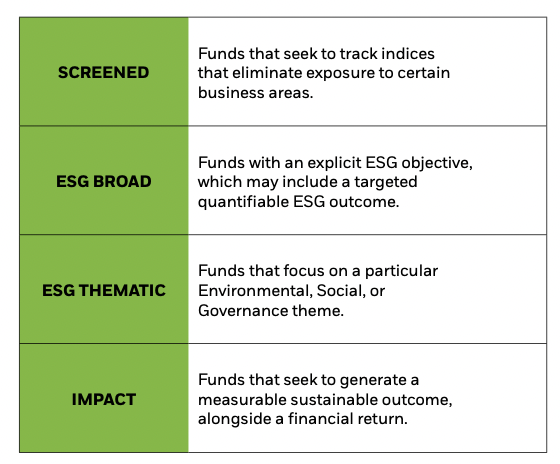

BlackRock has three approaches to climate investing to help investors navigate our range and select the best climate option for them.

5. Company engagement

We firmly believe in the value of engaging with companies. When BlackRock engages a company, we do so from the perspective of a long-term investor. Engagement enables us to have ongoing dialogue with companies and build our understanding of the challenges and opportunities they face. This is particularly important for our clients invested in indexed funds, as they typically remain invested in a stock for as long as it remains in an underlying index – often many years.

iShares is backed by BlackRock’s Investment Stewardship team that engages with companies big and small, and at all stages of their sustainability integration journey. Engagement is one way the team advocates for sound corporate governance and sustainable business models that can help drive the long-term financial returns that enable our clients to meet their investing goals. In 2020–2021, we held more than 3,650 engagements with over 2,300 companies.⁷

BlackRock’s investment stewardship toolkit involves engaging with companies, voting in our clients’ interests and providing transparency in our activities.

To learn more about investing in sustainable ETFs, search ‘iShares ESG’

- [1] BlackRock, “Sustainability Goes Mainstream, 2020 Global Investing Survey”, EMEA results, December 2020, Survey of 425 clients representing USD25T in AUM.

- ² BlackRock, as at 30 June 2021, EMEA Client Sustainability Survey

- ³ BlackRock’s 2020 sustainability actions

- ⁴ BlackRock Global Business Intelligence, as of 30 June 2021.

- ⁵ BlackRock, Bloomberg, as of 30 June 2021.

- ⁶ Munich Re NatCatService database (as of 30 March 2021).

- ⁷ BlackRock Investment Stewardship; Protecting our clients’ assets for the long-term, July 2021.

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. This material is for distribution to Professional Clients (as defined by the Financial Conduct Authority or MiFID Rules) only and should not be relied upon by any other persons. Issued by BlackRock Advisors (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Registered in England and Wales No. 00796793. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. © 2021 BlackRock, Inc. All Rights reserved. -1876481