In case anyone actually needed further proof of the benefits of diversification, JP Morgan Asset Management (JPMAM) has gone and reaffirmed the notion that the days of a traditional 60/40

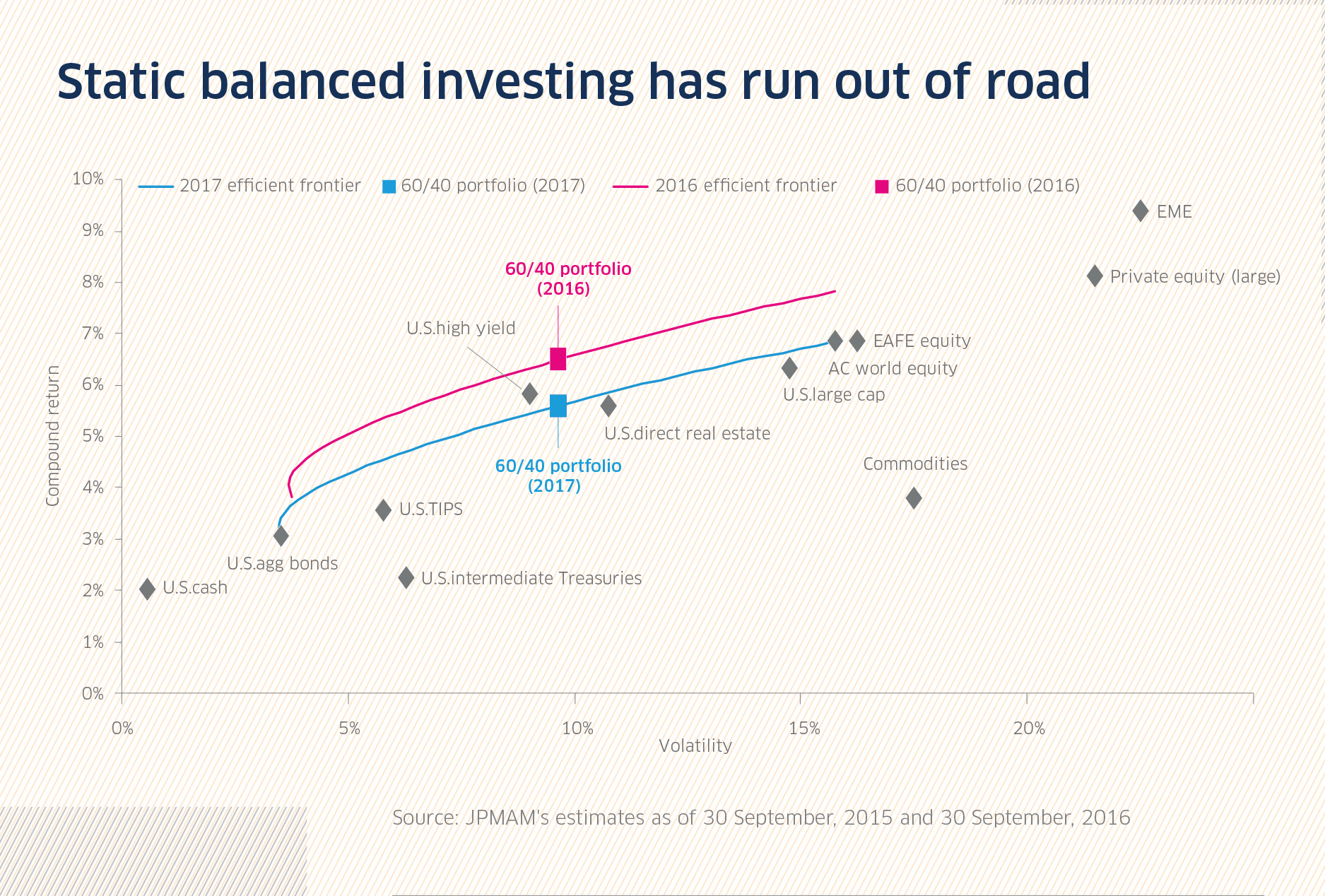

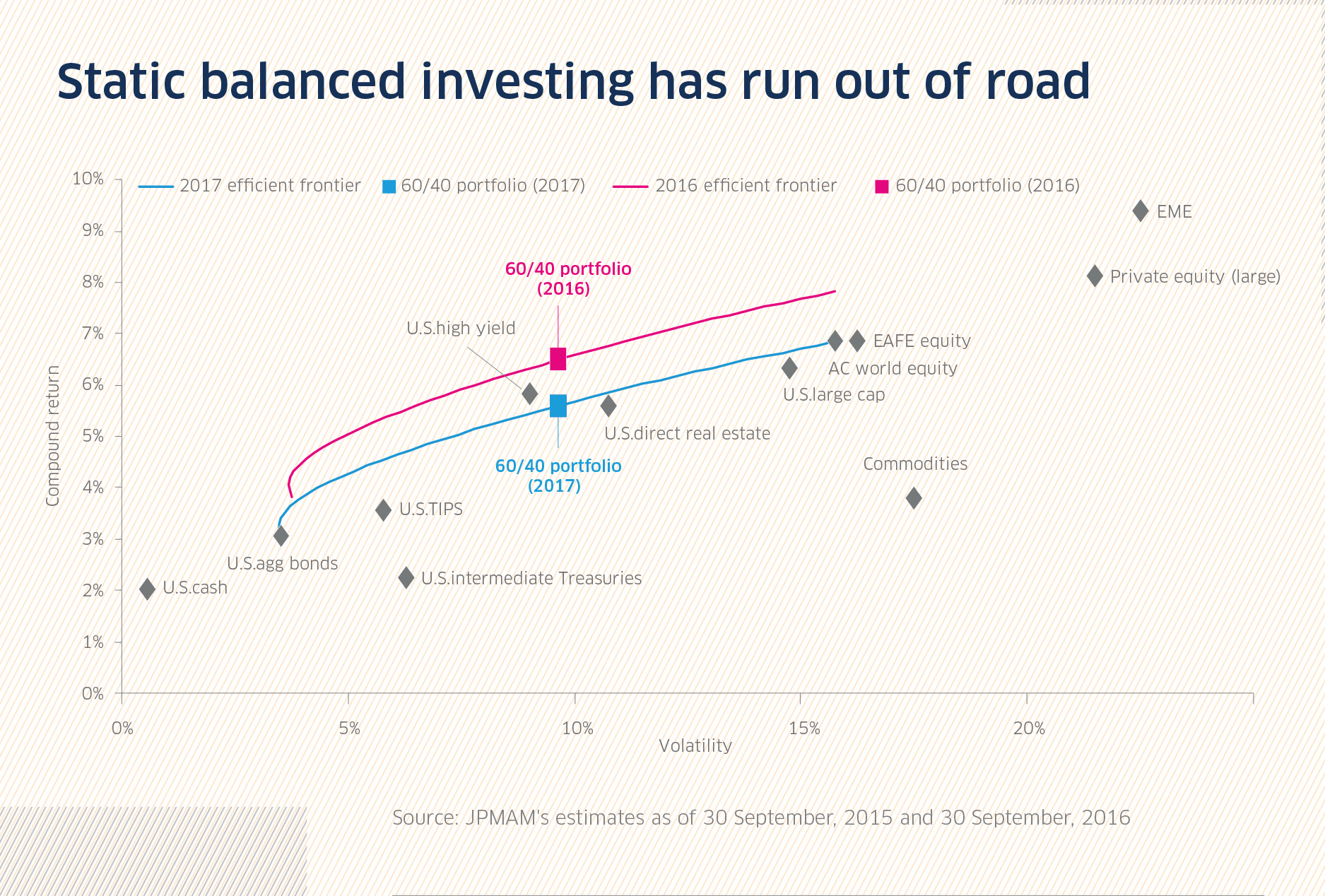

equity- bond portfolio are dead and buried. The asset manager’s latest Long term Capital Market Assumptions – a guide issued to investors to help them with strategic asset allocation decisions over the long-term – said investors maintaining a largely static 60/40 balanced portfolio over the next decade would see their portfolio decline by 0.75% over that period, from more than 6% to mid-5% (see chart above).

It said this drop would be driven by declining expected returns across most asset classes in the next 10 years, caused by weak developed market real economic growth, averaging just 1.5%, and weak emerging market growth, set to average 4.5%.

Elsewhere, it said the legacy of central bank policies will cast a long shadow on expected returns and cause interest rates to stay lower, meaning negative real returns on cash as well as the erosion of duration premium on bonds to near zero.

JPMAM said investors therefore face a stark choice: accept a lower level of return and stay static, or explore alternative assets more fully, seek new sources of diversification and embrace an active allocation approach.

According to the manager, credit markets offer a glimmer of hope, particularly in the high yield and longdated investment grade areas, while real assets would hold up best in a world of challenged growth and lacklustre returns.

JPMAM head of international institutional clients Patrick Thomson said: “An outlook of muted returns across the board for the decade ahead underscores the importance of having a thoughtful, long-term strategic perspective. Reaching the hurdle rate needed to meet