Con Keating thinks it’s high time to rethink the accounting and regulation of corporate defined benefit pensions.

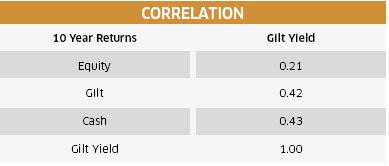

We are all familiar with the way in which small changes in initial conditions, assumptions or the structural set-up of our models may lead to radically divergent outcomes. It turns out that this is nowhere a more relevant concept than UK defined benefit (DB) pensions, where a simple shift of viewpoint has led to the near-total demise of corporate provision.This shift of perspective has been reinforced by the introduction of new regulations and obscured by shifts in accounting standards. Simply put, since the Maxwell affair in the early 1990s, the emphasis has moved from valuation of the current and expected development of the pension promises, their contractual values, to a new promise, provision of the pension under all circumstances.The poster child for this new assessment is the bulk buyout. This process involves the closure and wind-up of the scheme, but near total assuredness of payment of the pensions outstanding. In this regard, it is also the poster child for the destructive influence of the new idea.The issue at the heart of this development is a comparatively rare event: sponsor insolvency. The ambition is well-intentioned; protection of the pensions promised to employees. The process has been to devise institutions, and processes associated with them, which will survive beyond the death of the sponsor. It is a classic case of the best operating to the detriment of the good. Many millions of people in the UK have benefitted from DB pensions over many decades; far fewer suffered losses of their pensions.The shift has taken DB pension liabilities away from being similar to corporate bonds, where the contractual terms of issuance define the value expected in liquidation, to a new world in which these pension liabilities are now to be super-secured obligations, continuing regardless of the sponsor status.The important point to understand is that this is not the contract entered into by the sponsor. The sponsor promise when treated as a corporate bond, will return the principal originally advanced plus any unpaid coupons at the date of liquidation. The bondholder receipt, when paid in full, is sufficient to buy a bond with an equivalent yield to that dissolved, but there is no assuredness that such a bond may be available for purchase in the market. Full-funding of the pension contract would put the scheme member in precisely this position.As has been shown in many notes and articles, the valuation of a pension liability does not require the use of any discount rate; the expected value at any point in the life of a pension promise is fully defined by contribution made at origination and the projected benefits expected ultimately to be paid.The change of status of the scheme on sponsor insolvency does not, itself, require or warrant a change of the accounting basis from contractual to market-consistent. The contract being honoured is that originally generated by the sponsor and employee; the liabilities are unchanged.The quite separate question is whether the scheme has sufficient assets and a sufficient expectation of returns from those assets to discharge those liabilities. It is trivial to calculate the return required from those assets necessary to achieve that full and timely discharge objective. Assessment of the likelihood of achieving that rate is more difficult, but it depends principally upon the portfolio already held and only marginally upon the gyrations of prices and yields. The discount rates used in current (market-consistent) valuation practices are implicitly rates of return expected to be earned on assets; the contractual rate clearly so, by its very construction.However, these are independent of the required rate of return on assets and overwhelmingly irrelevant to the objective of paying the pensions fully, on time. Somehow, the idea that gilt yields are a sound predictor of future returns has taken hold.This simply is not true. By way of contra-indication, the table inset (click to enlarge) shows the correlation between gilt yields and the subsequently achieved real 10-year equity, gilt and cash returns. Not one is substantial and none are statistically significant.The question must also arise as to the extent of the differences between liability valuations using these two different approaches. This gilt yield, the contractual investment accrual rate and the differences in liability values are shown in the chart above. These differences in liability values can be huge: from a 55.6% understatement in 1974 when using gilts to an 81% overstatement in 2015.Many believe rising gilt yields will resolve the issue. Higher gilt-based discount rates will tend to lower the reported deficits as liability valuations fall, but this will not resolve the more important issue; the change of perspective and the costs that has brought to bear.The folly of requiring schemes to (over) fund themselves in this manner should be obvious. It has raised the cost of DB provision to such an extent that it is no longer an efficient form of company remuneration.Con Keating is head of research at BrightonRock Group“The valuation of a pension liability does not require the use of any discount rate; the expected value at any point in the life of a pension promise is fully defined by contribution made at origination and the projected benefits expected ultimately to be paid.”

Con Keating