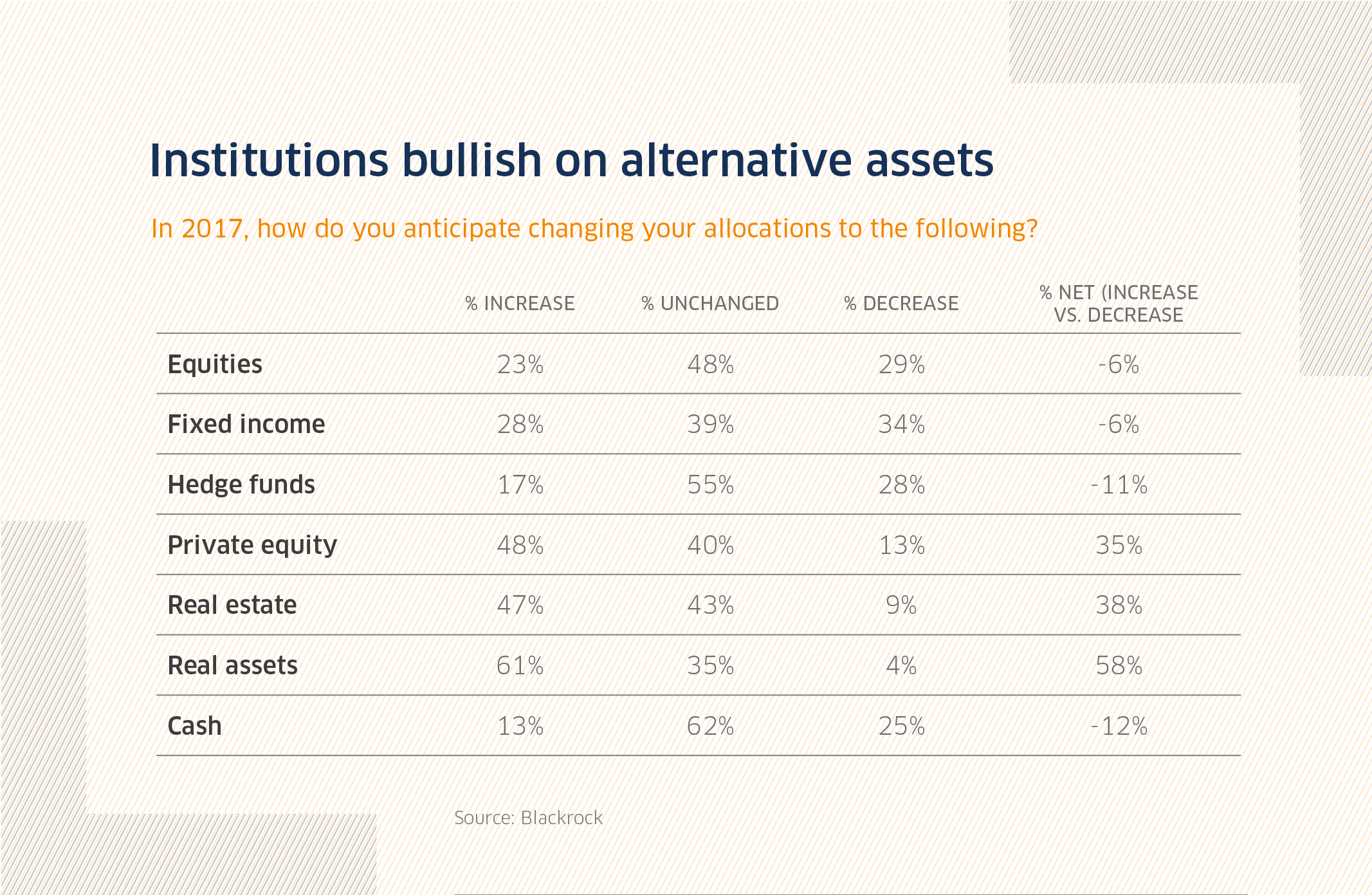

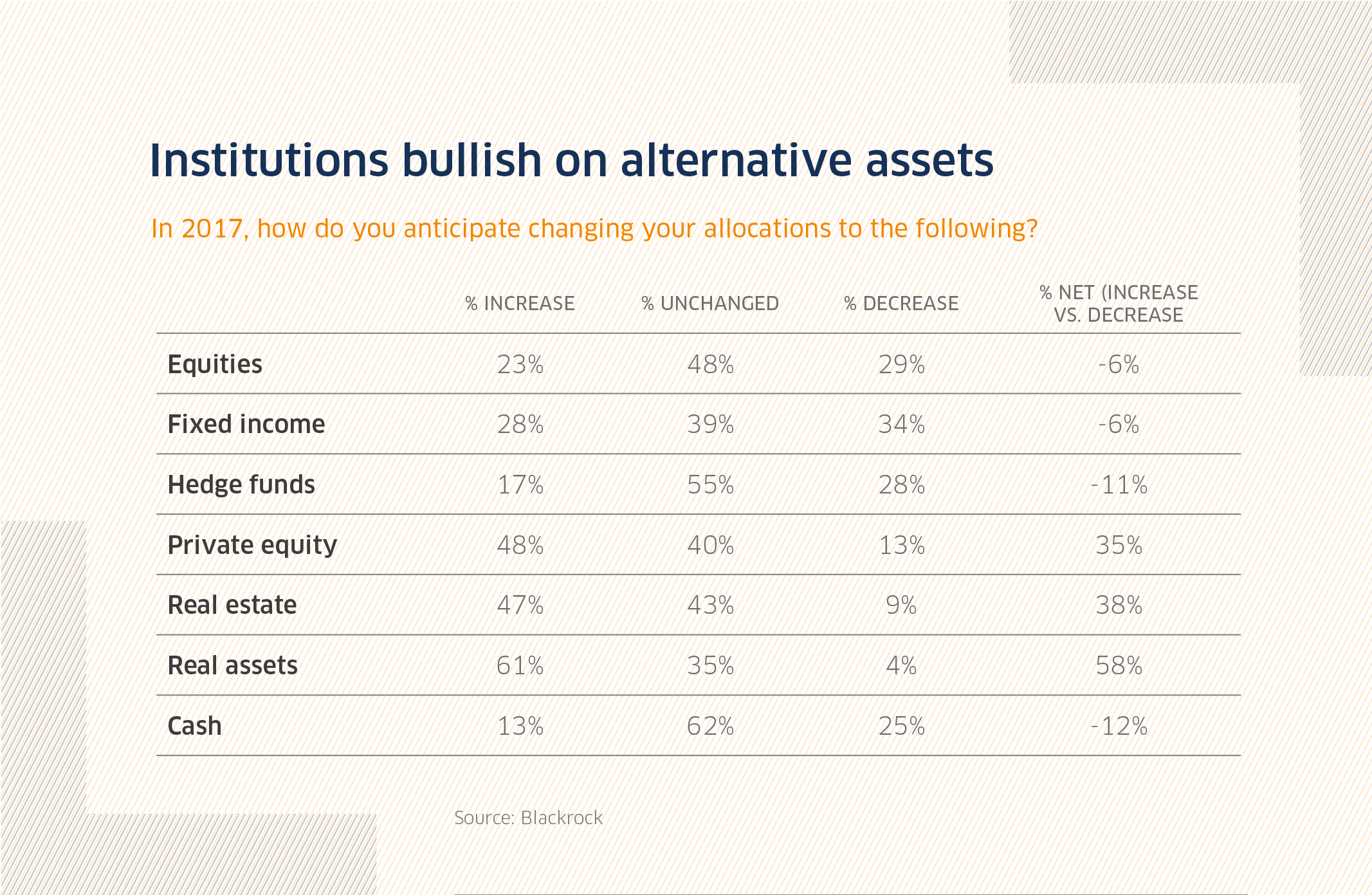

One in four of the 240 institutions surveyed by the asset manager intend to buy more real assets this year. This is almost double the 13% of respondents who plan to liquidate parts of their portfolio to boost cash reserves. Of those looking to invest their cash this year, 61% of respondents, or 58% net, expect to increase their allocations in real assets. This beats the 49% net recorded by respondents when asked about their investment intentions at the start of 2016.

Institutions looking to invest this year are moving into less liquid holdings in search of yield. Government bonds and equities are not only offering lower returns, but are also expected to face a bout of volatility. These factors, along with forecasts of reflation on the horizon, have led many institutions to reappraise their appetite for risk.

Blackrock’s head of institutional client business in EMEA, Justin Arter, anticipates an uptick in institutions considering alternative ways to generate returns and income. “The tide of institutional investor interest in less liquid assets is turning into a wave,” he said.

Long-lease property, infrastructure and renewable energy are some of the alternative investments professional investors are looking at. Blackrock’s global head of institutional client business, Edwin Conway, said not only can these assets provide secure income streams, but they also protect against inflation.

The above table shows where those planning to invest this year are looking to put their cash. Almost half of global institutions (48%) plan to increase exposure to private equity, while for the 28% of those questioned wishing to remain in fixed income, private credit appears the preferred path with 61% of respondents choosing this route to income.

Real estate is another popular choice with 47% of income-seeking institutions looking to increase their exposure to bricks and mortar. This compares to 9% who want to put a for sale sign up on their properties this year. The move to more real assets is eroding sentiment for hedge funds, with 28% decreasing investments to the industry, compared to the 17% who are ready to increase exposure.