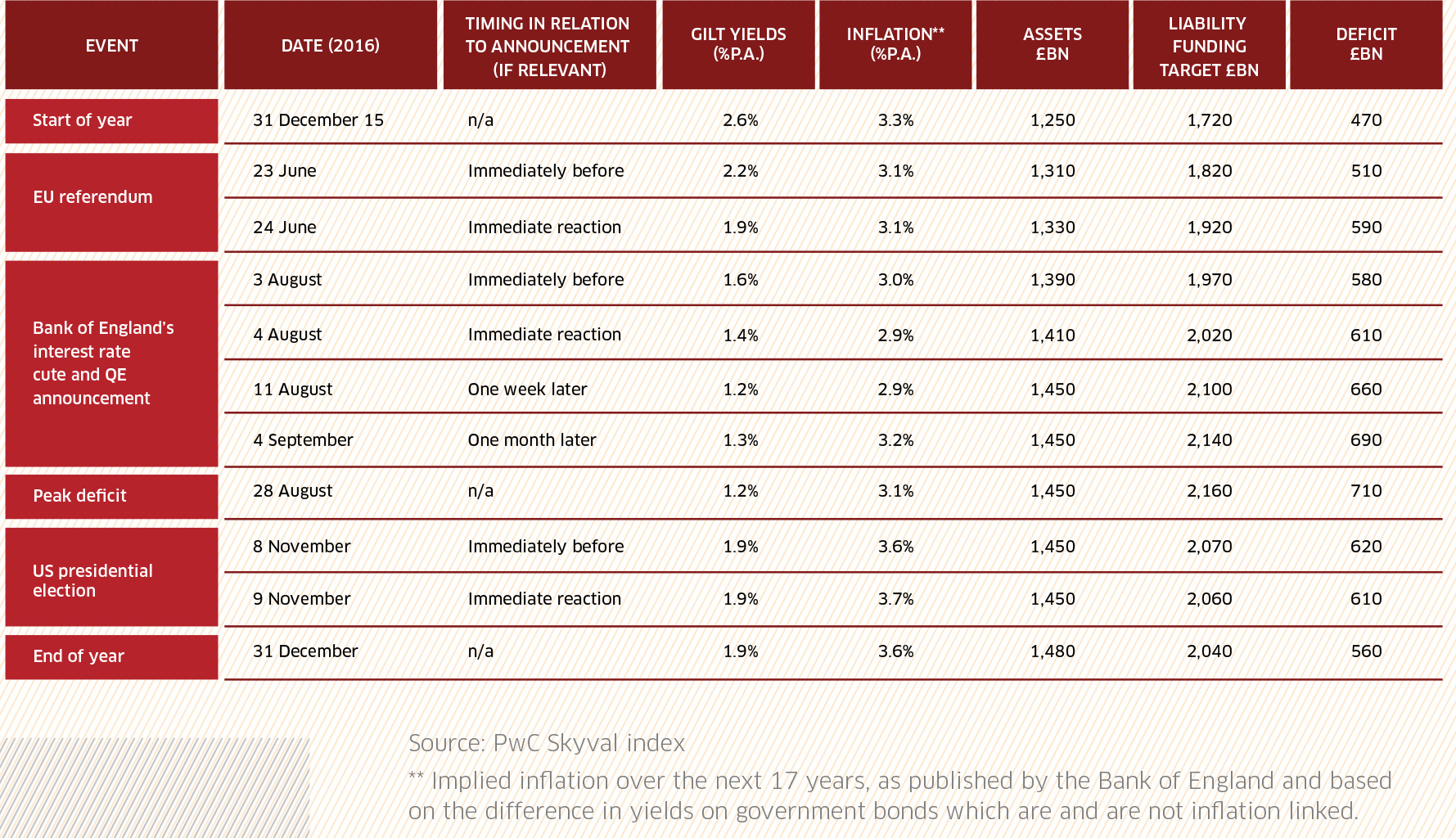

The vote for Brexit, interest rates cut to an historic low, a fresh stimulus package and Donald Trump elected leader of the free world made 2016 a volatile time for investors. The above table highlights the impact these events had on defined benefit (DB) pension scheme deficits.

The shortfall increased by £90bn during the year to £560bn across the UK’s 6,000 DB retirement funds, research by PwC claims. This equates to almost a third of Britain’s national debt. The impact of 2016’s political and economic events has left fund managers with a tough task. PwC estimates that scheme sponsors would have to invest an additional £10bn a year to wipe out 2016’s deficit growth within a decade.

The vote to leave the European Union (EU) had the biggest short-term impact on the deficit. It expanded by £80bn to £590bn on 24 June, the day the referendum result was confirmed. However, the Bank of England’s (BoE) decision to slash interest rates to 0.25% and announce £60bn of quantitative easing (QE) on 4 August, caused the figure to leap by £110bn to £690bn. It was during this period that the deficit reached its 2016 peak of £710bn (28 August).

The US election had the reverse effect. The day after Trump was named President-elect, the figure contracted by £10bn to £610bn. The leadership contest across the Atlantic had no impact on the UK’s riskfree rate, but other events did. The yield on UK government debt started 2016 at 2.6%, but slumped to 1.9% by the end of the year. The referendum result wiped 0.3% off the debt’s returns, which shrank by a further 0.4% in the week following the interest rate cut. The rise in bond and equity prices that followed the base rate reduction and QE announcement helped pension asset values improve by £60bn. But this saw pension funding targets increase by more than double that amount, or by £130bn. Inflation is in the outlook statements of several economists this year, but in 2016 it made little more than a cameo, moving only 0.3% higher to 3.3% during the year, with the only real impact being the 0.2% rise that followed in the month after the BoE’s announcements. The vote for Brexit and Trump’s election victory were not predicted by commentators and pollsters. Leicester City defying odds of 5,000-1 to claim the Premier League title was another shock of 2016. This, however, appears to have had little financial impact on anything other than Leicester’s profit and loss account.