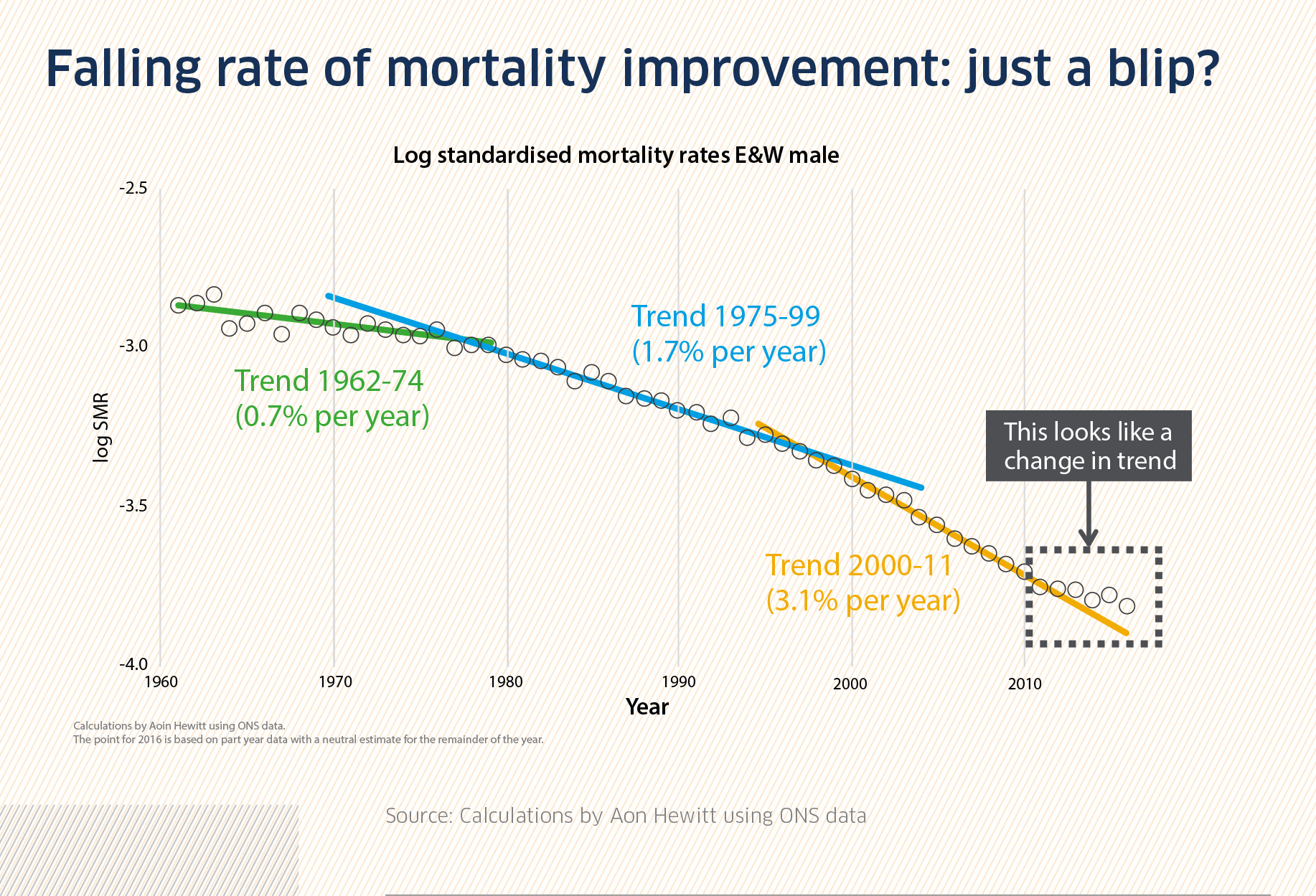

The chart above shows annual male mortality rates in England and Wales by calendar year. The mortality rates have been standardised by reference to the 2013 European Standard Population (limited to ages 50 to 89). So, even though the population of England and Wales is increasing in size and ageing, the mortality rates in the above chart in different years are comparable.

The chart shows that not only has mortality improved over time, but the rate of improvement itself has increased, i.e. the trend has become steeper, at least up until 2011. The significance of the data since 2011 is that after a decade of historically high mortality improvements, the rate of mortality improvement appears to have fallen: mortality rates over the past five years have improved at around only 1% per annum compared with over 3% for the period 2000 to 2011.

It is too early yet to fully recognise this apparent change in trend. For instance, one reason mortality in 2015 was so heavy was the ineffectiveness of the flu vaccine, which may be viewed as an exceptional event. In addition, pension scheme members have on average a higher life expectancy, and by virtue of having an index- linked pension, they may be more resilient to the negative factors that affect the life expectancy of the wider population.

However, Aon Hewitt partner and head of longevity, and chair of the Mortality Projections Committee at the CMI, Tim Gordon, adds: “The cumulative departure from expected mortality improvements cannot be ignored – this is the most extreme reversal in mortality improvement trends that we’ve seen in the past 40 years. What was initially assumed by many actuaries to be a ‘blip’ is increasingly looking more like an earlier- than-expected fall off in mortality improvements and we expect it to feed into pension scheme funding and insurance company reserving over time.

“This has financial implications for pension scheme liabilities and insurance company reserves because mortality projections typically depend on current improvement rates.”

One important implication is that pension schemes contemplating longevity insurance, such as a bulk annuity or a longevity swap, need to ensure that they have up-to-date pricing.