As discussions at the COP26 international climate conference continue, Thibaud Clisson dives into one vision of a net-zero future – that from the International Energy Agency – and asks what it would mean for investors.

As we’ve previously explored, getting to net-zero carbon emissions around mid-century is key to achieving the aims of the Paris Agreement on climate change and limiting the global rise in temperatures to 1.5C.

The International Energy Agency (IEA) this year outlined its version of what a ‘net zero by 2050’ future could look like. The organisation is well known for its scenario-based work charting energy and emissions futures, but has been criticised by investors and other stakeholders – which use its scenarios to help inform decision-making – for not producing a scenario in line with 1.5C warming.

This changed with the launch of the Net Zero by 2050 report, which outlines measures based on a new Net Zero Emissions Scenario. The NZE is normative – it is designed to achieve an emissions pathway consistent with 1.5C (with no temperature overshoot), while providing universal access to energy and significantly reducing air pollution in 2030.

What does the report mean for investment in the energy industry?

A reliance on yet-to-be-developed tech

The NZE follows the well-trodden path of decarbonisation via a large focus on electrification combined with more renewables, with hydrogen and carbon capture and storage (CCS) targeted at hard-to-abate sectors, in what is essentially a supercharged version of the IEA’s Sustainable Development Scenario (SDS).

One major point to note is that 50% of the emissions reductions realised by 2050 are ascribed to technologies that do not exist (at least not at any scale) today. This means CCS, advanced batteries, green hydrogen and negative emissions technologies such as direct air capture (DAC) and bioenergy and carbon capture and storage (BECCS), which today are only at demonstration or prototype phases, are carrying a lot of weight in 2050. These need to ramp up in scale significantly after 2030 to realise the NZE.

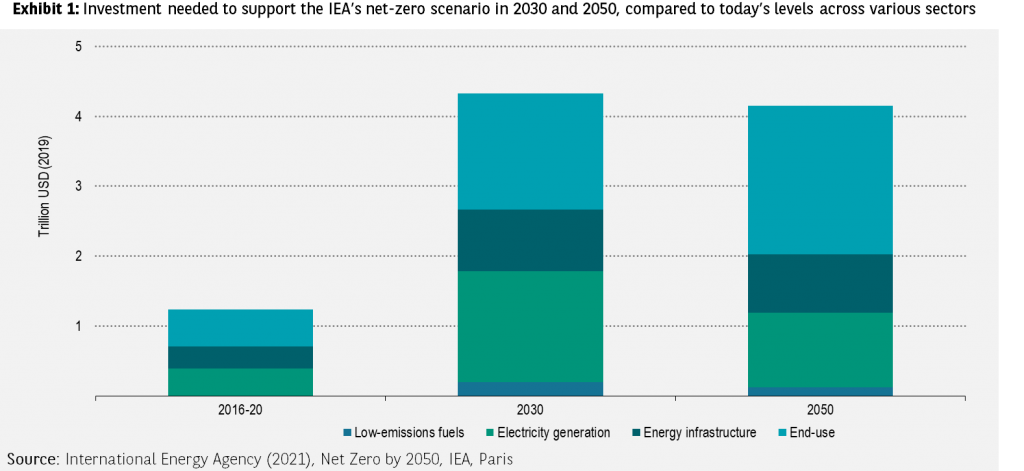

This means, for example, increasing investment in pipelines for CO2 alongside hydrogen infrastructure to USD 40 billion annually by 2030, compared to USD 1 billion today. More broadly, NZE requires clean energy investment to triple by 2030 to USD 5 trillion. Together with the IMF, it says this will add 0.4 percentage points a year to global GDP growth. By far the largest proportion of investment globally in NZE is in electrification and the electricity system.

A roadmap to 1.5C

As well as new tech development, the IEA lists 400 milestones that need to be reached across energy, buildings, transport and industry. These contain striking figures. Around 630 GW of solar panels and 390 GW of wind capacity will need to be added every year by 2030. That is triple the amount of solar and wind capacity installed in 2020.

On top of this, around 60% of cars bought in 2030 need to be fully electric, compared to 4.6% now. This means around 20 battery production ‘gigafactories’ will need to be built every year for the next 10 years.

New sales of fossil fuel boilers needs to be halted by 2025; coal power must be phased out of advanced economies by 2030 and across the entire world by 2040 and, by the same year, 50% of the fuels used in aviation should come from low-carbon sources.

How realistic is the NZE?

It’s fair to say the IEA makes some heroic assumptions around technology acceleration and the potential for carbon capture and negative emissions technologies. For example, by 2030, the scenario sees around 10 industrial facilities a month being equipped with CCS technology. There are only 27 commercial CCS facilities operating worldwide today.

The wind and solar installation figures are substantial. However, solar and wind capacity additions tripled between 2010 and 2020, so a tripling again between 2020 and 2030 is not out of the question. Nevertheless, the IEA does not address the environmental impact associated with the extraction of the raw materials needed to develop such massive renewables capacities. It should be reported, monitored and managed better to ensure acceptability and the sustainability of such an energy transition.

It’s worth noting that the IEA has been criticised for its conservative estimates of the pace at which the cost of renewables could be reduced and their use would grow.

Other criticisms are levelled at the NZE’s land use and bioenergy assumptions. The IEA says there will be no additional use of cropland for bioenergy crops, but it also sees bioenergy production rise by 25% to use a total of 410 million hectares by 2050, partly to fuel negative emissions bioenergy and carbon capture and storage plants. There is scepticism this can be done by using just marginal land.

NZE’s assumptions around the potential for energy efficiency are critical – the IEA envisages an economy in 2050 that is twice as large as today’s, but which uses 8% less energy on the back of significant investment in improving energy end use (see Exhibit 1). Another assumption is that individuals will change their behaviour significantly, but there is no detail on how this will be done.

What can investors do?

All this being said, as countries globally continue to delay climate action, the window of opportunity for decarbonisation narrows, requiring more fearless actions to reach net zero. Scenarios that are more realistic than the NZE are hard to find, although we, together with other investors, have attempted to do so as part of the Inevitable Policy Response initiative.

It’s clear that making the energy sector net zero needs investment in electricity and renewables expansion, and all the associated mineral resources.

Governments will need to be supported in their research and development and early-stage projects to help accelerate technological development. Advocating for effective and enhanced policy is key. The IEA’s 2021 World Energy Outlook finds that current government net-zero pledges are around 12 gigatonnes short by 2030 compared to the NZE pathway.