Social bonds have been the fastest growing segment of the market for thematic bonds. Numerous factors are driving their popularity, including their use to address gender inequality and to support pandemic relief.

Social bonds raised USD 147.7 billion in 2020 – more than seven times the roughly USD 20 billion in 2019, Bloomberg data shows. This massive increase underscores their appeal as a potentially significant force for effecting social changes such as making more affordable housing available, improving access to essential services and creating jobs.

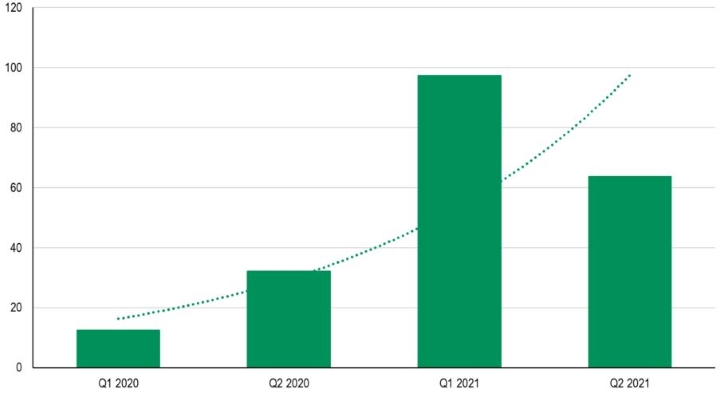

Exhibit 1: Issuance of social bonds rose markedly in H1 2021 (in USD billion)

A case for social bonds – Gender equality

While great strides have been made towards gender equality around the world – this is goal 5 of the UN’s Sustainable Developed Goals – this SDG is still a long way from being achieved.

The economic fallouts from the pandemic have increased gender inequality, especially in terms of pay gaps and workforce participation. According to the UN, the pandemic has caused 25% of self-employed women to lose their jobs compared to 21% of men.

Academic studies have confirmed the link between economic development and gender equality. For instance, a 2012 study found that empowering women and economic development are closely interrelated. In general, gender inequality is higher in emerging economies than in advanced markets.

G20 countries, for example, score a median 0.08 on the UN’s 2019 Gender Inequality index, compared with 0.31 for major emerging markets with lower per capita incomes. The index ranges from 0 to 1, with higher values indicating greater inequalities.

Even in high-income countries, women’s participation and access to measured and compensated economic activity remains below their share of the population. Mercer research found that 40% of the global workforce is female, yet only 7% of Fortune 500 companies are run by women.

There are unrealised economic benefits from narrowing and closing gender gaps. A higher share of women in paid employment can lift economic output, while an increase in women’s incomes can boost consumption and household finances. Employing more women can help offset the negative effects of population ageing.

A scenario where women participate in the global economy on the same level as men could increase annual global GDP by USD 28 trillion, according to a McKinsey study.

Social and gender-related bonds can be an effective tool in promoting gender equality. A recent example is IDB Invest issuing a USD 122 million bond in Mexico to fund projects advancing gender equality and women in Latin America and the Caribbean.

Banco Davivienda issued Latin America’s first gender-focused social bond in August 2020 to fund loans to eligible women-led businesses in Colombia and to first-time female home buyers on low incomes.

Social bonds for pandemic relief

The pandemic has sped up the growth of social financing. Since the beginning of 2020, social bonds have seen an uptick in issuance volumes as the public sector and development agencies turned to debt financing in response to the impact of Covid-19.

Between 2014 and 2019, a large number of social bonds was dedicated to affordable accommodation projects. Examples are Dutch state-owned bank NWB’s USD 2.2 billion issue for affordable housing and National Australia Bank’s USD 384 million gender equality bond.

Pandemic relief efforts have increased the number of social bonds focused on issues such as tackling unemployment and access to healthcare. For example, in May 2020, Unédic, the French unemployment agency, issued a EUR 4 billion social bond followed by a second EUR 4 billion bond a month later.

How growing awareness can help social change

Beyond pandemic-related financing, there is an increase in social awareness among investors, businesses and governments.

Sovereigns, supranationals and agencies represented 80% of all social bond issuance between 2020 and H1 2021, but financial institutions, corporations and non-profit organisations are now expected to play an increasingly important role in the market. Ford Foundation, for example, issued USD 1 billion of social bonds in 2020.

Companies have issued sustainable bonds to support racial equality initiatives. Last year, Bank of America issued a USD 2 billion Equality Progress Sustainability Bond to advance racial equality, economic opportunity and environmental sustainability.

As the overall popularity of social bonds grows, we believe it is reasonable to assume that fixed-income issuance linked to the economic empowerment of women and addressing female underrepresentation will also be bolstered.

Such instruments can be expected to have long-term positive effects for issuers and national/regional governments because expanded opportunities for women can reduce operational and reputational risk and benefit economic growth and social cohesion.

Regulatory developments such as the EU’s Social Taxonomy and the Sustainable Finance Disclosure Regulation (SFDR) are likely to increase investor confidence in the social bond market and increase capital flows towards these bonds. This in turn could strengthen the liquidity of social financing in debt capital markets.