By Scott Richardson

In an environment of low or negative yields, institutional investors face a challenge to generate sufficient returns and match liabilities. Systematic investment strategies are well developed and understood in equity markets, but they are scarcely utilised in fixed-income markets despite their potential to enhance returns.

A disciplined, systematic approach to over/under-weight securities based on well-known styles such as value, momentum, carry and defensive (sometimes called “quality”), can offer alternative sources of outperformance not only within equities, where this method has long been studied and applied, but also within fixed-income markets. The “styles” above have the following characteristics:

– Value is the tendency for relatively cheap assets to outperform relatively expensive ones;

– Momentum is the tendency for an asset’s recent relative performance to continue in the near future;

– Carry is the tendency for higher yielding assets to provide higher returns than lower yielding assets;

– Defensive is the tendency for lower risk and higher quality assets to generate higher risk-adjusted returns than higher risk and lower quality assets.The possibility that these factors may work in bond markets is both a potential boon to fixed-income investors and a wonderful “out-of-sample” test of the original equity-focused results, reinforcing our belief that the efficacy of these factors could be the result of real forces and not random data mining.Equity and fixed-income markets are both enormous in size, yet there is relatively little academic literature on the drivers of relative performance within bonds compared with the extensive research on equities. This seeming lack of empirical analysis is attributable to at least two forces. One, the limited availability of reliable pricing data has historically hindered the broader academic community from exploring cross-sectional drivers of fixed-income returns. Two, there is an apparent scepticism of a systematic approach to investing in fixed income markets, because people are often hesitant to embrace something different (there was similar scepticism of systematic investing in equity markets 15 to 20 years ago) and perhaps also because some fixed-income markets, particularly corporate bonds, are less liquid than equity markets.However, we believe that the fundamental drivers of relative performance in fixed-income markets can be effectively and efficiently captured using a systematic and risk-balanced approach based on measurable factors.

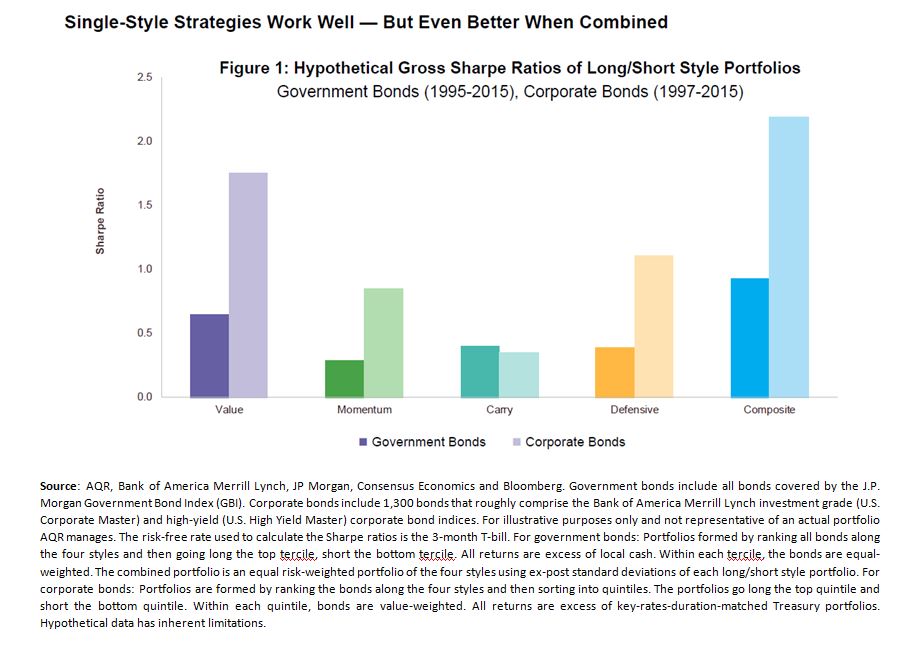

Combining factors systematically Government bonds, particularly of developed countries issued in their local currencies, are considered to have low, if any, default risk. Hence, the primary driver of government-bond returns is interest-rate risk. Other types of bonds issuers do not have the same status and hence their returns are driven by credit quality or credit risk.Having identified these two primary sources of return, we now turn to security selection within each source as a way to potentially generate excess returns over the passive fixed income indices. Value, momentum, carry and defensive style factors have historically (through back-tested simulations) worked well for both credit exposure within corporate bonds and rate exposure within government bonds. In fact, across the four styles evidence suggests the existence of positive risk-adjusted returns. However, combining the four styles may increase diversification while further improving overall expected risk-adjusted returns

(see Figure 1 inset – click to enlarge).An important potential benefit of this multi-style composite lies in its historically low correlation to traditional indexes, which we find is 0.13 to the Barclays Global Treasury index and zero to both the Barclays US Corporate Investment Grade index (excess of Treasury) and the S&P 500, respectively.In sum, fixed income commands a significant portion of many institutional investors’ portfolios. The primary drivers of returns in this asset class are rate and spread exposure. However, investors should be aware that there is possible efficacy to systematic style investing for security selection within rate exposure for government bonds and spread for corporate bonds.As institutional investors seek to address their fixed income allocation in a challenging environment, we believe that style investing may enhance their portfolios – either in a long-only or long/short context – when implemented efficiently.

Scott Richardson is a managing director at AQR Capital Management