Jon Exley, Solutions manager, Schroders

Although the focus of CDI is often on meeting assumed liability outflows, in reality it is all about securing the asset inflows.

One of the reasons why cash flow driven investment (CDI) gains attention is that it benefits from a simple and intuitive explanation around arranging assets to meet liability outgo. However, this simple explanation alone doesn’t really distinguish CDI from many other pension fund investment strategies. After all, the investment objective of nearly every pension fund is to “meet the liabilities as they fall due”.

As a result the simple explanation is easily critiqued. Unfortunately, this can deflect focus away from the real benefit of CDI as an investment strategy, which is the greater certainty of asset inflows. Liability driven investment (LDI) then complements CDI by matching liability outgo.

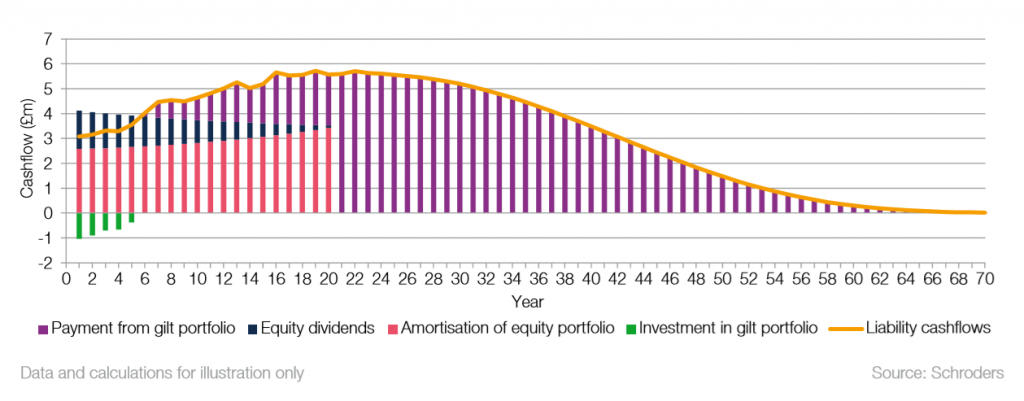

Traditional example of meeting liability cashflows

Let’s start with a traditional investment strategy consisting of equities and gilts. Importantly, we will ignore risk initially and just work in terms of an expected outcome. To generate a strategy which is expected to “meet the liabilities as they fall due”, we apply an equity allocation strategy which disinvests uniformly over 20 years. Based on assumed equity and gilt returns, all of the liabilities are paid as they fall due out of the projected fund without running out of money for a typical scheme shown below:

Our assumed equity disinvestment plan in this solution actually generates more cash than required to meet benefit outgo in the early years, while in later years the equity disinvestment alone isn’t sufficient. This isn’t a problem though; in the early years the excess cash is invested in gilts to meet later cashflows and in the later years the pension outgo is met from both equities and gilts or just gilts.

