The outcome of the 2021 COP26 climate conference showed that, despite nations planning their own environmental efforts, collective climate action is difficult to foster. What does this mean for investors? Is there any way governments can be swayed into working together more effectively?

All eyes on US (and China)

The Principles for Responsible Investment’s Inevitable Policy Response modelling has provided forecasts informing investors of the impact climate policy decisions will have on their portfolios. In drawing up its forecasts, IPR sheds light on which nations’ policies will be most critical to climate action.

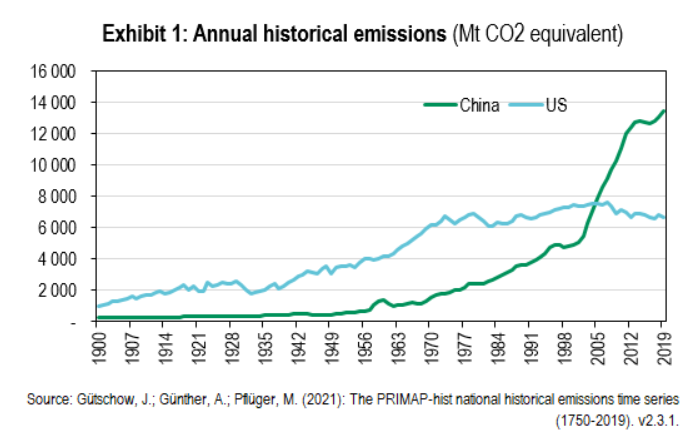

The IPR’s database shows the US is the world’s largest historical cumulative emitter. China, however, will take this title given its current and projected emissions trajectory. So it is fair to assume that material progress on climate change hinges largely action by these two nations.

There have been tentative signs that negotiations are possible. Despite continued geopolitical tensions, President Xi Jinping attended a virtual climate summit hosted by President Joe Biden in April 2021. During the event, the Chinese leader even pledged to reduce coal consumption between 2026 and 2030 – although this lacked specifics. The two countries then then jointly declared at COP26 to work together to enhance climate action over the coming decade.

Of course, there have also been reasons to be pessimistic. One of the headlines at COP26 was a last-minute change of key wording of the Glasgow Climate Pact. In the end, the language specified a goal to ‘phase down’ rather than ‘phase out’ coal in response to objections from China – among other nations.

The most optimistic forecasts at COP26 had temperature rises being limited to as little as 1.8C as a result of negotiations. This roughly matched the expectations embedded in the IPR’s Forecast Policy Scenario, published in October before the summit. That concluded that nationally determined contributions from developed countries up to 2030 – i.e. the efforts each nation will make to reduce emissions – were consistent with limiting warming to 1.8C.

This is still above the 1.5C target set out in the Paris Agreement on climate change. More inter-governmental cooperation is needed and negotiations must continue.

The investors’ viewpoint

How can investors have a say in climate negotiations? Small and large private investors can make their wishes known through individual and collective action such as the annual Investor Agenda’s Global Investor Statement.

There are ways in which investors can – and do – influence geopolitics indirectly. Pushing companies – particularly those deriving their revenues from polluting activities – to align their lobbying activities with the 1.5-degree goal of the Paris Agreement. They can work to ensure their trade associations are also aligned.

The same could be said of efforts to encourage the adoption of corporate net-zero goals. Additionally, investors can provide feedback to appointed regulators rather than elected policymakers in key jurisdictions (e.g. by responding to public consultations for new ESG-related disclosure rules).

While some were disappointed with the outcome of COP26, it undoubtedly raised awareness of some of the obstacles facing international cooperation on climate change.

For example, the conference showed a severe disconnect between developed nations and emerging economies. Policies such as carbon border taxes and carbon offsetting are touted by the world’s richest countries, but are not necessarily viewed positively elsewhere.

COP26 made it clear that poorer nations feel they have faced the brunt of climate change to date and are now being asked to ‘pitch in’ on collective action.

Can investors address the historical damage and create a pathway to increased international cooperation? The answer is ‘possibly’, again by influencing public and corporate policy through engagement or by allocating assets while minding Scope 3 carbon emissions.

Today, developed market companies have been found to be reducing their Scope 1 and 2 emissions on the back of outsourcing arrangements with emerging market companies, pushing their emissions into the largely unaccounted-for Scope 3 category.[1] By working to resolve this discrepancy, investments in emerging markets may become relatively more attractive through a climate lens.

Keeping climate action front of mind

Stocktakes of national targets at COP gatherings will now be happening more frequently as the world seeks to accelerate environmental action. This means countries – and indeed companies – will face regular scrutiny of their net-zero plans.

Investors should keep this in mind. Laggards may face growing international ire, which may affect portfolios with a global focus.

It is worth considering a scenario where international cooperation on climate change elements, with different nations – or groups of nations – going it alone. This could have implications for supply chains and overall operations as multinational companies look to navigate a variety of environmental policies.

The BNP Paribas Asset Management position

BNP Paribas Asset Management has made a long-term commitment to, and has a successful track record of, public policy engagement to advance its sustainability goals. We advocate both to strengthen ESG considerations in the financial sector and, more broadly, to improve sustainability-related regulation for the markets in which we invest.

We actively engage with regulators and policymakers, helping to shape the markets in which we invest and the rules that guide and govern company behaviour. Public policy can affect the ability of long-term investors to earn sustainable returns and create value. It can also affect the sustainability and stability of financial markets and social, environmental and economic systems. We are looking to expand our research on carbon data with the aim of enabling the consideration of all emissions scopes in our investment process. Together, we hope these actions will strengthen our contribution to solving the climate crisis.

References

[1] See Research finds US firms talk cheap on climate change for more on scope 1, 2 and 3 emissions