Analysis of pay trends indicates that total pay remains largely stable, but there is an increase in performance- related pay for the company top-bods in some of Europe’s largest economies.

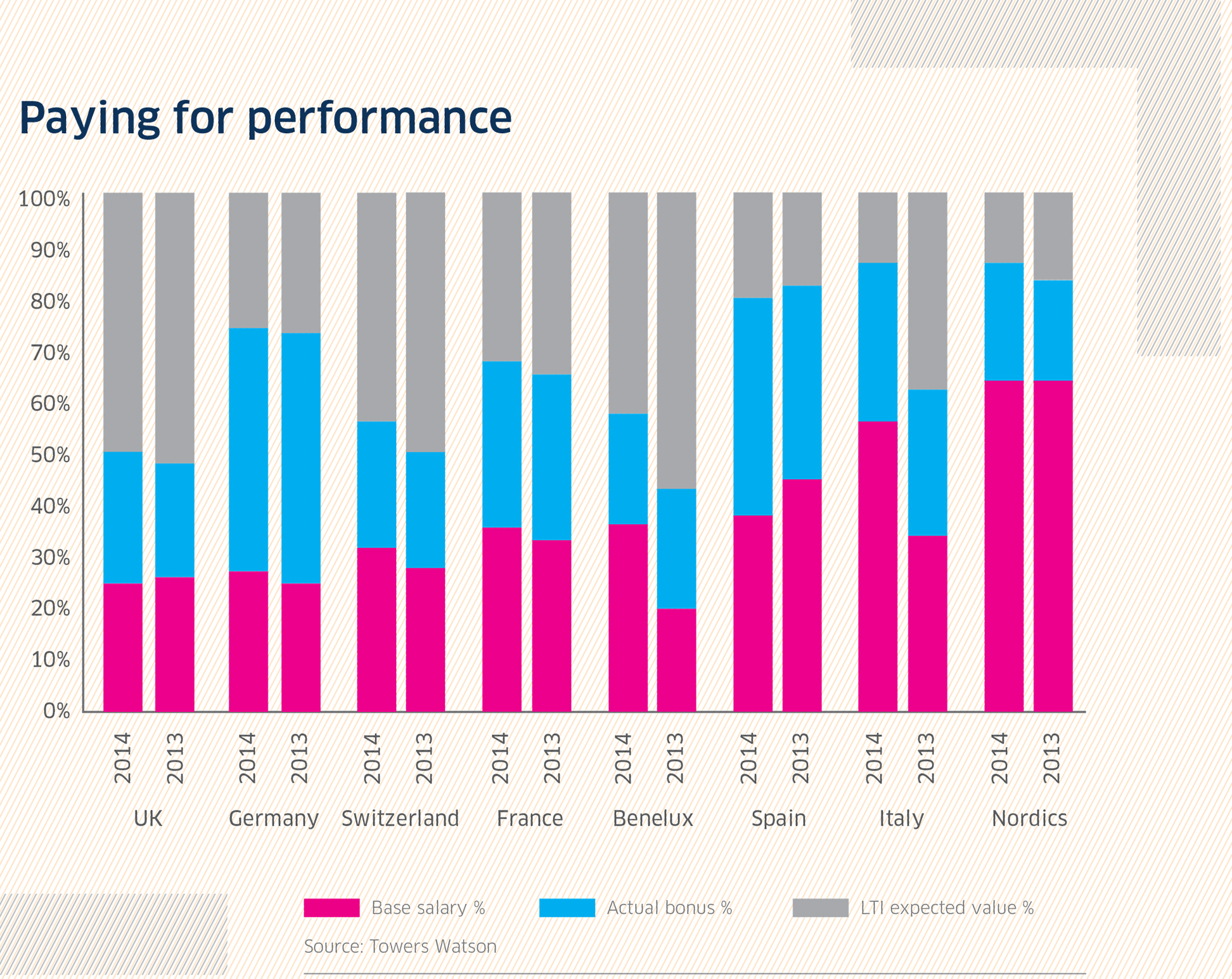

The chart above and inset, compiled by Towers Watson, shows executive remuneration at CEO level across Europe, based on analysis of 96 companies’ remuneration reports as at 31 July 2015.Overall, the research found 64% of Europe’s leading CEOs received no salary increase this financial year up from 40% in 2014, but the breakdown of the type of remuneration in different countries is interesting.The chart shows what proportion of executive pay is fixed or base salary (pink bar) and what proportion is variable, or performance-related pay made up of two components: short-term actual bonus (blue) and long-term incentives (LTIs) such as the issuance of shares (grey).Incentive pay is most significant in Germany, Switzerland and the UK. In the UK, a quarter of total remuneration (25%) was fixed pay in 2014 while the rest (75%) was performance-related made up of 25% bonus and 50% long-term incentive pay.In Germany however, the annual bonus was much more important, making up roughly half of total remuneration (47%) compared to long-term incentives (26%).This trend towards performance-based pay is positive for shareholders, particularly as an increasing number have been calling for performance-related pay at the firms they invest in.Towers Watson consulting services director Damian Carnell says: “Institutional investors have been calling for pay for performance for many years and this is proof a lot of pay is delivered in the form of performance- linked pay, certainly at CEO level in the UK and in other countries.”However, he adds: “It is still a work in progress in that pay for performance is difficult and it can be complicated and certainly institutional investors are starting to say ‘we want these plans to be simpler, they have become too complicated’.”“Institutional investors have been calling for pay for performance for many years and this is proof a lot of pay is delivered in the form of performance- linked pay, certainly at CEO level in the UK and in other countries.”

Damian Carnell

Comments