Jim Rogers is one of the pioneers of the hedge fund industry and known worldwide as a manager of the Quantum Fund, which he started together with George Soros in 1970. He retired 10 years later at the age of 37. Today Rogers lives in Singapore and, as Heike Gorres discovered, he still has plenty to say about investing.

“The most important thing is to invest only in what you fully understand – no matter what that is. Do not listen to me, do not listen to the television or the internet. Listen only to yourself. This is especially true for the times ahead.”

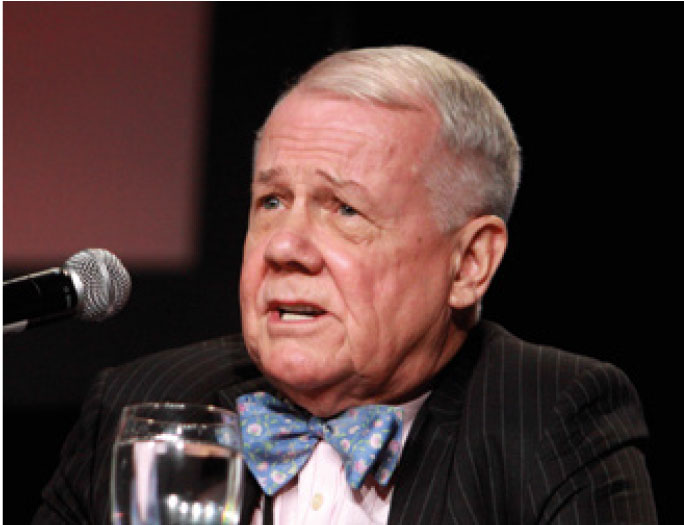

Jim Rogers

Warren Buffett has compared the performance of a pool of hedge funds to an S&P 500 index fund from 2008 to 2015. In most single years the passive fund performed better and the outperformance was much better than the pool of hedge funds. What lessons would you draw from that yourself as former hedge fund manager and for the industry in general?

Unfortunately for our industry, studies repeatedly show that passive investors do better on average than most active investors, 70-80% of the time, year-after year. This is partly because we now have something like 50,000 hedge funds on the market, but we don’t have that many smart 29-year-olds, I assure you.

Most people simply don’t do as well as the index, whether that’s commodities, stocks, bonds, or in whichever assets whatsoever. It’s a sad commentary, but it’s been proved to be accurate. There are some very good hedge fund managers out there, they do exist, but they are few and far between and you have to find them early. After 10 or 15 years many of them no longer do better than the index because they get lazy or sloppy.

These results are likely to have an impact on demand.

Yes. In the US, for example, more and more institutional investors say they are no longer willing to pay high annual management fees plus 20% of the profits of a fund. That’s as it should be. On the cost side, therefore, there’s still a lot to do.

On the “Jim Rogers blog about financial markets, the economy and the world”, you are quoted as saying that the central bankers will fail eventually. At a certain point the market would no longer accept the masses of printed money and then the policy can no longer support the financial system. By 2017 there will be disaster everywhere. What would this disaster look like? Hyperinflation? A collapse of the bond or equity markets?

First of all I don’t have a blog, nor an account with Twitter, Facebook or any other social media, so any blog you read will be an imposter, a fake or a phoney.

To the point, however, yes I have said and will say again, that the central banks are printing unlimited sums of money and that has to come to an end, it cannot last forever. In my view there are two possibilities: either the central bankers come to their senses, but that’s very unlikely, or the market eventually says ‘we no longer want this garbage anymore.’ Interest rates have been 0% and eventually people will react and do something else. At this point the central banks will lose control – if they have control now – interest rates will go higher and the whole system will collapse. We will have bear markets again. 2008 was a problem because of too much debt and everyone has talked about austerity, but nobody has practiced austerity. Even in China now debt has grown year-on-year.

If the world survives this bear market, there will be another, even more serious bear market after some time. Whether hyperinflation comes, no one can say. Some countries now also have now a serious inflation problem, such as Brazil.

Have the countries concerned not always had problems with inflation?

Brazil has undergone many recurring inflation periods, that’s right. Since Luiz Inacio “Lula” da Silva took over the presidency over 10 years ago to 2011, things were somewhat under control. But what I really mean is that the coming bear market will affect more countries than those which people have always thought of.