Laurent Trottier is global head of ETF, indexing and smart beta management at Amundi

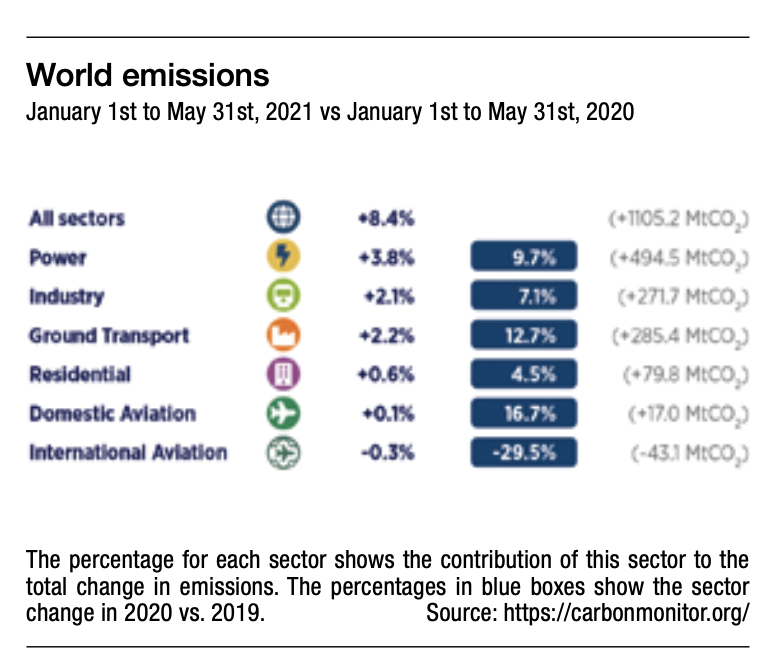

Climate change has accelerated, leading to the past five years being the hottest since records began1. The Covid-19 crisis, while devastating for society and global economies, had a positive effect on global CO2 emissions, which fell by 6.4% during 20202. However, emissions rebounded as economies began recovering. Meanwhile, the investment industry proved resilient, raising expectations for investors to act with urgency in tackling climate change.

The potential to invest for positive climate impact has never been greater. Global assets under management in 2020 grew 11% to $103trn (£75.3trn).3 Assets in passive strategies totalled $22trn (£16trn) in 20204.

Moreover, environmental, social and governance (ESG) assets are predicted to reach $53trn (£38.7trn) by 20255, and ESG represented 51% of all ETF flows in 20206.

Why climate change matters to investors

The increasing urgency of climate change has become critical for everyone, investors included. On one hand, investors are recognising not only the reputational risks but also investment risks resulting from the climate crisis. On the other hand, research and innovation in climate solutions could offer opportunities over the long term.

Not forgetting the growing desire of investors to reflect their values in their investment portfolios. Pan-European regulations are ambitious. In July 2021, the EC confirmed its 2050 goal of climate neutrality in the EU with at least 55% net reduction in greenhouse gas emissions by 2030.

This includes the phase-out of coal, curtailing deforestation, the transition to electric vehicles, and investment in renewables. Developed countries and international financial institutions are expected to play a key role.

Climate and index investing

Historically, climate investing focused on active management and impact strategies. Yet indexing is compatible with climate co-developing the MSCI Low Carbon Leaders index series with Swedish and French pension funds in 2014.

Improved data quality and availability have led to a new generation of climate indices, which consider indirect emis- sions and forward-looking climate commitments alongside historical data.

Furthermore, the Climate Transition Benchmark and Paris-Aligned Benchmark, enable passive investors to incorporate climate goals into their portfolios to align with their individual objectives. Further aiding investors’ alignment with their values are those managers offering robust engagement and voting strategies.

Tangible change achieved across a range of sectors recently has proven the importance of a manager that “walks the talk” in tackling climate change.

For more on climate index investing with Amundi visit: www.amundietf.co.uk

1) Source: IPCC, Climate Change 2021: the Physical Science Basis, 9 August 2021

2) Carbon Monitor programme/Nature analysis

3) Source: BCG, Global Asset Management 2021: The $100 Trillion Machine, July 2021

4) Source: BCG, Global Asset Management 2021: The $100 Trillion Machine, July 2021

5) Source: Bloomberg, ESG assets may hit $53 trillion by 2025, a third of global AUM, 21 February 2021

6) Source: Amundi/Bloomberg, December 2020