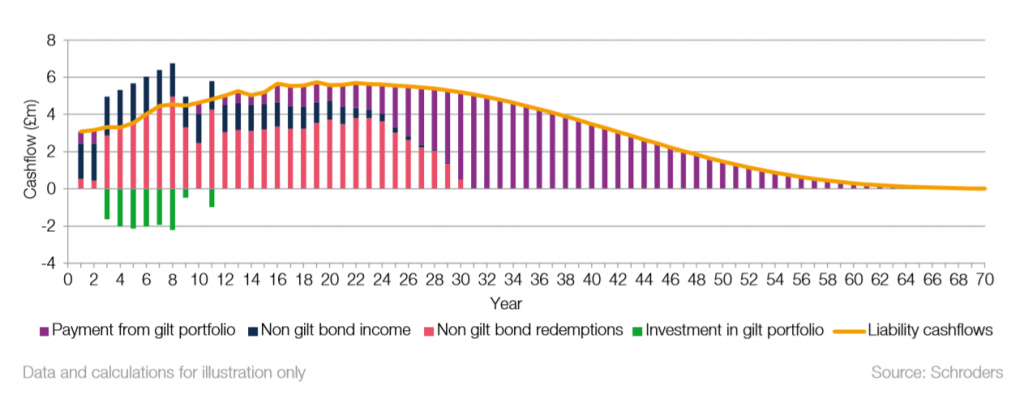

Moving on to CDI strategies

To get from a traditional equity and gilt strategy to a CDI strategy, we would replace the equity allocation with a different (typically higher) allocation to fixed income assets held on a “buy and maintain” basis. This is illustrated below with the asset cashflows separated between gilts and non-gilts.

As with our previous example, the non-gilt portfolio does not need to match the liability cashflows. The gilt portfolio fills gaps and mops up excess asset inflows through reinvestment. Instead, as above, the non-gilt portfolio is designed to meet the client preferences in terms of risk profile and deliver the overall quantity of cash required without worrying about precise timing.

So what is so different about CDI?

Our cashflow diagrams have looked similar for our traditional strategy with planned equity disinvestment and our CDI strategy with various fixed income and redemption inflows. They are both expected to meet the liability cashflows as they fall due based on the assumptions made. The crucial difference between CDI and traditional “growth plus LDI” strategies is actually in the distinction between:

- “assuming” the cashflows from dividends and planned disinvestments from the equity portfolio and

- “securing” cashflows from fixed income assets under a CDI approach.

Although this may sound like semantics, there are two important reasons why we make this distinction:

1) Parameter uncertainty – in particular knowing what the central scenario looks like

2) Market risk – the risk associated with disinvesting from the equity portfolio at unknown prices rather than relying on coupons and maturity proceeds from fixed income assets.

Parameter uncertainty – what is the central scenario?

A key assumption in our projection of the traditional strategy was the assumed excess equity return over gilts or “equity risk premium”. In fact, it takes about 100 years of reliable data to estimate the equity risk premium to within +/- 2% p.a. with two-thirds confidence.

Furthermore, the impact of this parameter grows as we increase the projection period and, in any event, it is not necessarily constant over time! To put this in context, a 2% p.a. downwards shift from assumption to reality reduces the expected proceeds from equity disinvestment in the tenth (middle) year of our amortisation plan by around 20%.

By contrast, for fixed income assets held on a “buy and maintain” basis to maturity, the central outcome is far more predictable. This is because it can be based on the known yield secured at inception less an allowance for defaults which are generally stable (and low) in central economic scenarios.

Market risk – volatility relative to the central scenario

The other important difference between CDI strategies and traditional approaches is the market risk exposure on top of any uncertainty in the central scenario. The equity strategy relies on selling a proportion of the equity portfolio in the market every year. As discussed above, there is significant uncertainty in the expected (or average) proceeds from these sales, but more importantly, there is also significant market risk.

By contrast the “amortisation process” under CDI involves structuring a series of fixed income assets such that their income and maturity proceeds deliver a planned series of future cashflows. Although these fixed income assets may be subject to significant market risk prior to maturity, investment grade bonds and many alternative credit securities held to maturity have a much narrower risk profile of outcomes compared with selling the equity portfolio in the market.

The role of LDI

Thus far we have described strategies as simple combinations of gilts and either equities in the traditional allocation or non-gilt fixed income assets in the CDI example.

However, in addition to the market risk of equities and default risk of non-gilts, both strategies would also be exposed to interest rate and inflation risks and potential liquidity risk, which could be addressed using an LDI strategy. In this context it is important to stress that CDI is not an alternative to LDI, and in particular for both the traditional equity plus gilts strategy and the CDI strategy:

1) The longest-dated liabilities would be met from long-dated gilts with maturities matching the liability

profile of the tail where possible

2) The LDI hedging would be used to add inflation exposure to match that of the liabilities

3) The LDI portfolio would provide day-to-day liquidity as discussed above, acting as a reservoir out of which pension outgo is paid and into which income and proceeds from equity sales or bond maturities are deposited.